Starting a best manufacturing businesses requires insight into both the product and the market demand. Entrepreneurs and startups in 2025 should look for industries that combine growing market demand, sustainable resources, and supportive trends like health consciousness or infrastructure development. Below, we explore eight promising manufacturing business ideas – from renewable energy fuels to packaging materials – each with strong growth prospects.

To kick things off, provides a snapshot of the market size and growth projections for each of these eight sectors, helping you compare their potential at a glance:

| Manufacturing Sector | 2025 Market Size (USD) | 2030 Market Size (USD) | Approx. CAGR (Annual Growth) |

| Biomass Pellets (from Bio-Waste) | ~USD 12 Billion | ~USD 16 Billion | ~6% per year |

| Groundnut Oil | ~USD 11 Billion | ~USD 14 Billion | ~4.5% per year |

| Ethanol (from Sugarcane) | ~USD 120 Billion | ~USD 150 Billion | ~4–5% per year |

| Chlorinated Paraffin Wax (CPW) | ~USD 2.5 Billion | ~USD 3.2 Billion | ~4% per year |

| Bathroom Fittings (Sanitary Ware) | ~USD 57 Billion | ~USD 80 Billion | ~6.5% per year |

| Sorbitol | ~USD 1.7 Billion | ~USD 2.3 Billion | ~5.5% per year |

| Duplex Printed Cartons (Packaging) | ~USD 125 Billion | ~USD 156 Billion | ~4.5% per year |

| GFRP Rebar (Fiber-Reinforced Polymer) | ~USD 0.7 Billion | ~USD 1.2 Billion | ~10–11% per year |

Global market size estimates (approx.) and growth rates for each sector. CAGR = Compound Annual Growth Rate.

As shown above, all these industries are on an upward trajectory. The following chart illustrates the relative annual growth rates of these sectors, highlighting which markets are expanding the fastest:

Projected Annual Growth Rate (CAGR) by Sector (approx. 2025–2030). GFRP Rebar leads with the highest growth rate, indicating a rapidly expanding market, whereas mature sectors like oils and packaging still show steady growth.

Now, let’s dive into each opportunity in detail. For each product, we’ll describe what it is, its applications, why it’s a promising venture, and the market demand and forecast that make it attractive for a new manufacturing business.

View our Books for more additional information

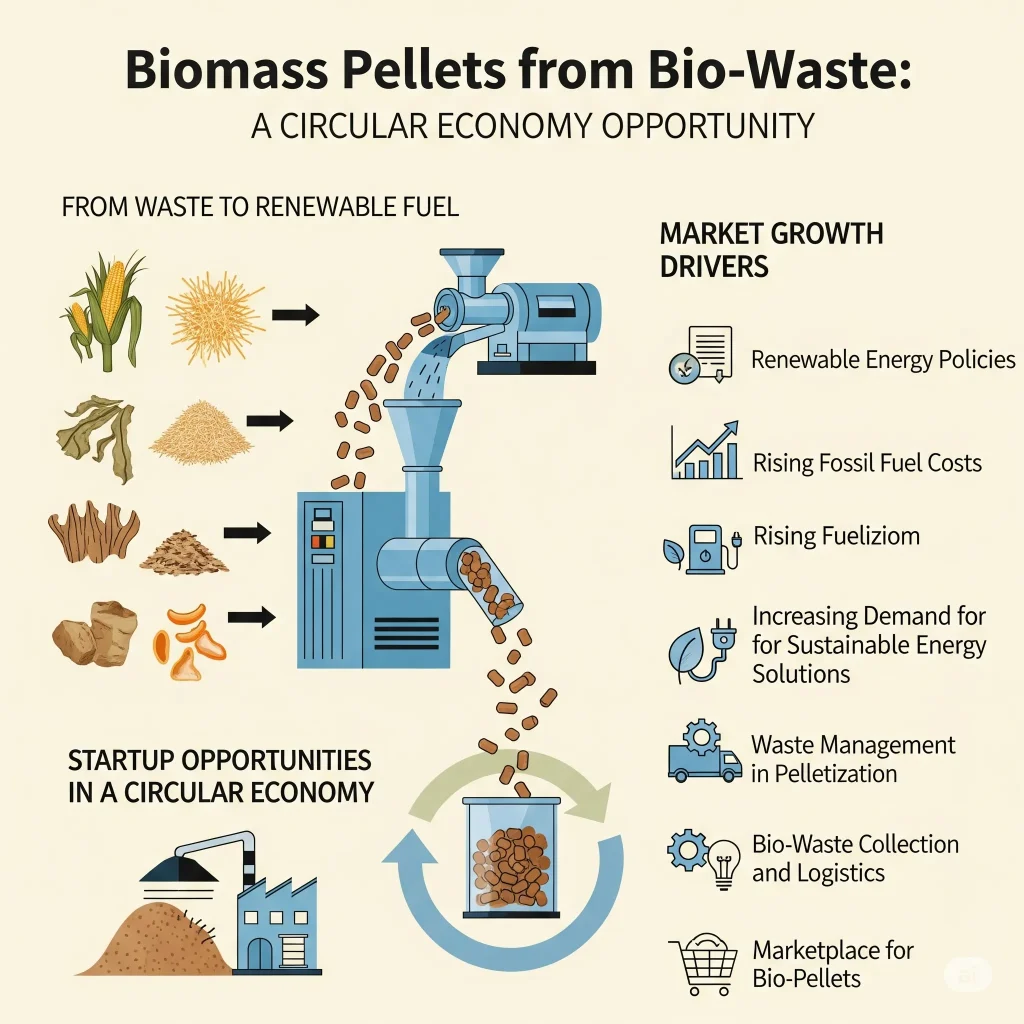

1. Biomass Pellets from Bio-Waste

Overview

Biomass pellets are small, cylindrical fuel pellets made by compressing agricultural residues, wood chips, sawdust, and other bio-waste. They replace coal and other fossil fuels in power plants, heating systems, and industrial boilers. Entrepreneurs can source crop stalks, sugarcane bagasse, rice husk, or wood waste and convert them into clean-burning fuel pellets. This process not only creates value from agricultural waste but also solves disposal problems for farmers. At the same time, it meets the rising demand for sustainable energy solutions.

Market Demand & Growth

The global demand for biomass pellets has been climbing steadily, driven by the push for greener energy. As of the mid-2020s, the biomass pellet market is valued at over $10 billion globally, and it is projected to grow to around $15–16 billion by the end of the decade. This implies a healthy CAGR of roughly 6%. Several factors are fueling this growth:

- Renewable Energy Policies: Many countries have introduced policies and incentives to reduce carbon emissions. International agreements like the Paris Climate Accord have led to national targets for renewable energy use.

- Energy Security and Cost Stability: Biomass pellets provide an alternative to imported fossil fuels, which can improve energy security. They also offer more stable pricing – fossil fuel prices are volatile, while pellets derived from local waste can be more predictable in cost.

Opportunity for Startups

Setting up a biomass pellet manufacturing plant can be an attractive venture, especially in agrarian economies or regions with lots of forestry/agricultural residues. Government support is often available in the form of subsidies or renewable energy credits for biomass projects. Entrepreneurs will need access to raw material (bio-waste), pelletizing equipment, and knowledge of quality standards (pellets have to meet certain density and moisture specs).

End markets include power generation companies, industrial heating users, and export buyers (for example, Europe’s strong demand for heating pellets). With the global focus on clean energy, a bio-waste pellet business has solid growth potential. It also reduces waste and cuts emissions a double win for a new enterprise.

