The spinning mill industry forms the backbone of the textile manufacturing sector. From producing fine cotton yarns for luxury apparel to creating technical fibers for industrial applications, spinning mills serve as the essential link between raw fiber and finished fabric. For entrepreneurs and startups looking to enter manufacturing, this sector offers a blend of steady market demand, diverse product possibilities, and significant innovation potential.

However, launching a spinning mill is not simply a matter of purchasing machinery and securing raw materials. In this detailed guide, we explore the global market outlook, sector growth, manufacturing workflow, and strategic considerations that can help new entrants build a sustainable spinning mill business.

Understanding the Market Landscape

Globally, the spinning yarn market has been expanding steadily, supported by rising textile consumption in both apparel and non-apparel segments. Fashion remains one of the biggest demand drivers, with rapid style cycles and growing consumer interest in performance fabrics keeping the need for yarn constant throughout the year. In addition, the market for technical textiles used in sectors like automotive, healthcare, geotextiles, and filtration has been expanding at a faster pace, offering lucrative niches for specialized spinning operations.

The current global market growth rate is estimated to be in the range of 4–6% CAGR, with Asia dominating production due to the abundance of cotton cultivation, competitive labor costs, and established textile clusters. India, China, Bangladesh, and Vietnam are at the forefront, supplying not only domestic markets but also exporting to fashion and technical textile hubs across the world.

Related: How to Start a Pesticides and Insecticides (Agrochemicals) Manufacturing Business

Global Market Forecast for Spinning Yarn (2025–2030)

| Year | Estimated Market Size (Million Metric Tons) | CAGR % | Key Growth Drivers |

| 2025 | 116 | – | Recovery in apparel manufacturing, technical textile expansion |

| 2026 | 121 | 4.3% | Sustainable yarn adoption, regional production hubs |

| 2027 | 126 | 4.1% | Demand from fashion brands, e-commerce growth |

| 2028 | 132 | 4.7% | Growth in home furnishing and industrial textiles |

| 2029 | 137 | 3.8% | Automation in spinning mills, efficiency gains |

| 2030 | 143 | 4.1% | Emerging market demand, nearshoring trends |

Regional Growth Outlook

- Asia-Pacific remains the largest and fastest-growing hub, driven by strong cotton production in India, China’s scale of manufacturing, and Vietnam’s export-driven apparel industry. Government incentives and textile parks in India further encourage investment.

- Africa is gradually emerging as a production base, particularly in Ethiopia, Kenya, and Egypt, due to lower labor costs, cotton availability, and trade agreements such as AGOA that enable duty-free exports to the U.S.

- Latin America—led by Brazil and Mexico—offers opportunities in cotton-based yarns for both domestic consumption and exports to North America.

- Europe focuses more on specialized, high-value yarns and technical textiles, often importing raw fibers but adding value through advanced spinning and finishing technologies.

- Middle East nations like Turkey and Egypt are investing in modern spinning facilities to serve regional apparel and home textile markets.

These trends highlight that while Asia dominates, opportunities for smaller, strategically positioned mills are opening worldwide.

Demand Drivers and Growth Trends

One of the most significant shifts in the spinning mill industry is the increasing demand for sustainable and traceable yarns. Global buyers, particularly in Europe and North America, are pushing for yarns that come with certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX. This has led to a rise in the production of organic cotton yarns, recycled polyester blends, and other environmentally responsible materials.

Technological advancements are also shaping the industry’s growth. Automation, IoT-based quality monitoring, and predictive maintenance systems are being adopted to improve production efficiency and minimize defects. Digital systems enable real-time monitoring of yarn evenness, twist levels, and production speed, helping mills reduce waste and enhance consistency.

In parallel, the market for high-performance yarns is expanding. Mills are now producing fibers with flame-retardant, antimicrobial, or conductive properties for specialized industries. These advanced yarns command higher prices and offer long-term contracts with industrial clients, providing stable revenue streams beyond the volatile fashion market.

Strategic Positioning for New Entrants

For a startup, success in the spinning mill business often comes down to three interconnected choices: location, product mix, and technology.

Location plays a vital role because proximity to raw fiber sources significantly reduces logistics costs and helps maintain fiber quality. Mills set up near cotton-growing regions, polyester chip suppliers, or import-friendly ports gain a competitive advantage. Equally important is the availability of reliable infrastructure—consistent electricity, accessible transportation routes, and water supply—since spinning is a continuous process that suffers if interrupted.

Defining the product mix is another strategic decision. Many new mills begin by producing commodity yarns such as carded cotton or polyester blends for the mass market. While these products have high volume potential, they also face stiff competition and tighter margins. Others may opt for niche products like compact combed yarns, eco-friendly blends, or specialty yarns for technical applications, which typically yield higher profit margins but require more precise manufacturing and marketing.

