Stand Up India Scheme

(Ministry of Finance)

April 05, 2022

‘Stand Up India’ scheme aims to empower every Indian & enable them to stand on their own feet”

Stand up India Scheme was launched on April 05, 2016[2] to promote entrepreneurship at grassroot level focusing on economic empowerment and job creation. The scheme has been extended till 2025.

Background:

As India is growing rapidly[3], hopes, aspirations and expectations of a large group of potential entrepreneurs, particularly Women, Scheduled Castes (SCs) and Scheduled Tribes (STs), are rising. They want to set up an enterprise of their own to allow themselves to thrive and grow. Such entrepreneurs are spread across country and are bubbling with ideas on what they can do for themselves and their families. The Stand Up India scheme envisages to facilitate the dreams of aspiring SC, ST and women entrepreneurs into reality by supporting their energy and enthusiasm and removing hurdles from their path.

Objective

- Promote entrepreneurship amongst women, SC & ST category

- Provide loans for greenfield enterprises in manufacturing, services or the trading sector and activities allied to agriculture

- Facilitate bank loans between 10 lakh and Rs.1 crore to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one woman borrower per bank branch of Scheduled Commercial Banks.

Need for the scheme:

The Stand-Up India scheme is based on recognition of the challenges faced by SC, ST and women entrepreneurs in setting up enterprises, obtaining loans and other support needed from time to time for succeeding in business. The scheme therefore endeavours to create an eco-system which facilitates and continues to provide a supportive environment for doing business. The scheme seeks to give access to loans from bank branches to borrowers to help them set up their own enterprise.

The scheme, which covers all branches of Scheduled Commercial Banks, can be accessed in three potential ways:

- Directly at the branch

- Through Stand-Up India Portal (standupmitra.in)

- Through the Lead District Manager (LDM)

Eligibility:

- SC/ST and/or women entrepreneurs, above 18 years of age

- Loans under the scheme are available for only green field projects. Green field signifies, in this context, the first-time venture of the beneficiary in manufacturing, services or the trading sector and activities allied to agriculture

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur

- Borrowers should not be in default to any bank/financial institution;

Changes made to the Scheme

Pursuant to an announcement by the Union Finance Minister in the Budget speech FY 2021-22, the following changes have been made in the Stand-Up India Scheme:

- The extent of margin money to be brought by the borrower has been reduced from ‘up to 25%’ to ‘up to 15%’ of the project cost. However, the borrower will continue to contribute at least 10% of the project cost as own contribution;

- Loans for enterprises in ‘Activities allied to agriculture’g. pisciculture, beekeeping, poultry, livestock, rearing, grading, sorting, aggregation agro industries, dairy, fishery, agriclinic and agribusiness centers, food & agro-processing, etc. (excluding crop loans, land improvement such as canals, irrigation, wells) and services supporting these, shall be eligible for coverage under the Scheme.

Related Feasibility Study Reports: Projects for Small and Medium Enterprises (SME). Profitable Manufacturing Business Ideas to Start. Small Scale Industry. Business Ideas to Make Money.

To extend collateral free coverage, Government of India has set up the Credit Guarantee Fund for Stand-Up India (CGFSI). Apart from providing credit facility, Stand Up India Scheme also envisages extending handholding support to the potential borrowers. It also provides for convergence with Central/State Government schemes. Applications under the scheme can also be made online at (www.standupmitra.in) portal.

Apart from linking prospective borrowers to banks for loans, the online portal https://www.standupmitra.in/ developed by Small Industries Development Bank of India (SIDBI) for Stand-Up India Scheme is also providing guidance to prospective entrepreneurs in their endeavour to set up business enterprises, starting from training to filling up loan applications, as per bank requirements.

Through a network of more than 8,000 Hand Holding Agencies, this portal facilitates step by step guidance for connecting prospective borrowers to various agencies with specific expertise viz. Skilling Centres, Mentorship support, Entrepreneurship Development Program Centres, District Industries Centre, together with addresses and contact number.

Achievements

- More than 1 lakh women promoters have benefitted from this Scheme during its six years of operation.

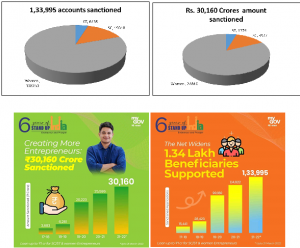

- As on March 21, 2022, 30160 crore has been sanctioned under Stand Up India Scheme to 133,995 accounts.