Related: How to Start a Biomass Pellets from Bio Waste Manufacturing Business?

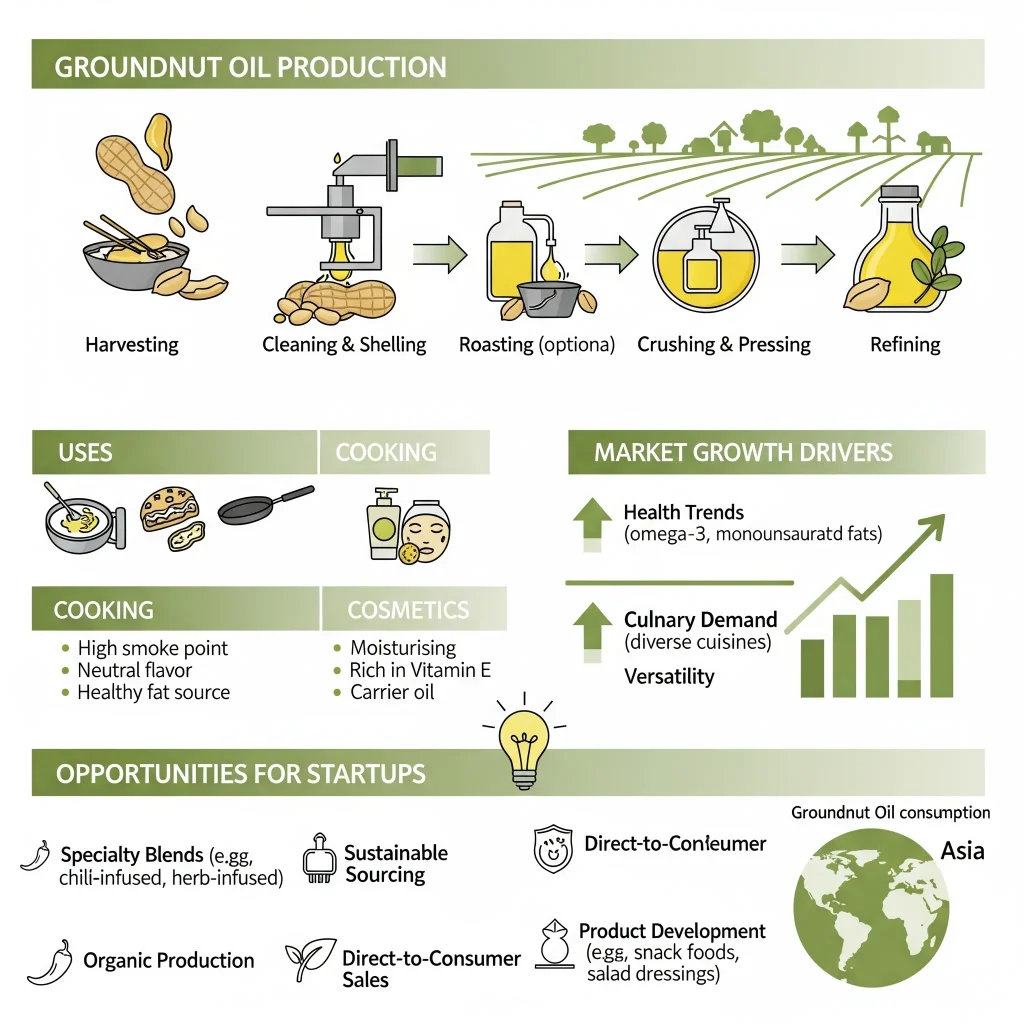

2. Groundnut Oil

Overview

Groundnut oil, also called peanut oil, is an edible vegetable oil made from peanuts. The oil contains a high amount of monounsaturated fats and vitamin E. These nutrients make it popular among health-conscious consumers as a heart-friendly cooking oil. Households and restaurants use it for everyday cooking, while food manufacturers add it to snack foods and confectionery. Cosmetics and personal care brands also use groundnut oil in soaps and massage oils for its natural moisturizing properties.

Market Demand & Growth

The global groundnut oil market is well-established but growing steadily. In 2023, the market size was estimated to be around $10–11 billion, and it is forecast to reach roughly $14 billion by 2030, with an annual growth rate of about 4–5%. Several trends explain this moderate yet sustained growth:

- Health and Nutrition Trends: There is a rising consumer preference for natural and healthy cooking oils. Groundnut oil’s composition (rich in unsaturated fats and vitamin E) aligns with modern dietary recommendations for heart health.

- Culinary Demand: Groundnut oil is especially popular in Asian cuisines such as Indian, Chinese, and Southeast Asian dishes. Many parts of Africa also use it for frying and deep-frying because of its high smoke point and rich flavor. The Asia-Pacific region holds the largest share of groundnut oil consumption, accounting for more than 40% of the global market. This dominance comes from large populations and long-standing traditional usage.

- Food Industry and Exports: The food processing industry’s growth also drives demand for peanut oil as an ingredient. India, China, Nigeria, and the USA are major producers of groundnuts. These countries meet strong domestic demand and also export groundnut oil to regions with limited local supply.

Opportunity for Startups

For entrepreneurs, groundnut oil production can be a viable business, especially in peanut-growing regions. A new venture could involve setting up an oil mill that includes cleaning, crushing/pressing peanuts, and refining the oil. Entrepreneurs can start small with cold-pressed or filtered groundnut oil, which is considered premium and retains natural flavor. They can also choose large-scale production with refined oil for the mass market. Success requires a reliable supply of quality groundnuts, often secured by working with local farmers. It also demands strict adherence to food safety and quality standards.

The market outlook for groundnut oil remains positive. Consumers will continue to cook with edible oils, and groundnut oil’s mix of taste and health benefits ensures steady demand. Other oils such as sunflower, palm, and soybean create strong competition. However, brands that focus on quality and smart positioning can stand out. Marketing groundnut oil as a healthier and traditional choice helps new businesses carve out a niche.

