The Indian food industry develops at the speed of interruption. Although it was dominated by agriculture and small stores, it is now expanding to include large factories, systematic supply networks and products suitable for global markets.

According to the annual MOFPI report 2024–2025, food processing itself represents $ 46.43 billion worth exports. The industry also represents 7.93 % GVA in production and 8.45 % in agriculture.

Startups should entertain. Since India has the highest production in the world of milk, pulses and onions and the second for fruits and vegetables, there is a possibility for entrepreneurs access to quality raw materials for value added products that can be exported.

Indian food processing sector at first sight

- Growth rate: 6.55 % Cagr (2014–2023).

- Employment: 22,96 Lakh in registered units; 46.57 Lakh in unloaded units.

- Exports: $ 46.43 billion in FY 2023–2024 (11.7 % of total exports)

- FDI: The tide of $ 7.22 billion (2014–2024).

Obviously, the sector exceeds only India feeding; They feed the world.

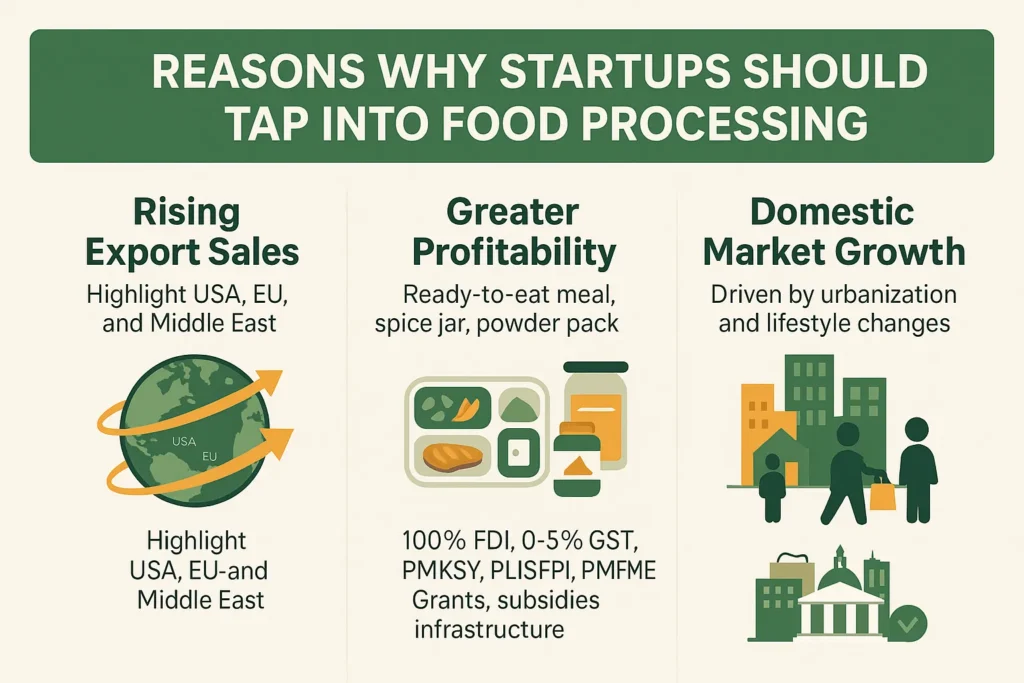

Reasons why startups should be connected to food processing

- The first would be a growing export sales for the US, the EU and the Middle East.

- Secondly, there is more profitability of processed foods such as food prepared, dried pills and spices.

- Thirdly, government support, such as 100% FDI, 0-5% GST and PMKssy, Plisfpi and PMFME schemes with grants, subsidies and infrastructure, help relieve startups.

- Finally, there is a rapid growth in the domestic market for urbanization and lifestyle changes.

Key government programs supporting startups

Pradhan Mantri Kisan Sampada Yojana (PMKSY)

It provides support for mega food parks, cold chains, agro -process clusters and storage.

It adds value to raw materials, reduces waste.

Advantage to Startup: Shared infrastructure dramatically reduces the input costs.

PM formalization of enterprises for the processing of micropodnic (PMFME)

35% credit subsidy for 2 lakh units.

Supports One District One Product (ODOP).

Startup Advantage: Take part in local specialties such as manga pulp to UP, refreshments of millet in Karnataka.

Production Motivation System for Food Processing for Food Processing (Plisfpi)

Processed food sales and/or export incentives.

Prepared to eat, seafood, dairy products, fruits and healthy foods.

Advantage for Startup: High value, export oriented production is supported.

Read More: FEMA Guidelines 2025: Impact on MSME Exporters and What It Means for Export Growth

NiveSh Bandhu portal

Electronic platforms allow investors to access clusters, raw materials and exported food in agricultural resources.

Startup Advantage: Quickly identify supplier chains and integrate smoothly with investors.

Potential business opportunities for startups 2025 – 2030

The processing of cereals and cereals

Grain & Cereal Processing

It is estimated that the grain and cereal sector has generated $ 10.9 billion. Millet Foods, gluten -free flour and fortified rice, along with other rice products, have a growing demand for both domestic and international.

Here, startups have the potential to create savage exports, instant rice packages, fortified flour and couscous. Other instant ready -made cooking of cereal products.

