India is transitioning from producing bulk-commodity chemicals to high-value, high-margin specialty chemical manufacturing. Exports of specialty chemical manufacturing are expected to form a significant part of India’s $20.38 billion chemical export industry in 2023-24, as reported in CHEMEXCIL’s 61st Annual Report. This change is not a shift in focus, but rather a strategic initiative in growth, catering to the needs of various startups and entrepreneurs. High-performance, function-specific specialty chemicals are regarded as high-value franchise products and present a phenomenal opportunity in the international market.

This blog outlines the specialty chemical manufacturing and export opportunities available to Indian manufacturers, key growth drivers, regulatory backing, product categories, and the business setup process.

Specialty Chemicals: What Are They and Why Are They Important To Businesses?

What are Specialty Chemicals?

Specialty chemicals are value-added constituents or chemicals that are used as intermediates or active pharmaceutical ingredients, excipients, and or specialized reagents in various segments of industries. Unlike bulk chemicals that are created in large quantities and are sold by weight or volume, specialty chemicals, also known as fine chemicals, are created in smaller quantities with an emphasis on:

- Performance

- Function for application

- Customization.

Applications Across Industries

| Sector | Use of Specialty Chemicals |

| Pharmaceuticals | Intermediates, APIs, excipients |

| Agrochemicals | Pesticides, herbicides, growth enhancers |

| Electronics | Photolithography, semiconductors |

| Textiles | Dyes, pigments, softeners |

| Paints and Coatings | Additives, dispersants, resins |

| Cosmetics | Fragrances, emulsifiers, actives |

Related: Why should one step into the Specialty Chemicals Manufacturing Industry

Specialty Chemicals Export Performance

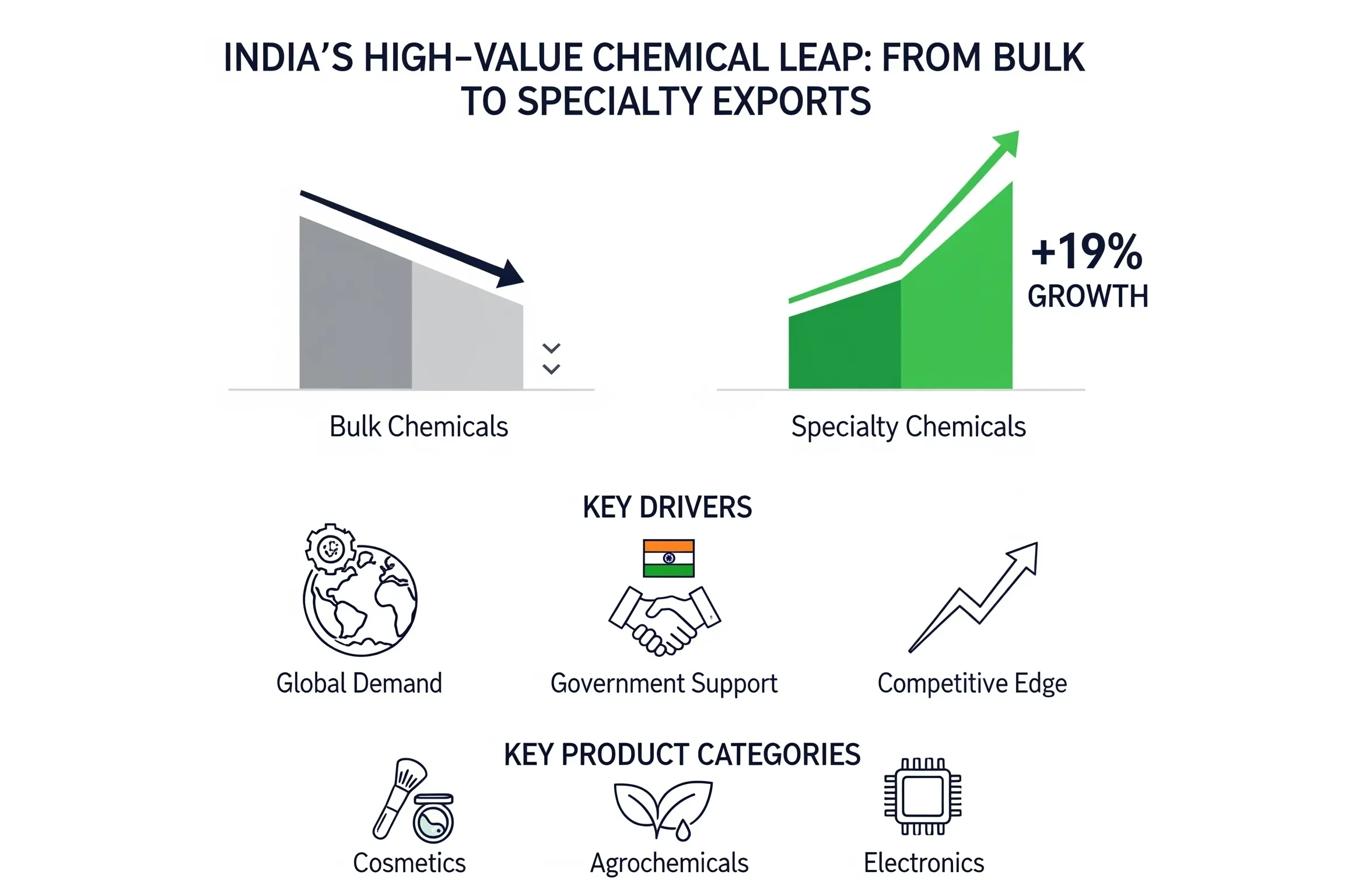

According to CHEMEXCIL, an entity created by the Ministry of Commerce and Industry of the Government of India, the panel of cosmetics, soaps, toiletries, and essential oils, which also includes specialty chemical manu, recorded an export growth of 19 percent for the year 2023-24, reaching an export value of $3.229 billion. This, coupled with the 22 percent decline in bulk organic chemicals, paints a picture of a clear transition towards high-value specialty chemicals.