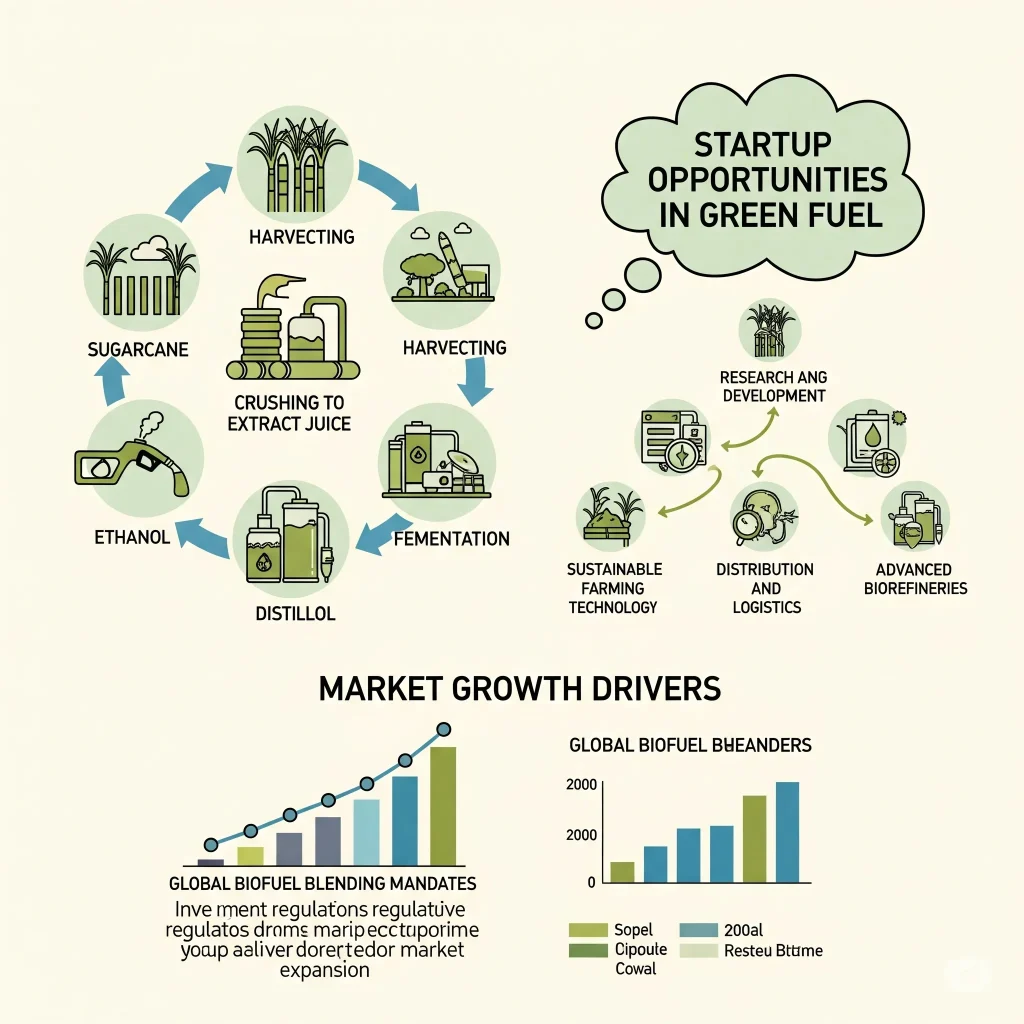

3. Sugarcane Cultivation and Extraction of Ethanol

Overview

Producers create ethanol, a renewable biofuel alcohol, from sugarcane juice or from molasses, which is a by-product of sugar production. Entrepreneurs who tap into this opportunity engage directly in sugarcane cultivation and ethanol extraction through distillation. Fuel companies mainly use sugarcane-derived ethanol as a transportation fuel. They blend it with gasoline to cut fossil fuel use and reduce emissions. For example, E10 fuel contains 10% ethanol, while E20 contains 20%. Some vehicles can even run on E85 blends or pure ethanol.

Market Demand & Growth

The global ethanol market is huge – well above $100 billion – and continues to grow as more nations adopt biofuel policies. Analysts valued the worldwide ethanol market at $110–115 billion in 2023. This estimate includes all feedstocks, not just sugarcane. They project the market to cross $150 billion by 2030. The sector is set to grow at a mid-single-digit CAGR of about 4–5%. For sugarcane ethanol specifically, growth is strong in sugar-producing countries:

- Government Fuel Blending Mandates: This is the single biggest demand driver. Many governments have set targets to blend ethanol into petrol to curb oil imports and cut carbon emissions. Brazil uses over 50% of its sugarcane harvest for ethanol and has gasoline routinely blended with 25%+ ethanol (and cars that run on 100% ethanol).

- Environmental and Economic Factors: Using ethanol reduces tailpipe emissions of certain pollutants and greenhouse gases (since the CO₂ released is partially offset by what the sugarcane absorbed from the atmosphere).

- Global Market & Industrial Use: Besides fuel, ethanol has a global market for beverages and industrial uses (like sanitizers, solvents, chemicals). The pandemic, for instance, spiked ethanol demand for hand sanitizers. However, the long-term growth story is still fuel ethanol.

Opportunity for Startups

Starting an ethanol venture is more complex than other ideas. It requires both agriculture, such as sugarcane cultivation, and industrial processing through fermentation and distillation. Entrepreneurs can choose to focus on one part or manage both. For example, they can establish a distillery that buys molasses from sugar mills as raw material. They can also build an integrated setup with their sugarcane farm and crushing facility. Key success factors include:

- Access to raw material (sugarcane or molasses) at competitive cost – partnerships with farmers or owning land for cultivation.

- Compliance with regulations, since ethanol production is often under government license (especially if used for fuel or potable alcohol).

- Capital for setting up fermentation tanks, distillation columns, and possibly cogeneration units (most sugar/ethanol plants use bagasse, the fibrous residue, to fuel their own power needs).

The market prospects are excellent due to policy support. For example, the Indian government offers financial incentives and soft loans to establish new ethanol plants. Similarly, other countries have tax breaks or purchase guarantees for biofuels.

Related: Start a Sugarcane Bagasse Tray Unit in India: Profits & ROI

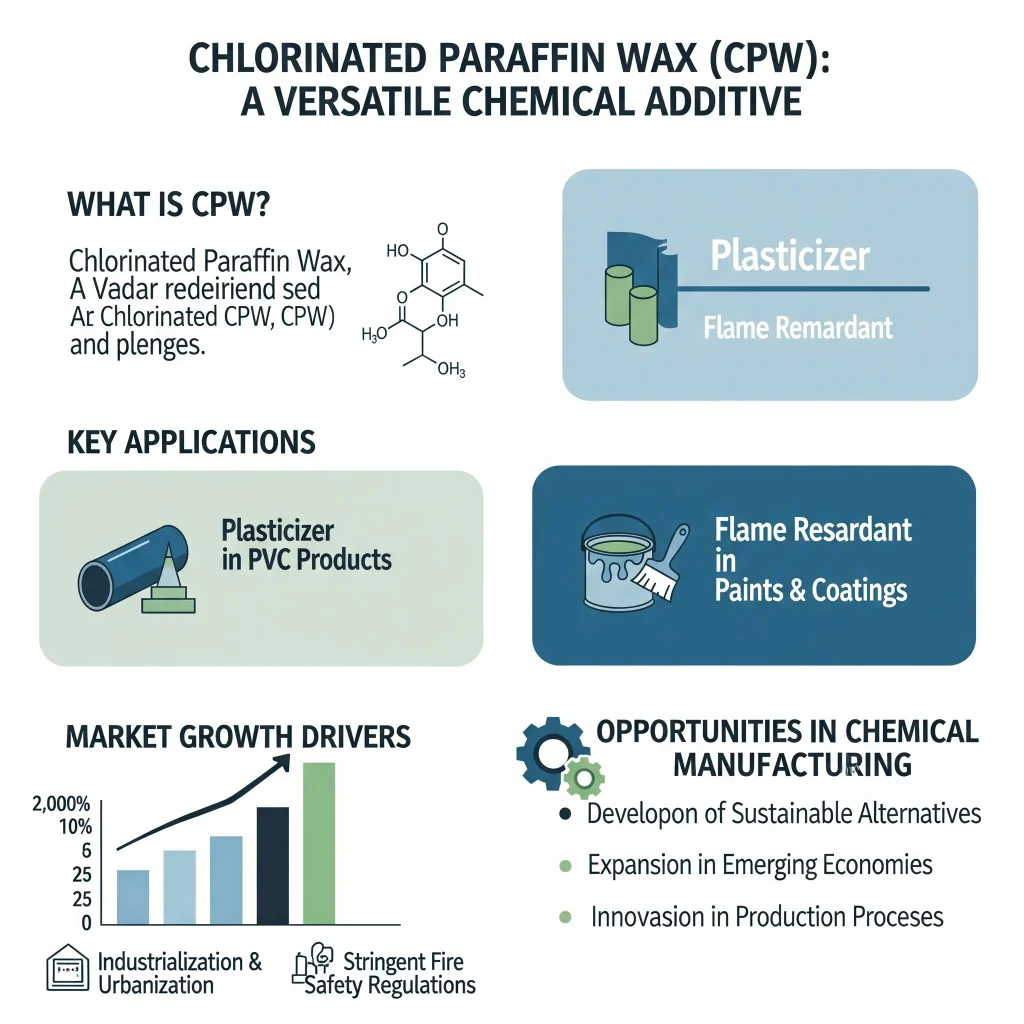

4. Chlorinated Paraffin Wax (CPW)

Overview

Chlorinated paraffin wax (CPW) is a chemical product – essentially paraffin (wax) that has been chlorinated to various degrees (typically 40–70% chlorine content). The result is a viscous liquid or soft solid with desirable properties for industrial applications. CPW comes in different grades (short, medium, long-chain, depending on carbon chain length) tailored for different uses. Key application areas include:

- Flexible PVC Products: CPW is a cost-effective secondary plasticizer in PVC compounds. It’s widely used in things like PVC cable insulation, floorings, synthetic leather, hoses, conveyor belts, and footwear soles.

- Rubber and Sealants: In rubber formulations and adhesives/sealants, CPW provides flame retardancy and flexibility. For example, some conveyor belt coatings or industrial rubber sheets contain CPW to self-extinguish fires.

- Paints and Coatings: Certain specialty paints, varnishes, and waterproof coatings incorporate chlorinated paraffin as a flame retardant additive and to improve water resistance.

- Metalworking Fluids: CPW (particularly medium-chain grades) is used as an extreme-pressure lubricant additive in metal cutting and machining oils. It helps in cooling and lubricating cutting tools under high stress.

Market Demand & Growth

The global market for chlorinated paraffin wax is a niche within the broader chemicals and plastic additives industry, but it has been growing steadily in line with industrial growth. That translates to a CAGR of roughly 4% per year. Growth drivers include:

- Industrialization and PVC Demand: Emerging economies in Asia and Africa are rapidly building infrastructure and manufacturing capacity. This growth increases demand for cables, construction materials, vehicles, and consumer goods. Many of these products rely on flexible PVC and rubber parts.

- Cost-Effectiveness: CPW is popular because it delivers dual benefits (plasticizing and flame retardancy) at a low cost. It often replaces a portion of higher-cost primary plasticizers in formulations. Companies looking to reduce formulation costs in PVC or rubber often increase CPW usage, as long as regulations allow.

- Regulatory Environment: It’s worth noting that environmental regulations play a role. Short-chain CPWs have been restricted in some regions (like Europe) due to bioaccumulation concerns.

Opportunity for Startups

Manufacturing CPW involves chlorination of paraffin feedstock, which requires chemical processing equipment and safety measures (since chlorine is reactive). A new CPW plant would typically procure heavy paraffin or wax (often a petroleum by-product) and then chemically react it with chlorine gas in a controlled process. Entrepreneurs with a background in chemicals or who can hire experienced chemical engineers could find this a profitable B2B business, supplying to plastic compounders, PVC product makers, paint manufacturers, etc. Key success factors include:

- Location close to industries that use CPW (to save on transport and build local client base) or near sources of raw material.

- Quality control to produce consistent chlorination levels as per customer needs.

- Environmental compliance: ensuring emissions and effluents are managed properly, as chlorinated processes can produce pollutants.

The market outlook for CPW is positive, where industrial growth is robust. It may not be as high-profile as renewable energy or food products, but it’s a quietly profitable segment with widespread applications. A startup in this field can gain a foothold by meeting domestic demand (reducing reliance on imports) or offering specialized grades of CPW.

5. Bathroom Fittings (Commode and Hand Wash Basins)

Overview

This category refers to the manufacturing of sanitary ware – in particular, ceramic bathroom fixtures like toilets (commodes), sinks (wash basins), urinals, etc. These products are essential components of housing and commercial real estate, as well as public infrastructure. Quality bathroom fittings improve hygiene and living standards, and there’s an ongoing shift in many markets toward modern, water-efficient, and aesthetically pleasing designs.

Manufacturing these typically involves working with ceramics (vitreous china), although there are also materials like acrylic or composite used in some basins.

Market Demand & Growth

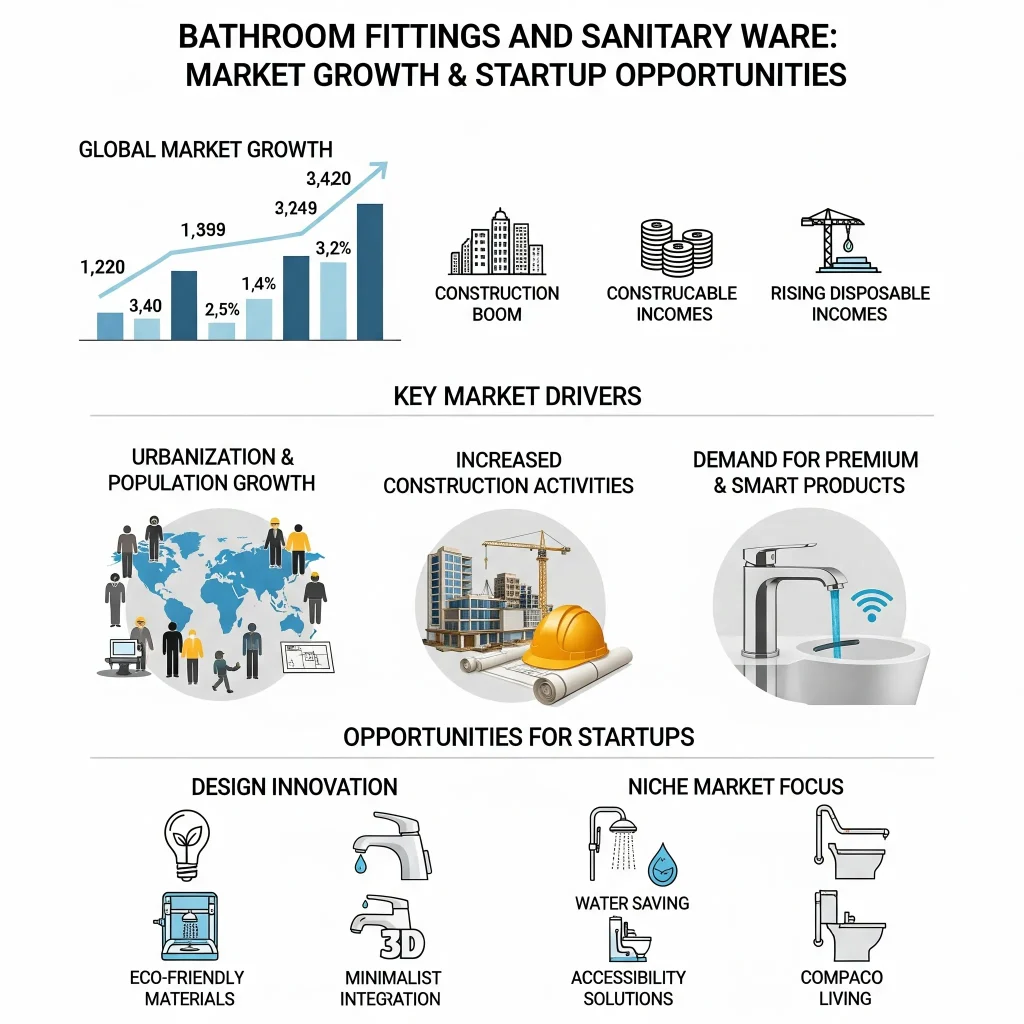

The market for bathroom fittings and sanitary ware is robust and linked closely to the construction industry (both new construction and renovation). Researchers valued the global sanitary ware market—including commodes and basins as major segments—at around $50–60 billion in the mid-2020s, and they project it to reach nearly $80 billion or more by 2030. This corresponds to a CAGR in the 5–7% range. Key demand drivers include:

- Urbanization and Housing Development: In developing countries, rapid urbanization is creating demand for millions of new homes and apartments, all of which need bathroom fixtures. Even in developed markets, there’s a constant cycle of home renovation and upgrades.

