Recovery of Ferric oxide (Fe2O3) & Titanium Dioxide (TiO2) from Bauxite Processing Waste. Wealth from Waste

Ferric oxide (Fe₂ O₃) is an inorganic compound also known as hematite. Ferric oxide is used in the iron industry in the manufacturing of alloys and steel. The Food and Drug Administration (FDA) has approved ferric oxide pigment for use in cosmetics. Moreover, ferric oxide granules are used in the form of filtration media for removing phosphates in saltwater aquariums.

The global titanium dioxide market size was valued at USD 15.76 billion in 2018 and is expected to witness a CAGR of 8.7% from 2019 to 2025 In addition, high demand for anti-corrosive architectural coatings in the pigments has increased the demand for titanium dioxide.

FOR Fe2O3

- In iron industries for producing steel and alloys

- Ferric oxide powder, also called jeweler’s rouge, is used for polishing lenses and metallic jewelry

- Its granular form is used as a filtration media for pulling out phosphates in saltwater aquariums

- As FDA-approved Pigment Brown 6 and Pigment Red 101, for use in cosmetics.

- In biomedical applications, because its nanoparticles are non-toxic and biocompatible

Recovery of Fe2O3

Fe2O3 is another material in red mud that has attracted a number of researchers. Until now, there are three means to recover iron from red mud: smelting, solid-state reduction and magnetic separation. In smelting process, red mud is charged into blast furnace or rotary furnace with a reducing agent. Then, iron oxide in red mud is reduced to generate pig iron that can be used in steel production.

However, smelting process has some demerits. High energy and capital costs are associated with blast furnace (BF) operation because scale of operation is high. Red mud must be mixed with some good-grade iron ore to maintain the minimum grade of the charge to BF. In addition, titanium reacts with other constituents of the slag to form multiple oxides that are difficult to leach. In the solid-state reduction process, the mud is mixed with a reducing agent or contacted with a reducing gas to produce metallic iron.

The product can be an input either in a steel-making furnace or a conventional blast furnace. Compared to smelting process, solid-state reduction process consumes less energy. But, it also has some disadvantages. First, the metallic iron produced is quite difficult to separate from the rest of product. So, it is easily polluted by gangue materials. Second, the product is in a very fine form.

The recovery rate of Fe2O3 was 45% (weight percent). Another means is to convert hematite or goethite in red mud to magnetite firstly, which is followed with magnetic separation. Obviously, this process is more complex than magnetic separation.

Advantages. Goethite is easier to separate magnetically and needs less energy to reduce compared to hematite. So, the extra cost of reducing hematite to magnetite can be compensated by the energy difference between reducing hematite and magnetite to metallic iron.

Titanium Dioxide, also known as titanium (IV) oxide or titanic, is a white crystalline powder, made up of limonite and rutile, which are used as the main raw materials. It is created using either the chloride process or sulfuric acid, referred to as the sulfate process. Titanium dioxide is extensively used as a white pigment in paints and coatings application. Also, it has a wide range of applications, ranging from paints and sunscreens to food coloring

FOR TiO2

Uses for white pigment Four million tons of pigmentary TiO2 are consumed annually. Apart from producing a white color in liquids, paste or as coating on solids, TiO2 is also an effective pacifier, making substances more opaque. Here are some examples of the extensive range of applications:

- Paints

- Plastics

- Papers

- Inks

- Medicines

- Most toothpastes

- Skimmed milk; adding TiO2 to skimmed milk makes it appear brighter, more opaque and more palatable

Recovery of TiO2

Generally, there have been two main methods developed by which the titanium can be recovered from red mud: pyro metallurgical recovery and hydro-metallurgical recovery. The pyro- metallurgical method generally comprises the separation of pig iron. The red mud is claimed at a range of temperatures, from 800 to 1350°C, and is smelted through a reducing agent using an electric-furnace to obtain melted iron as well as slag that includes titanium dioxide, silica and alumina. The metallic iron is removed from the slag and the slag is digested to recover the titanium and aluminium from the solution.