Technology selection must align with the chosen market strategy. Ring spinning remains the gold standard for producing fine-quality yarns, while open-end or rotor spinning offers speed and cost efficiency for coarser counts. Compact spinning, air-jet spinning, and other specialized methods are gaining ground for specific applications. Automation and advanced monitoring systems are increasingly considered essential rather than optional, as they help maintain consistency and optimize operational costs.

The Manufacturing Process in Detail

The journey from raw fiber to finished yarn involves several precisely controlled stages. It begins with raw material receipt and preparation, often in the blowroom. Here, bales of cotton, synthetic fibers, or blends are opened, cleaned, and blended to create a homogeneous fiber mix. This stage is crucial for ensuring that the final yarn has consistent characteristics.

The carding process follows, where fibers are separated, aligned, and formed into a continuous web. This stage not only removes impurities but also determines the basic quality of the yarn by influencing fiber alignment. For high-quality yarns, the combing stage is added, which eliminates short fibers and ensures only long, uniform fibers proceed further.

Once combing is completed (if applicable), the slivers pass through the drawing stage, where multiple slivers are combined and drawn out to ensure evenness and parallel fiber arrangement. This prepares them for the roving stage, where the fiber is given a slight twist and reduced in thickness, creating an intermediate product ready for spinning.

Spinning is the heart of the operation. Depending on the technology used—ring, rotor, compact, or air-jet—the roving is twisted into yarn with the required count and strength. Ring spinning is slower but delivers superior yarn quality, while rotor spinning is faster and better suited for coarser yarns. Compact spinning produces yarn with higher strength and less hairiness, favored for premium fabrics.

The final stages include winding, where yarn is transferred onto cones or packages, with any faults detected and removed by automatic clearers. Quality control is essential at this stage, as even small defects can affect the performance of the yarn in downstream processes like weaving or knitting. The yarn is then labeled, packaged, and prepared for shipment to customers.

The Use of Pesticides in Indian Agriculture

Pesticides, which include insecticides, herbicides, fungicides, and other chemical substances, are necessary to shield crops from a variety of pests, diseases, and weed growth. Along with increasing agricultural productivity, they also actively participate in maintaining balance by controlling agricultural pests and diseases. In India, where a large segment of the population is engaged in agriculture, pesticides have become a necessity to optimize yield. Due to pests and diseases, India is estimated to incur around 20-25% post-harvest losses of the total agricultural produce every year. For individual farmers, this level of loss can be crippling, and when viewed through the lens of the food security of the nation, the scenario is dire.

On the other hand, there are problems created by the use of pesticides. Environmentally, the indiscriminate or excessive use of synthetic pesticides poses significant harm, introduces toxins into the food chain, and causes ecological imbalance. Furthermore, pests evolving the ability to resist pesticides renders the pesticides useless over time. This form of resistance can create a “pesticide treadmill,” which would require the farmers to use stronger and more expensive chemicals to control the pests.

Related: Top 10 Profitable Pesticides and Insecticides (Agrochemicals) to Manufacture in India

Crops That Use High Amounts of Pesticides in India

Cotton

Cotton is often cited as the crop that uses the most pesticides in India. It is a crop that though cultivated on a small acreage, uses huge quantities of pesticides. This is mainly because of the heavy infestation of various pests, especially bollworms, aphids and whiteflies. These pests are very damaging to the cotton crops because of their ability to lower the quality and quantity of the cotton fibers. The advent of genetically modified (GM) cotton, especially Bt cotton, which is resistant to bollworms, has reduced some of pesticide usage.

Rexol Pasa has also been cited for resistant pests of other crops. Pesticide use is still heavy. Integrated Pest Management (IPM) is gaining acceptance as a means of lessening the use of chemical pesticides. It is the combination of various factors and biological control and cultural practices.

Rice

This is yet another principal crop that requires a huge amount of pesticides. Most of the pesticides used on rice are used in Andhra Pradesh. Rice crops are vulnerable to pests such as stem borers, brown planthoppers, and rice blast disease. If these pests are not managed properly, they can be very destructive.

In India, where rice is grown, the humid weather tends to aggravate the situation because it helps pests thrive. Farmers tend to use pesticides off-label to avoid damage to their crops, which adds to the total pesticides used. Strategies are being implemented to encourage the use of resistant rice varieties and Integrated Pest Management to lower the use of pesticides.

Vegetables

These and a variety of tomato, brinjal and okra also use a large amount of pesticides. Vegetables require a large number of pesticides because they are attacked by numerous diseases and pests. Farmers also have to use pesticides because of the high demand for attractive vegetables without spots. Many of the vegetables are also easy to grow, which can lead to increasing the problem. There is a growing concern that vegetables may have pesticide residues and this is motivating stricter action and oversight.