- Commercial and Infrastructure Projects: Beyond homes, think about offices, shopping malls, hospitals, schools, hotels – every commercial or institutional building has restrooms that require multiple sets of fittings. The growth of hospitality and tourism in many countries also fuels demand for high-end sanitary fittings in hotels and resorts.

- Lifestyle and Quality Upgrades: Consumer preferences are shifting towards better-designed and more comfortable bathrooms. As middle-class incomes rise, people invest in modern bathroom interiors – which can include stylish wall-mounted toilets, designer wash basins, and water-saving dual-flush systems.

Opportunity for Startups

Entering the sanitary ware manufacturing business entails setting up facilities for ceramic processing – including molds for casting, kilns for firing, and glazing lines. A new player can start by focusing on a segment (for instance, only wash basins or only commodes initially) or a niche (such as colorful designer basins or compact toilets for small bathrooms).

A few considerations for entrepreneurs:

- Market positioning: Decide whether to compete on cost (mass market affordable products, which is tough against established large manufacturers) or on differentiation (unique design, smart features, eco-friendly aspects). There are also opportunities in the premium segment, which has higher margins if you can build a brand.

- Distribution: Tapping into the network of real estate developers, construction contractors, and retail hardware/plumbing stores will be crucial. Often, partnerships with builders to specify your products in new projects can secure bulk orders. Export is another avenue – some countries import sanitary ware if local production is insufficient or high-cost.

- Quality and Standards: Bathroom fittings must meet standards for durability (not crack under weight or temperature changes) and often need certifications (for water efficiency or plumbing standards in different countries). Investing in consistent quality will build a good reputation in this business.

In summary, the growth in the bathroom fittings sector is a reflection of both population growth and rising living standards. For a startup, it’s a space where you can help build the future infrastructure and capture a share of a steadily expanding market.

6. Sorbitol

Overview

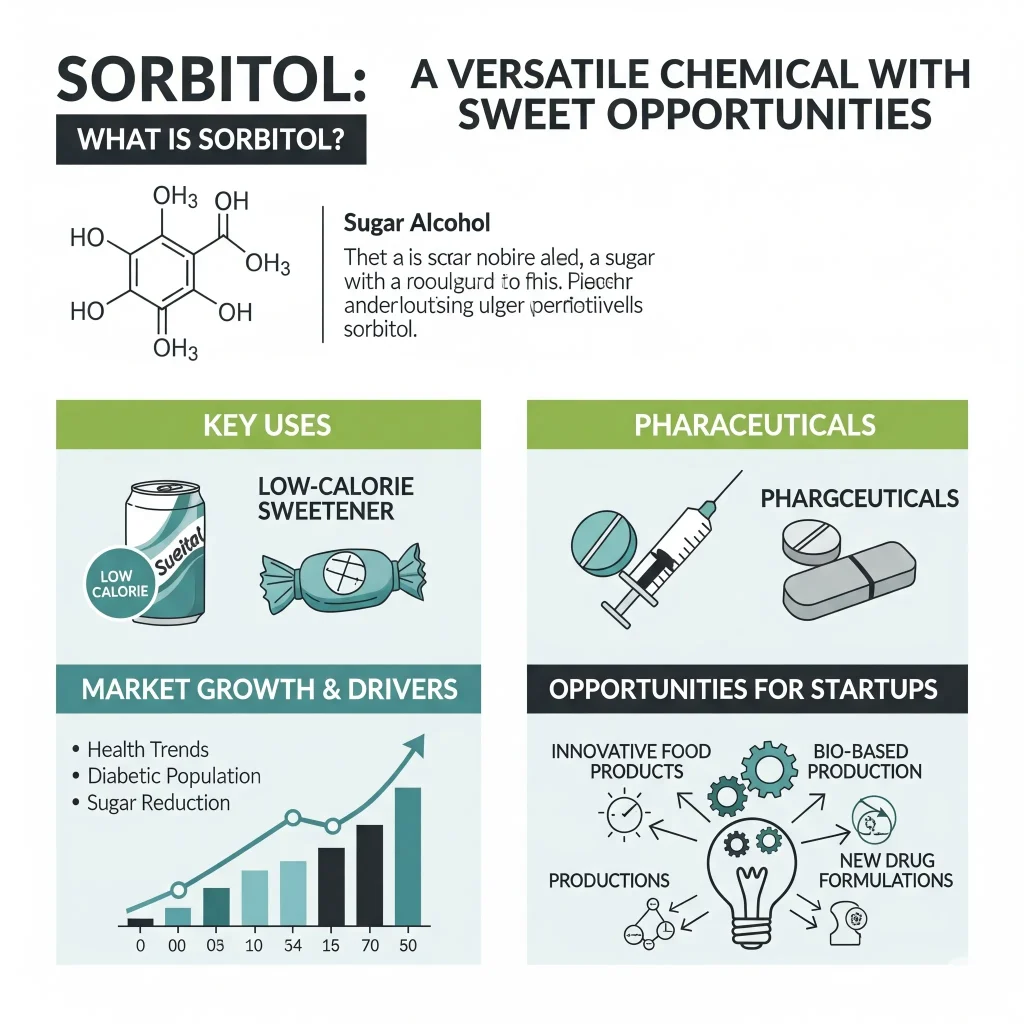

Manufacturers produce sorbitol, a type of sugar alcohol (polyol), by hydrogenating glucose obtained from corn syrup or other starch sources. Food, pharmaceutical, and cosmetic industries use sorbitol as a low-calorie sweetener and as a humectant (moisture-retaining agent). Sorbitol comes in two forms: a syrupy liquid (70% solution) or a crystalline powder. Sorbitol delivers about 60% of the sweetness of regular sugar (sucrose), and food manufacturers often use it in sugar-free products such as diet candies, chewing gum, and diabetic-friendly sweets because it reduces blood sugar spikes and provides fewer calories. Beyond sweetening, sorbitol’s chemical properties make it useful in:

- Pharmaceuticals and Healthcare: Sorbitol solution is used as a base in cough syrups and vitamin formulations. It also serves as a laxative ingredient (as it draws water into the intestine). Importantly, sorbitol is a key starting material for Vitamin C (ascorbic acid) production – one of the largest volume uses, as many vitamin C manufacturers convert sorbitol through a series of fermentation and chemical steps.

- Personal Care: You’ll find sorbitol in toothpaste and mouthwash (to keep them moist and add a touch of sweetness), in face creams and lotions (as a hydrating agent), and other cosmetics. It’s non-toxic and skin-friendly.

- Chemicals: It has niche uses in making surfactants and as a platform chemical to derive products like propylene glycol, but these are smaller segments.

