Coking coal import in India has become a critical issue for the country’s rapidly growing steel industry. The steel industry in India has reached a crucial phase of expansion due to large-scale infrastructure development, rapid urbanization, and growth in the manufacturing sector, all of which have sharply increased the demand for steel. However, India’s heavy dependence on imported coking coal continues to shape the economics of steel production and exposes the industry to global price and supply risks.

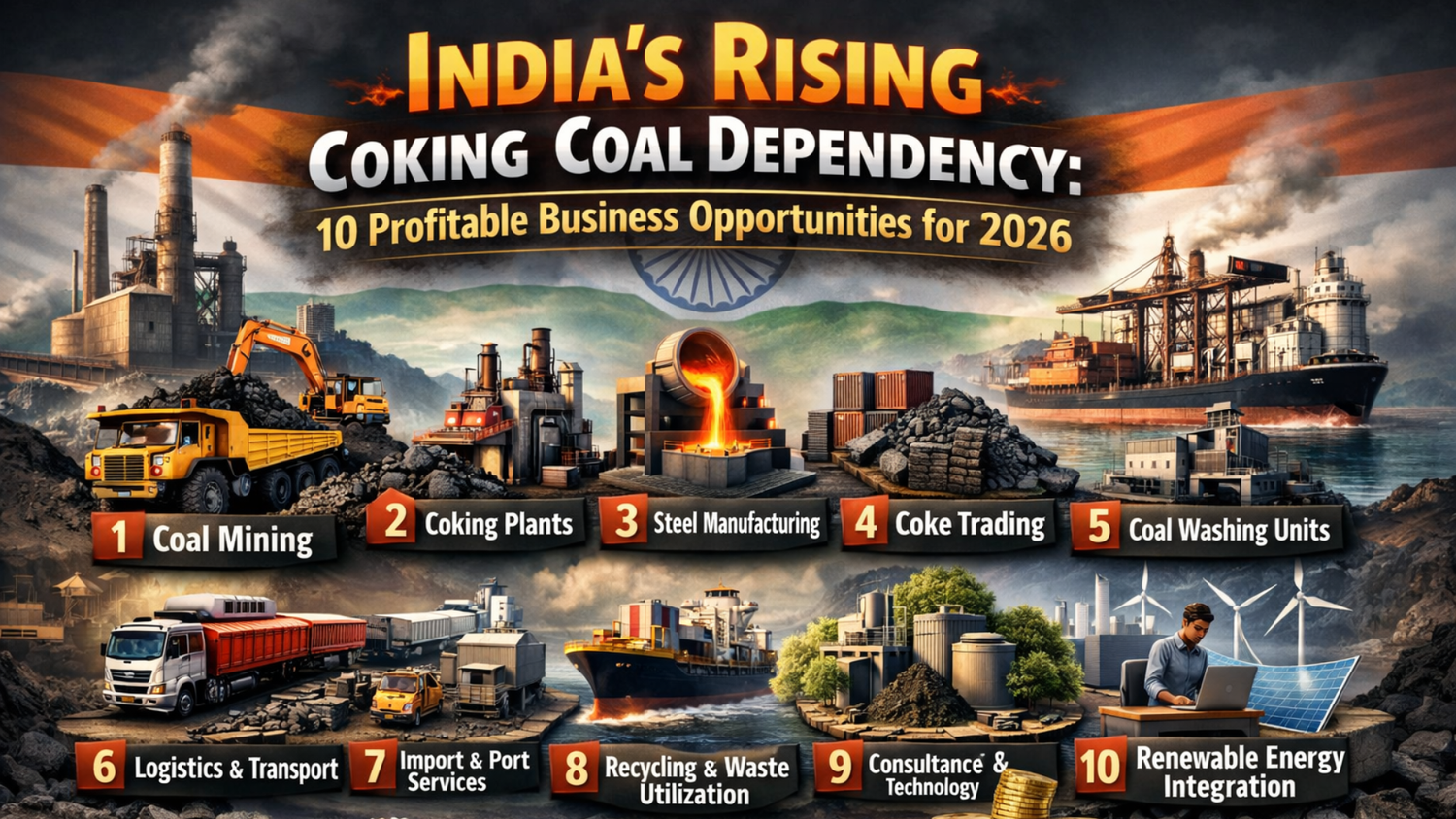

Despite this reliance being mainly a supply challenge, it is also an incoming signal for the entrepreneurs. Raw material constraints challenge every economy, and businesses with the capability, efficiency, and low costs must strengthen the supply chain. Hence, India’s coking coal dependency is actually opening up the avenues for such operations.

