Business and investing are interrelated, accumulating wealth along with promoting economic development. Business is about value creation through revenues generated by selling goods or services. Investing is about capitalizing resources, such as money, time, and expertise, into a venture and/or asset with the expectation of receiving a positive return over time.

Understanding the fundamentals of both business and investing can enhance the entrepreneur, investor and practitioner’s ability to make informed decisions, mitigate risks and achieve long-term financial objectives. A combination of the elements of business and investment strategies can help enhance profits, facilitate sustainable growth, and gain a competitive advantage in markets that are always changing. Entrepreneurs that blend knowledge of business operation with understanding how asset investments work, will gain a better advantage to grow their business, raise capital and meet challenges.

Importance of Business and Investing

The value of business and investing is in their complementary manner. Business is what drives innovation, jobs and economic growth while investing is what provides individuals and organizations the ability to build wealth, diversify income and be financially secure.

A strategic balance of entrepreneurial activities and strategic investing, will enable greater efficiency, promote innovation, and provide continuity in profitability. Having a good understanding of key market factors, consumer behavior and financial theory can provide insight into ways business and investing can be use strategically for learning purposes, creating wealth and risk management.

Principles of Business

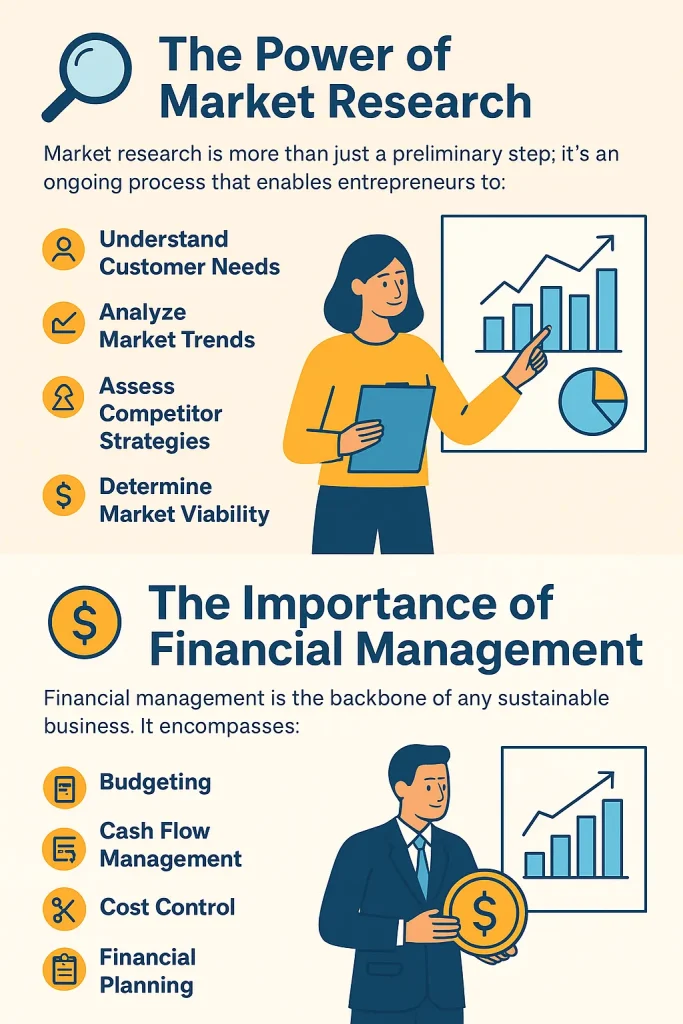

Key business principles include value creation, conducting market research, managing finances, fostering innovation, and maintaining operational efficiencies. A successful business provides customers with a product or service that effectively solves a problem, meets a need, or is convenient.

Completing comprehensive market research enables entrepreneurs to grasp consumer preferences, assess competing businesses, and recognize industry tendencies resulting in evidence-based decision-making and improved growth planning. Good financial management allows an entrepreneur to budget appropriately and limit costs, allowing the business to operate in a profitably and sustainably.

Entrepreneurs must also innovate and adapt continually to new technology, new patterns of consumer behavior, and new market dynamics. By streamlining processes, increasing productivity, and maintaining quality, an entrepreneur may preserve operational efficiencies while also ensuring consumer satisfaction.

For more information, see our project report

Principles of Investing

Investing demands a systematic approach based upon research, risk management, and thinking long-term. Investors should assess risk versus the potential for returns or gain and take a balanced approach to investments in various sectors, industries, or asset classes while orienting toward the long-term to maximize growth. It is essential to carefully review market behaviors, financial statements, and potential investment opportunities to make informed and rational investment decisions.

It is also important to understand liquidity and exit strategy. You want a way to quickly convert an asset to cash if you need to; or if necessary, you want ways to minimize any losses. Stocks, bonds, and real estate, along with mutual funds, private equity, or even alternative assets such as gold or cryptocurrencies all provide options to build wealth given your tolerance for risk and your investment objectives.

For those who want to learn more, we encourage you to further explore our books.

This is the Role of Niir Project Consultancy Services (NPCS).

Market analysis and research is vital for both business and investing. Understanding consumer behaviors, industry trends, economic indicators and competition, for both business and investing, is how entrepreneurs and others are able to find the most profitable opportunities and effectively reduce risk. Feasibility studies, SWOT analysis and pilot studies are ways of investigating how viable a business idea or investment thesis may be.

Consulting services, like NPCS, provide thorough deep market surveys and techno-economic feasibility reports that help entrepreneurs and investors evaluate investment options. Plus, the NPCS reports also provide insight, as to industry trends, demand, operational processes, raw materials, and plant layouts. While they do not provide hard financial numbers, consulting services will help alleviate uncertainty, mitigate risk, and help ensure the greatest likelihood of sustainable success.

Opportunities for Entrepreneurs and Investors

Technology, consumer tastes and sustainability provide opportunities for new products, services and investment options. There is an increasing number of entrepreneurship and investment opportunities in diverse and innovative markets.

A focus on thoughtful investments coupled with business operations will help lead families and organizations to grow value, innovation, and the economy. Entrepreneurs can capitalize on these trends by building strategic alliances, focusing on quality and differentiation, and using scalable business models. Likewise, investors can diversify their portfolios, focus on high-growth areas, and take advantage of market inefficiencies for long-term gains.

Conclusion

In conclusion, the keys to business success and financial security are understanding how businesses operate, and investing. Integrating entrepreneurship with investments allows for prosperity, security, and longevity. Using such consulting services as NPCS, provides so many insights and project details this same ensures zero risk with high standard of work.

With well intentioned planning, continued learning and a strategic implementation business and investing can and will be a powerful tool to create sustainable businesses, generate economic growth while.

Discover the best business ideas for you using our startup selector tools.

Frequently Asked Questions

Q: How are business and investing related?

A: Business creates value through products or services, while investing allocates resources into ventures or assets for future returns; both are tools for wealth creation.

Q: Why is understanding both important?

A: Combining business acumen with investing strategies helps maximize profits, manage risks, and ensure long-term financial growth.

Q: What are the key principles of business?

A: Creating value, conducting market research, managing finances, fostering innovation, and maintaining operational efficiency.

Q: What are the important investing principles?

A: Understanding risk and return, diversification, long-term perspective, research and analysis, and liquidity planning.

Q: How can consultancy services support business and investing?

A: NPCS provides market surveys and feasibility reports, helping entrepreneurs and investors understand trends, demand forecasts, and operational planning for informed decisions.