Market Demand & Growth

The global sorbitol market is solid and growing, reflecting the trends in food and pharma that favor its usage. In 2025, the market size is expected to be around $1.7–2.1 billion, and by 2030 it may reach approximately $2.3–2.5 billion. This indicates an annual growth rate of about 5–6%. Key factors influencing demand include:

- Rise of Sugar-Free Foods: With increasing awareness of health issues like obesity and diabetes, consumers (and therefore food & beverage companies) are cutting down on sugar. Sorbitol and other sweeteners enable “sugar-free” or “diet” versions of products.

- Growth in Pharmaceuticals & Personal Care: The pharmaceutical industry’s expansion, especially in developing countries, means more demand for formulations using sorbitol (cough syrups, etc.). Similarly, the personal care industry is growing globally, which supports steady demand for sorbitol in products like toothpaste and cosmetics.

- Nutraceuticals and Functional Foods: Sorbitol’s role in vitamin C production ties it indirectly to the huge market for vitamins and supplements. As vitamin C demand grows (for immune health, etc.), so does demand for sorbitol as the feedstock in many manufacturing processes.

Opportunity for Startups

Manufacturers typically set up hydrogenation plants to convert dextrose (glucose) into sorbitol, and they usually source starch-derived glucose syrups from corn, wheat, or cassava, so securing a reliable starch supply is important. For a startup, the sorbitol business can be attractive if there is a local market or export opportunity (for instance, if there’s a cluster of food or pharma manufacturers nearby who would buy in bulk). Things to consider:

- Scale and Cost: Sorbitol production benefits from economies of scale – larger plants can produce at lower unit cost. A new entrant might start mid-sized and expand, or find a niche like producing high-purity sorbitol for pharma-grade use, which commands a premium.

- Competition: The market has some well-established players (including in China, which produces sorbitol a large scale). To compete, focus on consistent quality, supply reliability, and possibly diversification (many sorbitol producers also make related products like mannitol or maltitol, or even glucose syrup, to maximize utilization).

- Value Addition: There’s also the possibility to integrate vertically – for example, starting from starch to glucose to sorbitol to Vitamin C, if one has significant capital and expertise. For most startups, that’s too ambitious initially, but partnerships could be explored (e.g., supply sorbitol to a vitamin C manufacturer with an offtake agreement).

Overall, sorbitol is a quietly omnipresent ingredient in modern life. The sector’s growth is tied to megatrends in health and consumer habits, making it a resilient business. A startup focusing on sorbitol can tap into multiple industries at once (food, health, personal care), providing a diversified customer base.

7. Duplex Printed Cartons

Overview

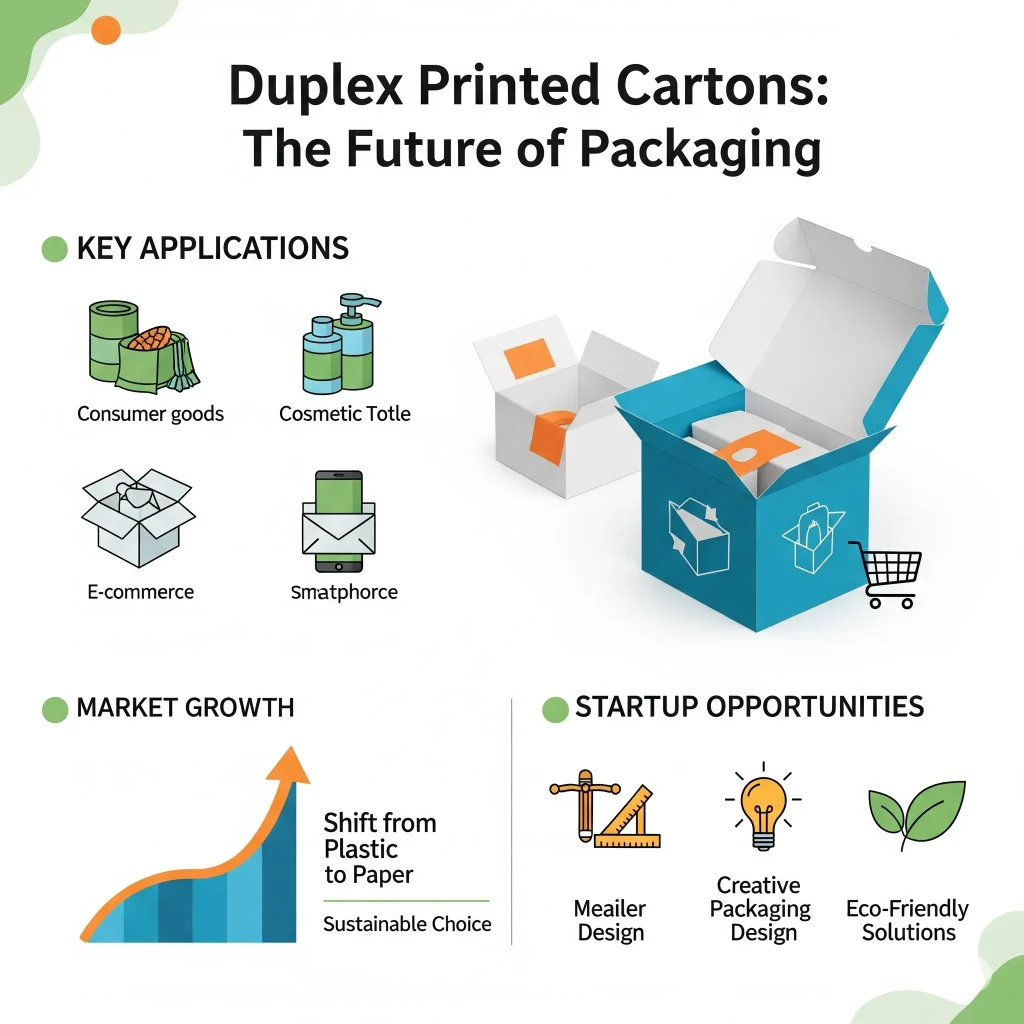

Duplex printed cartons refer to packaging boxes made from duplex board that are printed with designs or branding. Duplex board is a type of paperboard that has two layers (often a grey recycled fiber layer inside and a white coated layer outside suitable for printing). These cartons are widely used for packaging consumer products – from cereal boxes and medicine packaging to electronics, cosmetics, frozen foods, and shoes. Essentially, any product that needs a sturdy paperboard box with attractive printing could use a duplex carton. They are called “printed cartons” because companies print product information, logos, and marketing graphics on them to make the product appealing and informative to consumers.

Market Demand & Growth

The packaging industry as a whole is enormous and growing, and folding cartons (like duplex cartons) form a significant part of it. Global demand for such cartons is driven by the volume of consumer goods. Focusing specifically on duplex board cartons, the growth rate is roughly 4–6% annually worldwide. Key drivers include:

- Growth in FMCG and Consumer Goods: Fast-Moving Consumer Goods (FMCG) like packaged foods, beverages, household items, and personal care products are seeing rising demand, especially in developing economies with growing populations and incomes.

- E-commerce and Retail: The explosion of e-commerce has two effects: one, it increases the need for shipping cartons (corrugated boxes) but also, it encourages brands to invest in attractive packaging for a good “unboxing experience.”

- Shift from Plastic to Paper: Environmental sustainability trends are favoring paper-based packaging over plastics. Duplex cartons are biodegradable and often made partly from recycled material, which gives them an edge as companies aim to use more eco-friendly packaging.

