Tobacco Products Manufacturing Business

Beginning a business is not a piece of cake neither is skyrocket. Before opening a business of any kind, one needs to gather all important information regarding it, so that well ahead, the business doesn’t go in a collapse.

Indian tobacco, familiarized by Portuguese in the 17th era period, is respected universally for its rich, full-bodied flavor and levelness. It is now a progressively well-known and respected product in global tobacco markets and has found its way into cigarettes factory-made in numerous countries. India has a striking and progressive outline in the global tobacco industry, and it is an important vendible crop grown here. India is the second-largest tobacco creator and exporter in the world.

NPCS wide-ranging project article aims to bring you all the noteworthy info required. Here are a few things to save in mind if you plan to capitalize on this business:

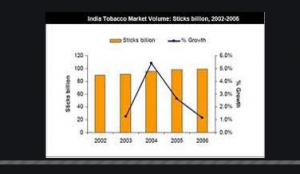

Analyzing the Market – India is the second-largest producer and third largest exporter of tobacco in the world. The tobacco industry provides employment to ~46 Mn people. With the evolving facilities provided by the Tobacco Board of India, the market has recorded a total (manufactured and unmanufactured tobacco) export of INR 60.84 Bn in FY 2018.

- Sub –a division of market – In India, tobacco is reaped mainly in two methods – cigarette tobacco and non-cigarette tobacco. During 2017-2018, non-cigarette tobacco alone had a ~69% market part. Production of cigarette tobacco has considerably reduced, globally, leading to an upsurge in the sale of non-cigarette tobacco. Based on intake, khaini established ~11%, and beedi and cigarette had a market segment of ~8%. The procedure of smoking mediums like hookah, hookli,, dhumti, and chillum, besides edible tobacco like snuff, , and pan masala has led to the development of this market. Seeing the consumption-tax revenue relation of the overall section of smoked tobacco, legal cigarettes account for ~10% of intake and ~86% of tax revenues. This implies that even though smokeless tobacco has the highest rate of consumption, more income is received from legal cigarettes. Tobacco, despite its triggering dependence and intoxication, is consumed considerably by Indians, particularly in the form of smokeless tobacco.

Related Videos- Manufacturing of Tobacco, Pan Masala, Khaini, Gutkha, Supari, Zarda, Mouth Freshener

- Market Challenges – Cigarette taxes (64% excise duty, 28% GST, and 5% cess) in India are amongst the highest in the world. Consequently, high tax charges make cigarettes costly to a large section of customers. As a result, they change towards the consumption of beedi and other forms of smokeless tobacco. Hence, the complete tobacco market practices slow growth. The Cigarettes and Additional Tobacco Products (Prohibition of Commercial and Guideline of Trade and Commerce, Production, Supply, and Circulation) Act of 2003 (COTPA, 2003) executes a blanket prohibition on tobacco advertising. This avoids companies from directly marketing their products, because of which they help to substitute advertising. Hence, it develops problematic for manufacturers to endorse their brands, limiting the development of the domestic market.

Related Videos- Book on Manufacture of Pan Masala, Tobacco and Tobacco Products

INDIAN TAX COLLECTION FROM TOBACCO PRODUCTS (2013-2020)

| S.No. | Year | Tax Collection (in crores) |

| 1.) | 2013-14 | 15286 |

| 2.) | 2014-15 | 17617 |

| 3.) | 2015-16 | 21787 |

| 4.) | 2016-17 | 27823 |

| 5.) | 2017-18 | 28489 |

| 6.) | 2018-19 | 30313 |

| 7.) | 2019-20 | 34129 |

- Current Growth – Over the years, tobacco has developed as an indispensable part of the Indian socio-cultural environment, particularly in the eastern, northern, and north-eastern portions of the country. A comparatively higher income growth recompenses for the growing price of cigarettes, important to greater consumption. Moreover, social influences such as peer burden also support in driving the response for tobacco goods. These are the vital factors pushing the market growth. With the support of the Tobacco Board, Indian tobacco creators are using technically advanced threshing plants and re-drying plants. These conveniences are used for growing the yield of Flue-Cured Virginia (FCV) tobacco, which can then be transferred to different countries, across the world. Hence, improved organization drives growth for this market.

Related Books:- Manufacture of Pan Masala, Tobacco and Tobacco Products

Concluding, India is a huge marketplace for tobacco consumption. Continued transformation of the tax structure and restraint of excise rates for cigarettes would offer the basis for up-gradation of intake. Businesses should try to meet consumer objectives in line with international trends. Entrepreneurs should expand foreign exchange earnings. And therefore result in Increasing Government revenues. Also bringing the multiplier influence of increased farmer profits to the rural budget. Can deliver Indian manufacturers a rising base to capitalize on brands and expertise to contest efficiently. NPCS’s project consultancy and market exploration fields put onward the developing option for the tobacco production business.