Health markets are now trying to germinated flour and fortified cereals, with certain decent edges available with added value for cereal products ..

Spice and oleoresins

The export of spices and oleoresins as a whole has reached $ 4.7 billion due to the demand of the world for essential oils, turmeric and chilli and natural flavors. This allows new companies to create organic powders and extracts and mixtures of spices or other oleoresins.

In addition, more benefits are sold to the US, the EU and the Middle East, with certified products of spices for organic and chemical and chemical spices along with high profitability and increased brand value.

Fruits and vegetables

The American imported market of processed fruit and vegetables is more than $ 1.15 billion, while the moving industry focuses on dehydration, annoying dry, cooling juices and exotic fruit concentrates.

Startups can therefore focus on the production of dehydrated tomatoes, onions and garlic powders, lakli, exotic fruit juices and fruit puree for countries in Africa, Europe and the Middle East. This market also has space for the development of plant powders with immediate use for soups, sauces and baby food.

Read More: Revised MSME Definition: A Game-Changer for Entrepreneurs

Meat and seafood

Exports of meat and seafood in India have exceeded $ 10 billion, while the growing market frozen, ready for cooking, halal and value added.

Startups can start their business in exports of frozen shrimp, ready to cook sea food refreshments, marinated vacuum sealed meat and various other processed poultry products.

Increasing demand for halal and healthy products on foreign markets can also be met at premium prices with long -term agreements.

Sugar, cocoa and confectionery

The industry earned $ 3.29 billion from exports and faces demand for jaggers, ecological products, sugar -free sugar, craft chocolate and cocoa snacks.

Startups can produce chocolate bars, jaggers and cocoa -based products that are made by hand and natural sweeteners. In addition, global demand grows in functional confectionery such as probiotic chocolate, is new to specialized products.

Milk/honey product

Indian export revenues from the milk and honey subject reached $ 625 million, with prospects spinning around protein concentrations, honey without lactose and organic honey. As a result, startups can explore the exports of craft cheeses, ghee, certified organic honey, whey proteins and milk protein isolates.

In addition, the health global marketplace represents a number of prospects of high value by adding lactic superfood mixes, superfood honey and other health -oriented health, along with plant proteins and fortified milk mixtures.

Unused International Markets = Opportunities to Start

- Edible oils: spend $ 15 billion on imports -> creating sunflower/soy oil refinery.

- Cocoa: Spend $ 512 million for imports -> Set chocolate factories for domestic cocoa processing.

- Drinks and vinegar: Spend $ 1.5 billion for imports -> produce craft fruit wines and local drinks.

Startups can reduce imports and meet international market needs.

Stories of Success: Little Squares

- LT Foods (Daawat Rice): extended from local family business to a global rice supplier.

- Hector Beverages (Paper Boat): Exported modernized versions of traditional drinks.

- MDH & Everest spice: improved quality and branding to become global leaders in the spice market.

- Lessons: Watch a specialized, high -value market, a scale with government support and global market access.

Read Our Book: Click Here

How NPCs can help you

As far as I am concerned, NPCS helps new businesses in establishing food processing compatible with exporting the preparation of the CUM techno-technical market survey on economic feasibility (DPR).

The reports include a detailed description of the production process, the market description including demand, the process diagram, market production and marketing planning, the payment of machines and raw materials, and finance, including the forecasts of investment and profitability and financial projections together with a detailed explanation of the process flow diagrams.

In addition, NPCS aligns projects with NABARD loans and subsidies MOFPI, which cause starters to receive low cost, infrastructure and tax financing. Therefore, entrepreneurs spend less time with NPCS, alleviate risks and easily expand their businesses to foreign elements.

Read Our Project Report: Click Here

Document outline: Starting food processing

- Explore your target markets using elements of the MOFPI portal and trade statistics.

- Select one product line (a series of cereals, dried and processed fruit, spices, milk, seafood).

- Ask for funding according to PMKSY, PMFME, PLISFPI.

- Invest in technology (cold strings, automation, processing and packaging systems) for your value plant.

- Ensure compliance with all legislatical requirements: FSSAI, HACCP and ISO certification.

- Develop export and branding plans.

- In cooperation with NPCs, design and expand your projects.

Find the Best Idea for Yourself With our Startup Selector Tool

Conclusion: From a farm, to a factory, to the world

The food processing industry in India is ready to develop as a world -class industry. With NPC and Government Help systems for increased exports, importing imports and availability of home raw materials, startups can build high -valuable processed foods and exportable products.

The decade of 2025 to 2030 will be a lot of food processing for the economy, as the NPC systematically loads the global market and starts startups on cereals, spices, dairy products, seafood and fruit.

FAQS

Question 1: What is the current rate of food processing in India?

The food processing industry has grown at 6.55%in the last decade in the last decade.

Q2: What government programs are available to support new businesses?

PMKSY, PMFME, PLISFPI and NIVESH BANDHA PORTAL.

Q3: Which products are highly desirable from export?

Cocoa, seafood, dairy products, vegetables, spices, fruits, jaggers and cereals.

Q4: How can NPC help new startups?

We compare projects with government financing programs and are preparing DPR, market research and funds.

Q5: Why now enter food processing?

Expected global availability and strong domestic market associated with robust governmental initiatives, unlocking potential and promise at minimal risk.