Opportunity for Startups

Entering the printed carton manufacturing business can be quite rewarding as it’s a B2B enterprise with a broad client base. To start, one would typically set up a small carton plant with printing, die-cutting, and gluing machinery. Here’s what an entrepreneur should keep in mind:

- Machinery and Expertise: Modern packaging printing often uses offset printing for high-quality graphics, and machines to cut and crease the board into box shapes. There is a technical aspect to getting prints right (color accuracy, alignment) and making precise cuts/folds. Skilled operators and good equipment maintenance are important for quality output.

- Customization and Design Services: Clients (product manufacturers) may expect you to help with package design or at least adapt their designs onto the carton dieline. Offering value-added services like an in-house designer or prototype sampling can make your business more attractive to customers. Short-run flexibility is also a niche – being able to economically produce smaller batches for niche brands or test launches.

- Economies of Scale: While you can start with a relatively modest setup, scaling up production brings costs down. Many successful carton businesses eventually expand into making the duplex board themselves or diversify into corrugated boxes, etc., to expand their market.

8. Glass Fiber Reinforced Polymer (GFRP) Rebar

Overview

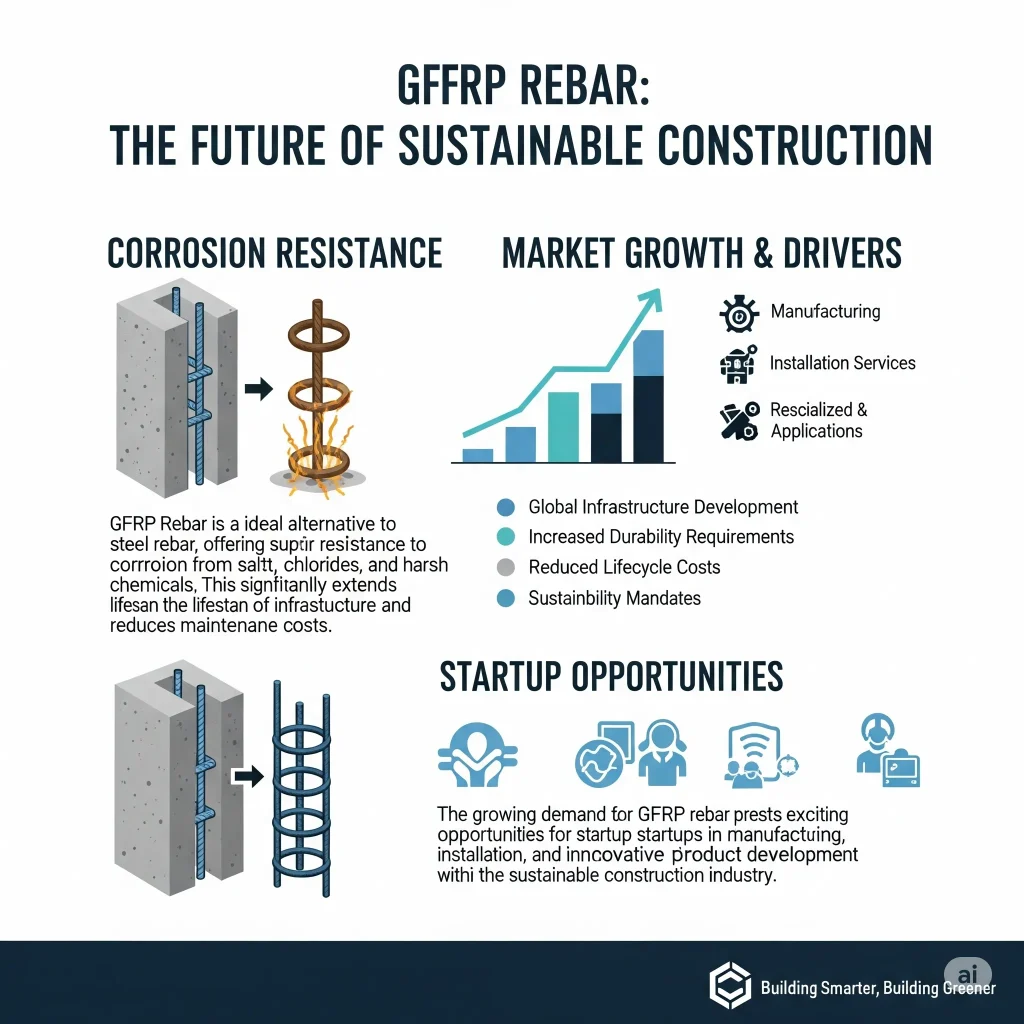

GFRP rebar is a composite reinforcement bar used in concrete construction, made from glass fibers and a polymer resin (usually vinyl ester or epoxy). It serves the same purpose as steel rebar (reinforcing concrete to carry tensile loads), but offers distinct advantages: it does not corrode, is much lighter in weight, and is non-conductive (electricity and thermal). GFRP rebars look like rods with a ribbed surface (often sand-coated or helically wrapped for bonding with concrete).

They have been used in specialized construction projects like bridges, coastal structures, road barriers, and tunnels – particularly where steel rebar would corrode over time due to water, salt, or chemical exposure. With growing awareness of life-cycle costs, GFRP rebar is gaining traction as an alternative to galvanized or epoxy-coated steel bars in many applications.

Market Demand & Growth

The market for GFRP rebar is emerging and growing fast, though from a smaller base compared to traditional steel rebar. In 2025, the global GFRP rebar market is estimatedto be around $0.6–0.8 billion, but by 2030 it could exceed $1.0–1.2 billion, which implies a robust growth rate on the order of 8–12% CAGR. Some analyses even predict doubling within the decade as adoption increases. Key factors include:

- Infrastructure Durability Needs: There is a worldwide emphasis on building infrastructure that lasts longer and requires less maintenance. One major cause of deterioration in bridges and concrete structures is the corrosion of steel rebar inside due to water and salts penetrating over years. GFRP rebar, being rust-proof, dramatically extends the service life of concrete in harsh environments (coastal bridges, marine structures, water treatment plants, etc.).

- Weight and Handling Benefits: GFRP rebars are roughly one-fourth the weight of steel for the same diameter. Construction crews find it easier to carry and install, which can improve construction efficiency and safety. In certain applications like high-rise construction, the reduced weight can also lower overall structural weight.

- Special Applications: There are niches where GFRP rebar is not just optional but necessary. For example, MRI rooms in hospitals use GFRP rebar to avoid magnetic interference (since steel would disturb imaging). Likewise, certain electrical or research facilities use non-conductive rebar for electromagnetic neutrality.

Also, in earthquake-prone regions, the lighter weight of GFRP might offer some structural performance benefits (and at least it won’t corrode if cracks let moisture in after a quake).

For more information, check out our related videos

Opportunity for Startups

Manufacturing GFRP rebar involves a process called pultrusion – pulling glass fiber strands through a resin bath and a heated die to form a solid rod, which is then typically sand-coated or textured. A startup entering this field will need to invest in pultrusion machinery and develop the right resin formulations and quality controls. Considerations:

- Technology and Know-how: The strength of GFRP rebar depends on fiber quality, fiber volume fraction, and proper curing of the resin. Ensuring a consistent diameter and a surface that bonds well with concrete are technical challenges that must be mastered. It’s important to either partner with or hire composites experts.

- Standards and Certification: Construction materials go through approval processes. Different countries have building code guidelines for FRP rebar (for instance, the U.S. has ANSI/ACI codes for FRP bars). A new manufacturer must get their product tested and certified for use in various jurisdictions. This might require collaboration with testing labs and demonstrating performance on parameters like tensile strength, bond strength, and durability.

- Market Education and Penetration: Because steel rebar has been the default for a century, convincing construction companies and engineers to switch takes education and marketing. A startup might begin by targeting obvious-fit projects (like corrosive environments or innovative architects) and build a portfolio of successful case studies.