Fruits

Like mangoes, grapes, and citrus fruit, fruit crops undergo numerous fruit fly, scale and fungal disease infestations, mandating the use of pesticides for control. These pests and diseases are harmful to fruits and can degrade their market value, causing massive financial losses to farmers. The use of pesticides in fruit crops is often the regretful answer to the significant financial and labor investment it takes to cultivate fruit crops and their lengthy growing seasons. In fruit production, the use of pesticides is tightly governed to protect consumers and avoid harmful food residues.

Wheat

The totalization of cotton and rice use still outstrips their collective consumption in comparison to wheat. Although the production of wheat is still considerably lower than cotton and rice in amount, the harvesting regions of wheat face the attack of pests, goldusts, sharpshooters and fungal diseases in selective regions and weather, thus high utilization of pesticides.

Protecting wheat yields and maintaining grain quality for the wheat variety are still sizable can be achieved through the application of pesticides. With the adoption of disease-resistant wheat and the improvement of agronomy practices, integrated pest management for wheat production can be accomplished.

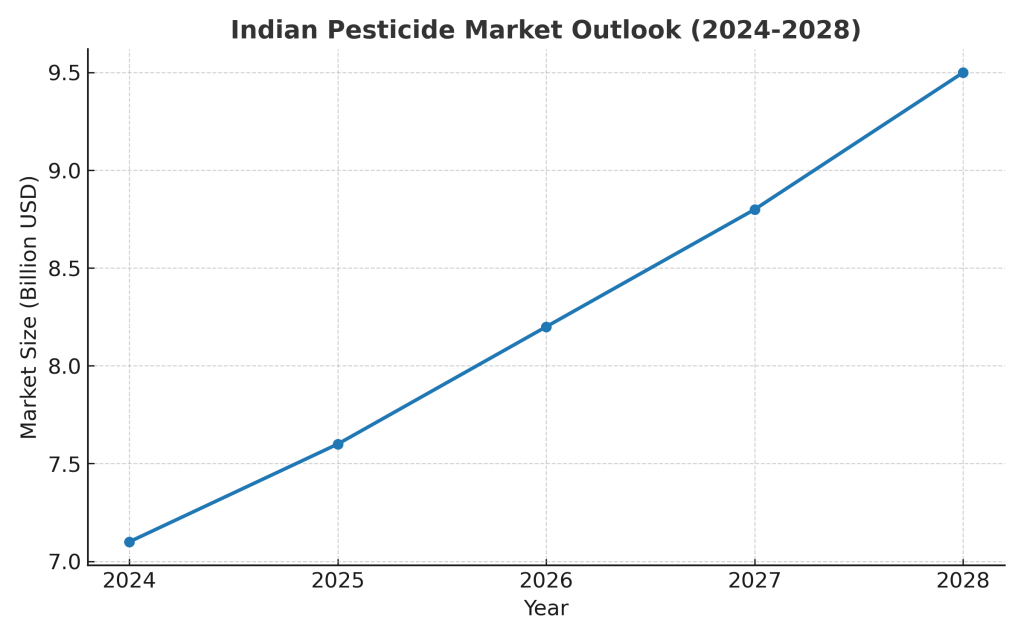

Market Forecast, Demand, and Growth of the Pesticide Sector in India

Currently, India continues to cultivate crops, hence the demand for crop protection in the Indian pesticides market is highly in motion, still the market continues to grow continuously.

Market Dynamics

In the Indian pesticide industry, there are numerous foreign and domestic competitors, each providing various products and services. In addition to crop cultivation and pest activity, the market is also impacted by the government and changes in technology.

Growth Drivers

Fueling the need is the requirement to increase agricultural productivity and to sustain food supplies for the ever-increasing population. Urbanization and rising demand for food further exacerbate the issues. There is also an increase in awareness among the farmers about the effectiveness of pesticides, as well as the availability of subsidies and loans. These also help in increasing market demand.

Trends

The Indian pesticide market is undergoing many changes. There is strong focus on pest control methods which are more environmentally friendly. In addition to IPM, there is also the increase in demand for biopesticides. These are produced from natural resources and are also thought to be more eco-friendly. The industry is also changing to cold release and targeted pesticides which are more precise and efficient.

Challenges

The market is challenged by the problem of counterfeit products, strict government regulations and the growing use of Integrated Pest Management (IPM) systems. Another challenge is the lack of education among farmers on the proper use of pesticides. The use of counterfeit pesticides harms farmers, consumers, and the environment.

Regional Analysis

The use and need for pesticides differ in various regions of India. It is determined by the growing season, pest infestation, and climatic conditions. Regions of Punjab, Haryana, and Andhra Pradesh have more developed agriculture and consume more pesticides.

Overview of Pesticides Manufacturing Steps

The production of pesticides is a multi-step procedure that entails the use of a complex manufacturing structure, specialized equipment, skilled staff, and strict observance of safety and sanitary guidelines. Below is an outline of the process.