Read More: Synthetic Red & Yellow Iron Oxide and Other Oxides of Iron – Manufacturing Plant, Detailed Project Report, Profile, Business Plan, Industry Trends, Market Research, Survey, Manufacturing Process, Machinery, Raw Materials, Feasibility Study, Plant Layout

Why Coking Coal Is Critical for Indian Steel

In the steelmaking process using a blast furnace, coking coal is always considered to be a non-replaceable input. The reason is that metallurgical coke forms from it, and it not only supplies heat and physical support but also provides the right environment for the iron extraction process by the ore reduction method. Production of large-scale steel would not be possible without the use of coke of good quality.(Coking coal import India)

In the 2023–24 period, India was the second-largest steel producer globally with an output of over 144 million tonnes and the world’s largest consumer of finished steel with a demand of more than 136 million tonnes. However, the situation with domestic coking coal is that the production is limited, the supply is inconsistent and the quality is generally poor

Indian coal typically suffers from several quality-related issues:

- The ash content is very high; it varies between 25 and 40 percent,

- Low fluidity and the coke produced is weak,

- Chemical composition is unstable,

- Very few reserves of high-grade metallurgical coal.

Blast furnaces need coal with the quality of 8–12 percent ash and stable coking characteristics which is why Indian steel producers are importing more than 90 percent of their coking coal requirement.

Why Rising Import Dependency Creates Business Opportunities

coking coal which is a main raw material accounts for costs of about 40 percent of the total steelmaking process. Any price fluctuation of coal globally or increase in handling cost would lead to a decrease in the profits from the steel business. The risk involved in this situation is one of the factors that are making the steel industry to maximize the use of domestic coal rather than depending completely on imports.

This shift is opening opportunities in areas such as:

- Coal washing and beneficiation

- Coal blending and homogenization

- Coal logistics and handling

- Coke production and testing services

All these segments show strong demand in the long run and integrate well with the Indian steel ecosystem.

Read More: Metallurgical Coke Plant for Coking Coal

Coal Washing: The Starting Point of Value Creation

Coal washing makes it possible to get rid of most of the ash and is the best way to enhance coal quality. Coal that has been treated with water and is free of ash is in high demand because of its low pollution and high efficiency in producing coke.

Coal washeries are becoming essential because:

- The quality of Indian coal cannot be of at least steel-grade in its natural state.

- Steel and DRI plants are increasingly opting for washed coal.

- The policy of the Government encourages coal washing as a way of cutting down on imports.

Entrepreneurs can either build their own washeries or enter into tolling agreements providing services to industrial clients across different locations.

Advanced Coking Coal Beneficiation

Metallurgical beneficiation, a technique that goes beyond basic washing, aims at enhancing the coal’s quality for use in coke production. Although local coal cannot compete with imported coking coal, the right beneficiation technique can cut down considerably the imports needed for imports and hence the cost of those imports.

This segment is attractive due to:

- Integrated steel plants consuming large volumes

- Processing contracts that are long-term

- Limited number of players who are specialized in this field

- Import substitution being the focus of the government

The beneficiation plants very much become the long-term partners for the steel producers rather than the short-term suppliers.

Coal Blending and Homogenization Units

With coal blending, the integrated steel plants can blend the best quality imported coking coal with the low-grade beneficiated domestic coal in a controlled way. This not only sustains the quality of coke but also decreases the overall cost of raw materials.