Export Data Snapshot (2023-24)

| Product Category | Export Value (USD Million) | Growth (%) |

| Organic Chemicals | 7542 | -22% |

| Agrochemicals | 4194 | -22% |

| Cosmetics & Specialty Chemicals | 3229 | +19% |

Source: CHEMEXCIL Annual Report 2023-24

Global Demand and India’s Competitive Edge

Global Specialty Chemicals Market Outlook

The global market for specialty chemicals is expected to grow at a compound annual growth rate (CAGR) of 5.3% and reach $900 billion by 2030. With its advantages in formulation capabilities, low-cost research and development, and innovation in processes, India can be a crucial player in the market.

Demand Drivers

- Outsourcing due to strict environmental laws in the West.

- Pharmaceutical and agrochemical expansion.

- Private label formulations for the cosmetics and nutraceuticals market.

- Increased need for performance chemicals in electronics and automotive industries.

Target Export Destinations

India is emerging as a key exporter of specialty chemicals to:

- United States of America

- Germany

- Brazil

- China

- Southeast Asia

View Our Books on Chemical Technology (Organic, Inorganic, Industrial), Fine Chemicals

Government Support and Policy Framework

Promotional Activities and Services Supported by CHEMEXCIL for Specialty Export Initiatives

With the subsidized designation of CHEMEXCIL, support services included:

- International exhibitions (e.g., Chemspec Europe, Indo Beauty Expo)

- Buyer-seller meets in Africa, ASEAN, and LATAM

- Regulatory guidance (REACH, GHS, CBAM)

- Subsidy under the MAI Scheme (50% registration reimbursement abroad)

In 2023-24, CHEMEXCIL assisted over 32 exporters in obtaining registrations for REACH and conducted major promotional activities in Vietnam, China, and Africa.

Government Incentives

| Scheme | Support Provided |

| MAI Scheme | 50% cost reimbursement for product registrations |

| EPCG | Capital goods import at zero/reduced duty |

| RoDTEP | Refund of unrebated taxes |

| Advance Authorization | Duty-free input procurement |

Manufacturing Specialty Chemicals: Key Considerations for Startups

Market Feasibility & Product Selection

- Focus on:

- High-margin products (pharma intermediates, specialty dyes, cosmetic actives)

- Export demand (USA, Europe, Japan)

- Regulatory complexity (choose based on capability

Plant Setup and Compliance

- Install batch-processing reactors with automated control

- Follow GMP, ISO, REACH, and BIS standards

- Environmental compliance under CPCB and SPCB norms

Raw Material Sourcing

- Partner with bulk suppliers for consistency

- Explore bio-based and green alternatives

Branding and Certifications

- Certifications: ISO 9001, GMP, HALAL, ECOCERT

- Showcase lab validation, COA, and safety sheets.

- Highlight performance metrics and customization.

Related: The Potential of Specialty Chemicals: A Startup’s Guide to High-Growth Markets

Case Study: Growth from Bulk to Specialty

Case: A Gujarat-based manufacturer shifted from generic dyes to reactive and vat dyes with eco-certification. With CHEMEXCIL support and process upgrades, they increased their export margin by 35% and entered the German and Turkish markets successfully within 2 years.

Forecast: Potential For Exporting Specialty Chemicals From India

| Year | Projected Export Value (USD Billion) |

| 2024-25 | 3.6 |

| 2025-26 | 4.1 |

| 2026-27 | 4.7 |

Key Focus Areas for Growth:

- Cosmetic Actives

- Agrochemical Formulations

- Electronic-Grade Chemicals

- Biodegradable Surfactants

Frequently Encountered Problems and Solutions

| Challenge | Strategic Solution |

| Complex international compliance | Invest in documentation, hire regulatory consultants |

| Process scalability | Use modular plant designs |

| Global competition | Compete on formulation, not volume |

| Sourcing consistency | Enter long-term agreements with vetted suppliers |

Frequently Asked Questions

Q1.What is the difference between bulk and specialty chemicals?

A1. Bulk chemicals are usually high-volume, commoditized products. Specialty chemicals are used for niche applications and are bespoke, thus, command a higher price.

Q2. Are specialty chemicals profitable?

A2. Yes, they offer twenty to forty percent higher margins than bulk chemicals because of the specificity and customization in applications in specialty chemicals.

Q3. Is certification mandatory for exports?

Not in all cases, however, REACH and GMP, alongside ISO certs, would greatly aid in the opportunity for market entry.

Q4. How much does it cost to set up a specialty chemical unit?

Depending on the products offered, a small-scale batch plant would set one back 2 to 5 crore INR.

Q5. Can I start by outsourcing production?

Sure. Contract manufacturing is a valid start. Just make sure the partner upholds the regulatory and quality standards.

Discover the Right Business for You With Our Startup Selector Tool

Role of NPCS for New Business Owners

Niir Project Consultancy Services NPCS assists new business owners with projects by providing Market Survey cum Detailed Techno Economic Feasibility Reports.

These reports encompass the entire business operation, including the processes of the business, the necessary inputs, the business’s plant layout, and the finances.

Assist new business owners in evaluating the profitability of establishing a specialty chemical unit.