Active Ingredient Synthesis

Building a biologically active chemical material of interest from raw materials and/or certain chemical building blocks is referred to as active ingredient synthesis. This step usually requires multiple, carefully controlled, stepwise reactions and purification of the final product. Along with the synthesis of the active ingredients, some amount of sur

Full Procedure for Pesticide Production

Pre-Mixing

A premixing system blends and disperses large quantities of powders. It may also require particle size reduction and should be flexible for different types of products. The premixing process is crucial for the uniformity and consistency of the final product.

Milling

Materials that need to be finely powdered are processed. This ensures effective use of the active ingredient, which should be evenly distributed. Various equipment like ball, hammer, and jet mills can be used to do the milling step.

Drying

It is possible to obtain powdery synthesis products through vacuum drying, which can then be used for additional synthesis. Drying not only removes moisture, but also prevents clumping and caking of the product.

Quality Control

Control measures during the entire process ensure that the final product is pure, potent, and safe. Quality control during the process includes the checking of the different levels of materials produced, including the raw materials, the intermediates, and the products, and ensures that they all comply with the set standards.

View our Handbook on Agrochemicals, Pesticides, Insecticides, Fungicides, Herbicides, Biofertilizer, Vermicompost Manufacturing

Things to Consider when Starting a Business

Raw Materials

For a pesticide manufacturer, finding a dependable supplier for raw materials is vital. Primarily, these raw materials need to comply with the stringent standards of purity and contamination.

Technology

To ensure product safety and minimize the environmental considerations associated with technology, the use of closed-loop systems, modern filtration techniques, and energy-efficient machinery is modern and green technology.

Safety

To ensure that workers are protected from injuries, the right safety measures should be taken. Tight safety measures, such as appropriate PPE, safety audits, and workers trained in the proper ways to handle the equipment, greatly improve safety.

Waste Management

Environmental pollution is a very serious issue. Some of the proper ways to reduce this issue is through proper waste management, which includes the treatment of wastewater, recycling consumable waste such as solvents, and the proper management of solid waste.

Key Players in the Indian Pesticide Market

This includes a blend of multinational corporations and local businesses. Some of these companies provide a variety of pesticides with solid distribution channels within the country. These companies also have strong R&D departments to for innovative and novel pesticide products.

Environmental and Health Considerations

Even though they are necessary for the protection of crops, pesticides can be harmful to both the environment and people’s health. Pesticides have the potential to pollute soil, water, and even biodiversity, which causes long-term damage to the ecosystem and people. These negative impacts call for the need to promote sustainable and responsible pesticide usage.

Water Pollution

Runoff and leaching can cause pesticide contamination in rivers, lakes, and groundwater, threatening marine life and clean water sources. Furthermore, this contamination can impact the quality of drinking water and damage water ecosystems.

Soil Contamination

Pesticides can negatively alter the soil microbial communities, impacting soil fertility and crop yields. Moreover, they can persist in the soil for long periods, causing long-term environmental damage.

Biodiversity Loss

Pesticides can negatively affect non-target species like useful insects, birds, and fish. The loss of biodiversity can disrupt the balance within ecosystems and negatively impact the entire food web.

Human Health Risks

Pesticides can result in acute poisoning, endocrine, reproductive issues, and cancer. These risks are especially dangerous for agricultural workers that regularly consume and handle the pesticides.

While entrepreneurs are entering the pesticide market, they should focus on developing safer practices and maintaining sustainable pesticide products. This can be done through investing in biopesticides, integrated pest management, and farmer education on proper pesticide usage.

For more information, check out this video

Niir Project Consultancy Services (NPCS)

NPCS offers complete assistance for entrepreneurs planning to set up a new business in an industry of their choice. They create Market Survey cum Detailed Techno Economic Feasibility Reports with NPCS, which aid in understanding the project and market. Along with the market and project surveys, the NPCS reports also contain the Process of manufacture, Raw Materials, the Plant Layout, and financial data Thus, NPCS aids in deciding whether new industries or businesses can be established or not. If NPCS aids the entrepreneurs in making correct decisions, the entrepreneurs will be in a position to maneuver the complexities in starting and scaling up their businesses.

Find the Best Idea for Yourself With our Startup Selector Tool

Conclusion

There is a tremendous scope for entrepreneurs and startups in the Indian pesticide industry. The understanding of the crops with the highest pesticide consumption, the market and it’s growth, the method of manufacture, and the ecology is essential. The entrepreneurs can aid in the growth of the agriculture sector while also working to reduce pesticide use with the help of innovation, business sustainability, and socially responsible practices. This can be in the form of safer pesticide manufacture, IPM advocacy, and farmer education about the responsible use of crop protection aids.