Key advantages of coal blending businesses include:

- All the integrated steel plants have a steady demand for it

- Lower capital outlay compared to coke ovens

- Criticality of quality assurance and the process expertise

Good blending yards near the steel clusters or ports can ensure regular cash flows.

Read More: Setup Coking Coal Washing Unit

Opportunities in the Sponge Iron (DRI) Sector

India holds the title of the highest sponge iron producer in the world, and DRI plants predominantly depend on non-coking coal. The coal’s quality directly influences the reaction efficiency, fuel consumption, and operating costs.

Growing DRI production has created demand for:

- Coal sizing and screening services

- Ash reduction and moisture control

- Standardized DRI-grade coal supply

The entrepreneurs working in this segment are the winners due to the high-volume consumption and repeat orders.

Coal Fines Recovery and Briquetting

Coal washeries usually do not utilize fines and slurry to their full extent. However, these materials can be transformed into briquettes or pellets, which can then be marketed as industrial fuel.

This business is gaining traction because:

- It turns waste into a salable product

- The cost of raw materials is very low

- There is demand from brick kilns, boilers, and small industries

- It helps to achieve environmental and circular economy objectives

Coal fines recovery is a win-win scenario where both profitability and sustainability are improved.

Read More: Top 25 Coal Business Ideas

Coking Coal Logistics and Handling Services

The fact that India heavily depends on coking coal imports has created a huge need for specialized logistics. The handling of imported coal has to be done very carefully in order to maintain its quality.

Key service areas include:

- Screening and crushing at the ports

- Stockyards that are covered and control of moisture

- Handling of conveyor and bulk materials

The coking coal import scenario in India will keep this segment alive and kicking.

Metallurgical Coke Manufacturing

Coke production is a direct extension of coking coal. As the capacity of the blast furnaces is increasing, the demand for metallurgical and foundry coke is still growing.

High-potential areas include:

- Stamp charging coke ovens

- Heat recovery coke ovens with simultaneous power generation

- Foundry coke for casting units

Coke plants are capital intensive yet they provide strong and long-term returns.

Read More: 10 New Manufacturing Business Opportunities in India for Startups and MSMEs

Testing, Compliance, and Environmental Services

Moreover, testing of the coal quality is a practice that cannot be avoided in the whole process of producing steel. At the same time, with the increase of import volumes, there is a need for laboratories that are reliable and accredited.

At the same time, environmental compliance has become a must. The steel plants and washeries need to implement modern pollution control technologies to stay in the game.

High-growth service areas include:

- Coal and coke testing laboratories

- Dust suppression and emission control systems

- Water and slurry treatment solutions

These service businesses not only offer stable demand but also require relatively moderate capital investments.(Coking coal import India)

Conclusion

Overall, india’s reliance on coking coal is usually regarded as a weakness; however, to entrepreneurs, it is a long-term industrial opportunity. Moreover, the demand for steel will continue to increase at a steady rate over the next decade, and coking coal will still be the main ingredient for steel production during that time. In fact, (Coking coal import India)

Therefore, the companies engaged in coal washing, beneficiation, blending, logistics, coke production, testing, and environmental services will be the key players in India’s steel ecosystem. Moreover, the high entry barriers and continuous demand make the sector less risky and capable of growing.

Therefore, those who dare to enter the market now will not only create profitable businesses but also be regarded as important participants in the story of industrial growth in India.

FAQs

What is the reason behind India’s importing of such an enormous quantity of coking coal?

The Indian coal that is produced has a high ash content and its coking features vary a lot, which is why coking coal has to be imported for the process of steelmaking in blast furnaces.

Is coal washing still relevant in the long term?

Yes. Even as green steel technologies develop, blast furnace routes will continue to dominate India’s steel production for years.

Which coking coal–related business has lower entry barriers?

Coal blending units, briquetting plants, testing laboratories, and environmental service providers typically require lower capital investment.

Can these businesses get long-term contracts?

Yes. Most steel and DRI plants prefer long-term suppliers for raw material processing and quality assurance.