- Total number of SC/ST and Woman borrowers benefited under Stand Up India scheme is depicted below (as on 21.03.2022):

Success Stories:

- Mrs Asiya Bin Gulshan is associated with the work of event catering. She proposed to start her own business of supplying chairs, utensils for various functions and approached the Char Minar branch of Andhra Bank for a loan. Her husband is also unemployed and came forward to assist her in the business. They were sanctioned term loan and working capital to meet daily expenditure. The proposed unit is located at prime area and there are no units of similar activities. Asiya is confident of successful in the new business.[5]

- Smt Sonalben Sureshbhai Rupara residing at Radhe Residency, Utran, Surat applied for purchasing of embroidery machines for production work to be set up at Old GIDC, Katargam, Surat under Stand-up India Programme. Smt Sonalben applied online in Stand-up India portal and the bank picked up the application from market place. The total financial assistance given to her as term loan of Rs. 39.00 Lacs as per her requirement. The entrepreneur is successfully running the embroidery unit and generating sufficient cash flow to regularly serve interest and instalment also providing employment 5 to 8 persons in her unit.[6]

Watch other Informative Videos: Business Ideas for Startups

- Mrs. Suma K T from Tripunithura, Kerala was engaged in production and manufacture of paper cartons and paper products. But, due to heavy competition in this field, she was unable to achieve decent profits. She then approached Bank of Baroda for modernization of the unit by installing the latest state of art technology laser cutting machines, which would diversify and enhance the quality of the products produced. The proposal was considered favourably, pre sanction inspection conducted, assessment was made and loan was sanctioned for Rs. 75 lakhs term loan and Rs.10 lakhs working capital limit. Now, Mrs. Suma is having several orders on hand. She has commenced repayment of the loan and is a successful entrepreneur.[7]

Reference Links

- https://www.pib.gov.in/PressReleasePage.aspx?PRID=1813432

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1709415

- https://pib.gov.in/PressReleseDetailm.aspx?PRID=1790112

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1737320#:~:text=Key%20Highlights%3A,Scheduled%20Tribe%20and%20women%20borrowers.

- https://pib.gov.in/PressReleseDetailm.aspx?PRID=1709415

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1703554

- https://pib.gov.in/Pressreleaseshare.aspx?PRID=1703444

- https://pib.gov.in/Pressreleaseshare.aspx?PRID=1776546

- https://pib.gov.in/PressReleseDetail.aspx?PRID=1604929

- https://pib.gov.in/newsite/PrintRelease.aspx?relid=138523

- https://pib.gov.in/newsite/PrintRelease.aspx?relid=147661

- https://pib.gov.in/PressReleasePage.aspx?PRID=1703083

- https://pib.gov.in/PressReleseDetailm.aspx?PRID=1790112

- http://www.standupmitra.in/Home/SchemeGuidelines

Tweets

- https://twitter.com/narendramodi/status/1511263434620686339?t=A31QPSOFvD5_JhHk0xD73g&s=08

- https://twitter.com/FinMinIndia/status/1511184467486191621?t=dWi21Yyqm-0tqutv-Py08w&s=08

- https://twitter.com/FinMinIndia/status/1511184486553513989?t=68Ai-VHNli8oZ9XjLiDo6Q&s=08

- https://twitter.com/FinMinIndia/status/1511184501967572992?t=bXTfthncvrlb3oGxb385pw&s=08

- https://twitter.com/FinMinIndia/status/1511184520728711168?t=agJ-_ldkqsw-ink-n6TEJA&s=08

- https://twitter.com/FinMinIndia/status/1511184532443377665?t=HCBYl8rg_VPoJ2nCjyJo0A&s=08

- https://twitter.com/mygovindia/status/1511184702140342274?t=2iHoI_IRC_G0NWZ3wH8VNQ&s=08

- https://twitter.com/mygovindia/status/1511185044395618309?t=DF-dHd4VxA76zOmi6-4qrw&s=08

- https://twitter.com/mygovindia/status/1511185454804049921?t=P3y33ClQjkU6PHr6hb8UXA&s=08

- https://twitter.com/mygovindia/status/1511185621666041862?t=4d9n9tRHEyAfsp6yEL-WNg&s=08

- https://twitter.com/hashtag/standupindia?lang=en

- https://twitter.com/finminindia/status/826450464996618240?lang=en

- https://twitter.com/DFS_India/status/1397121882512494597?s=20&t=59a3yXDfCbeHdE-EYbZdZA

- https://twitter.com/FinMinIndia/status/1378897833449771011?s=20&t=rayG3i80DBrvSqnf1cthtQ

YouTube Videos

- https://youtu.be/ncZf5F_ReLY, PM Modi’s address at the launch of Stand Up India Initiative in Noida, Uttar Pradesh

- https://youtu.be/M8o1TYfPJ-4

See More Links:

Start a Business in Potential Countries for Doing Business

Best Industry for Doing Business

Business Ideas with Low, Medium & High Investment

Looking for Most Demandable Business Ideas for Startups

Start a Business in Middle East

Related Market Research Reports

[1] https://www.narendramodi.in/pm-modi-at-the-launch-of-stand-up-india-initiative-in-noida-uttar-pradesh-440007

[2]https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1737320#:~:text=Key%20Highlights%3A,Scheduled%20Tribe%20and%20women%20borrowers.

[3] https://pib.gov.in/PressReleseDetailm.aspx?PRID=1709415

[4] https://www.standupmitra.in/Home/ImportantSteps

[5] Al Ameen Supplying Company (udyamimitra.in)