The pyro-metallurgical process is not an energy-friendly method and, hence, the hydrometallurgical technique usually attracts more attention from the research community. A number of the acids’ extractability have been analyzed to recover titanium from red mud, such as dilute and concentrated H2SO4 and hydrochloric acid. The solvent extraction technique has been applied to extract titanium from red mud using HCl, which comprised di- and mono-.

Red mud can also be considered a secondary source of the most important modification of titanium compound, titanium dioxide.

Market Outlook

The Global Ferric Oxide Market is expected to register a CAGR of 4.99% to reach a value of USD 2,414,382.9 Million by 2030.

The primary driver of the global ferric oxide market is its growing adoption in steel production. The increasing application of steel in the major end-use industries such as transportation, construction, and energy, packaging, and consumer appliances is also a prime factor driving market growth. Steel finds application in the manufacturing of automobile structures, panels, doors, engine blocks, gears, suspension, wheels, fuel tanks, steering, and braking systems. The use of iron oxide pigments to impart colors to construction materials, paints, inks, plastics, papers, cosmetics, rubbers, concrete blocks, and tiles is another key driver of the market.

Global Ferric oxide Market Revenue, by Application, 2030 (USD Million)

The growing construction industry output is expected to be one of the most significant drivers for the iron oxide market on a global scale. The growing adoption of iron oxide nanoparticles in wastewater treatment is an excellent opportunity for the players in the market. With the steady growth of the construction industry, stemming from increasing urban and civil infrastructure projects, the demand for iron oxides is expected to increase significantly.

The ferric oxide market is witnessing consolidation, driven by the pursuit for sustainability among market participants, owing to the imposition of stringent regulations on the production of ferric oxide, which are increasing the overhead costs for ferric oxide manufacturers. This has prompted ferric oxide manufacturers to consolidate production and business operations through acquisition of external enterprises having a sufficient infrastructure and resources.

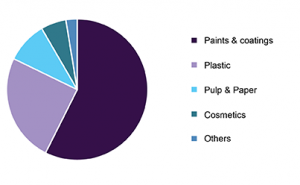

Global Titanium Market Share, By Application, 2018 (%)

Mining and metallurgy industry dominated the market in 2018, and it is likely to grow during the forecast period with the continuous growth in mining activities.

The increasing demand for titanium dioxide downstream products and natural dyes in the textile industry are likely to provide opportunities for the studied market during the forecast period.

Asia-Pacific dominated the market across the world, due to the growing mining activities in the region, and robust demand fueling the growth of polymer synthesis and chemicals industry.

The global titanium dioxide market size was valued at USD 15.76 billion in 2018 and is expected to witness a CAGR of 8.7% from 2019 to 2025. The major factors driving the growth of the market studied are the increasing demand from the mining industry and increasing use in polymer synthesis. On the flipside, the toxicity of titanium dioxide hampers the growth of the market.

Escalating demand for lightweight vehicles owing to strict emission policies is expected to fuel the market growth over the coming years. Thus, rising usage of lightweight materials for enhanced safety and fuel-efficiency is expected to have a positive impact on the industry over the forecast period. These lightweight materials, when coated with titanium dioxide, increase durability, stability, persistence, and scratch resistance.

The product has an increasing application scope in printing inks, rubber, and chemical fibers. In printing inks, it is used in flexographic, lamination, screen printing, UV-cured, and metal decorative inks.

The Top Players Including:

- Cathay Industries

- Huntsman

- Lanxess

- Bayferrox

- Toda Kogyo

- Quality Magnetite

- Prochem

- BariteWorld

- Bengal Chemicals & Pharmaceuticals Ltd.

- Bharat Chemicals & Fertilizers Ltd.

- Kerala Minerals & Metals Ltd.

- Kolmak Chemicals Ltd.

- Tata Pigments Ltd.

- Travancore Titanium Products Ltd.

- V V Titanium Pigments Pvt. Ltd.

- Kerala Minerals & Metals Ltd.

See more