The good news is, as reflected by the high growth rate, the pie is expanding and there are not many players globally compared to other industries. If you establish a brand for reliable GFRP rebar, you could become a go-to supplier in your region.

Conclusion

Embarking on a manufacturing business in any of these eight sectors can be a rewarding endeavor for entrepreneurs in 2025 and beyond. Each opportunity – whether it’s producing eco-friendly biomass pellets or high-tech composite rebars – addresses a growing market need and is backed by strong demand drivers. The key to success will be thorough planning, understanding the industry’s supply chain, and carving out a competitive edge through quality or innovation. It’s crucial to conduct detailed market research and feasibility analysis before diving in, to ensure you have clarity on raw material sourcing, technology, capital investment, and expected returns.

For entrepreneurs seeking professional guidance, Niir Project Consultancy Services (NPCS) can be an invaluable resource. NPCS prepares Market Survey cum Detailed Techno Economic Feasibility Reports for a wide range of industries, including all the ones discussed above. These reports cover everything from the optimal manufacturing process and required raw materials to plant layout and detailed financial projections.

In essence, NPCS helps entrepreneurs assess the feasibility of setting up new industries or businesses, taking a lot of the guesswork out of the planning stage. Leveraging such expertise can increase the chances of your manufacturing venture becoming a sustainable, profitable reality.

Discover the Right Business for You With Our Startup Selector Tool

FAQs (Frequently Asked Questions)

Q1: Which of these manufacturing businesses is the most profitable or easiest to start?

A: Profitability and ease of starting can vary widely depending on your location, experience, and resources. Generally, businesses like groundnut oil or printed cartons might be simpler to start on a small scale (since they have relatively straightforward processes and abundant demand). In contrast, something like GFRP rebar or ethanol production is more capital-intensive and technical, but they might yield higher margins if you succeed due to less competition in those niches. It’s important to consider what resources you have – e.g., access to raw materials (farming land for sugarcane, waste biomass, etc.) or technical know-how.

Q2: What factors should I consider before starting one of these manufacturing units?

A: There are several key factors to evaluate:

- Market Demand: Verify the demand in your target region. For example, if you plan to make biomass pellets, is there a local power plant or user base, or will you export? Look at current and future demand trends.

- Raw Material Supply: Secure access to quality raw materials at a reasonable cost. Starting a groundnut oil mill? You’ll need a reliable supply of peanuts. Making duplex board cartons? Ensure you can get paperboard or waste paper for recycling.

- Capital and Technology: Determine the investment needed for machinery, land, and working capital. Some industries here require moderate investment (oil expellers, pellet machines), while others need more (chemical reactors, distillation columns, pultrusion lines). Also assess if the technology is readily available and if you have the skilled manpower to run it.

- Regulations and Standards: Check any regulations (e.g., ethanol fuel requires licenses; food-related businesses need safety certifications; chemicals might need environmental clearances; building materials might need code compliance testing).

- Competition and Pricing: Research who the current players are in your intended market. Can you offer something better (price, quality, service)? Understanding the competitive landscape will help you position your business.

- Location and Infrastructure: The site of your plant matters. Being close to raw materials or customers can save transport costs. Also consider power, water, and waste disposal needs for the factory.

- Financial Feasibility: Finally, do the financial projections. Calculate the break-even point, ROI, and ensure you have a buffer for unexpected costs. It’s often helpful to have a feasibility report (which can be done through consultancy services like NPCS) to objectively assess viability.

Q3: Are there government incentives or schemes for any of these industries?

A: Yes, many countries offer support for manufacturing, especially in priority sectors:

- Renewable Energy & Environment: Businesses like biomass pellets and ethanol (biofuel) often enjoy subsidies, tax breaks, or soft loans. For instance, some governments have renewable energy credits for biomass projects, or blending mandates that ensure a market for ethanol (along with interest subvention on loans to set up ethanol plants).

- Agro-Processing: Groundnut oil, sorbitol, or any agro-based industry might fall under agro-processing schemes. These can include grants for setting up plants in rural areas, or minimum support prices for crops to make raw material pricing stable.

- Export-Oriented Units: If you plan to export (say, sorbitol or printed cartons or ceramic sanitaryware), there might be duty drawbacks, export incentives, or even special economic zones (SEZs) with tax benefits.

- SME/MSME Support: Many countries have general schemes for small and medium enterprises: easier credit, capital subsidy for buying plant & machinery, technology upgrade funds, etc. For example, an MSME making bathroom fittings could get a subsidy on bank loan interest or a grant for quality certification.

- Sector-specific initiatives: The sanitary ware (toilets) might get a boost if there’s a national sanitation drive. Similarly, composite materials might align with programs promoting new materials for infrastructure.

It’s advisable to check with local industry departments or small business development centers. These incentives can significantly improve the feasibility of a project. However, they also come with compliance requirements, so plan to meet those if you want to avail benefits.

Q4: How can I differentiate my manufacturing startup in a competitive market?

A: Differentiation can be achieved in several ways:

- Quality and Consistency: Especially in B2B sectors like chemicals or packaging, being known for reliable quality and on-time delivery can set you apart. Implement good quality control from day one.

- Innovation: Introduce a twist in your product. If you make bathroom fittings, perhaps focus on water-saving designs or anti-microbial surface glazes. If you produce cartons, maybe offer innovative structural designs or use eco-friendly inks that appeal to green-minded clients.

- Cost-Effectiveness: Through process optimization or lean operations, if you can afford to offer a slightly lower price (or higher value for the same price), you’ll attract customers. But be cautious not to undercut so much that it hurts your margins – aim for efficiency that competitors lack.

- Branding and Marketing: Even in industrial businesses, branding can matter. For example, create a brand around your groundnut oil as the pure, cold-pressed, premium option and market it well; or brand your sorbitol as pharma-grade with certifications. A professional image and marketing can make customers trust a new entrant.

In summary, study what incumbents are doing and find a gap – it could be in product features, in a customer segment underserved, or even in geographical reach. Leverage any new technology or process that can give you an edge. Over time, continuously improve based on customer feedback.

Q5: Where can I find detailed information or feasibility reports for setting up these projects?

A: A great way to get detailed, project-specific information is to use professional consulting services or industry reports. For example, Niir Project Consultancy Services (NPCS) provides comprehensive techno-economic feasibility reports for all kinds of industries, including the ones discussed here. These reports typically include crucial details such as required machinery, manufacturing processes step-by-step, raw material sourcing, plant layout considerations, regulatory requirements, and financial projections (costs, revenues, profit margins, break-even analysis).

Aside from NPCS, you can research:

- Industry Associations: Many sectors have associations (e.g., an Oil Millers Association, Plastics Association, etc.) that publish reports or guides.

- Government Publications: Oftentimes, ministries of industry or agriculture (for agro-based projects) release model project profiles with basic financials for small enterprises.

- Trade Journals and Market Research Firms: Subscribing to journals or purchasing market research reports can give insight into market size, major players, and future trends.

- Existing Entrepreneurs: Networking with people already in the business (even if in another region) can yield practical insights. Many are willing to share knowledge if you approach respectfully, and this real-world perspective is invaluable.

Using a combination of these resources will give you both the macro view (market size, growth, opportunities) and the micro details (equipment specs, input costs, etc.). It might cost some time or money to gather this info, but it significantly increases your chances of building a successful manufacturing startup with fewer surprises along the way. Good luck with your entrepreneurial journey!