Startup founders and entrepreneurs are always looking for new manufacturing opportunities that promise a strong demand, long-term profitability, and sustainable growth. In 2025, certain industrial sectors will stand out due to their high growth potential and market relevance. This article examines six high growth manufacturing business, including what they are, how they’re in demand, and why they offer lucrative opportunities. Bentonite, Organic Fertilizer (from Cow Dung), Maize Starch, Silica produced from rice husk ash, Lithium-ion Battery Recycling, and Chlorinated Paraffin Wax are among the industries that have been highlighted.

We will examine each one in depth, focusing on the market trends, growth projections, key applications, and tips for entrepreneurs to make an informed decision about entering these industries.

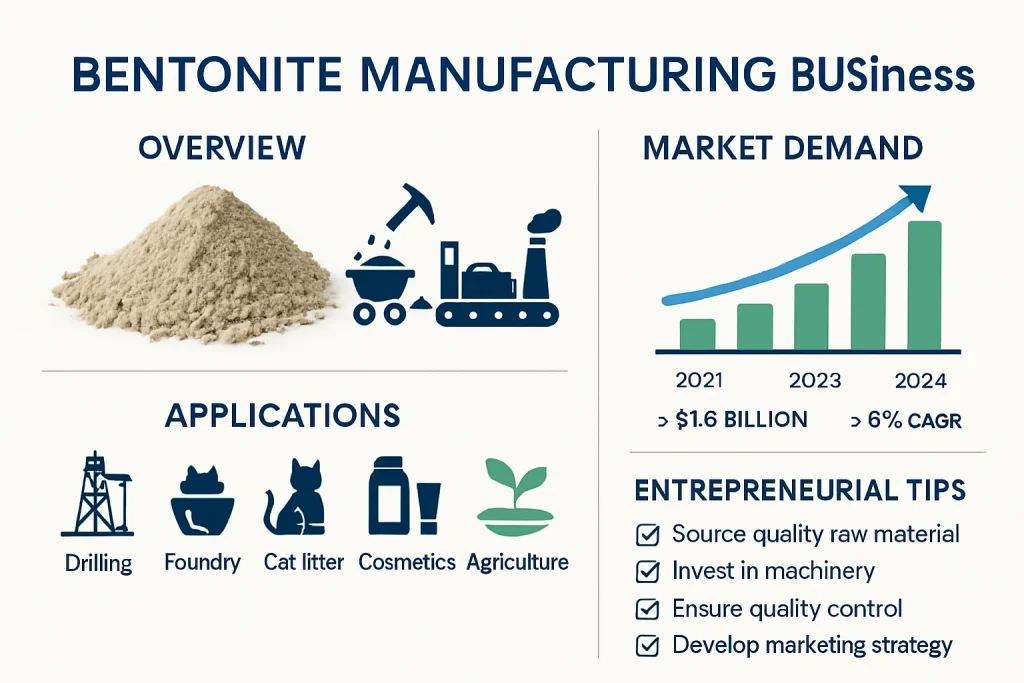

1. Bentonite Granules (Roasted Bentonite), Bentonite Powder, and Bentonite Pulp

Overview

Bentonite, a clay rich in montmorillonite, is known for its excellent absorbent and swelling qualities. Bentonite is available in a variety of forms, including bentonite granules and roasted bentonite. Each form has a specific application. Bentonite Granules are hardened, small particles that are commonly used in fertilizers and agrochemicals.

The granules are roasted to increase their porosity and hardness, which makes them perfect for absorbing liquids such as pesticides or nutrients that will be released slowly in the soil. Bentonite is a fine powder that can be used for a variety of industrial purposes, from oil and gas drilling mud to foundry sand binder, cosmetics, pharmaceuticals, or even as a detoxifying agent.

Bentonite Applications:

- Roasted bentonite: It is used in agriculture as a carrier of agrochemicals. They are used to coat crops with micronutrients or pesticides because they absorb liquids slowly and release them. Bentonite improves soil by holding moisture and nutrients.

- Oil & Gas Drilling Sodium bentonite: It is a key component in drilling fluids. When wet, it expands and helps seal holes, lubricate the drill bits, as well as carry cuttings up to the surface.

- Foundry and Metallurgy: In foundries, bentonite, mixed with sand, is used to create molds for metal casts. It is used as a binder to give sand moulds strength and shape integrity, even at high temperatures.

- Cat Litter: One of the most common uses of bentonite, especially sodium bentonite, is clumping litter for cats. Its ability to absorb moisture and to form clumps allows for easy removal of the litter and odor control.

- Iron Ore Pelletizing: Bentonite, used as a binder, is added to the iron ore pelletizing process. This helps form marble-sized, strong pellets that are used in steel production.

- Bentonite: It is used in many other applications, including civil engineering (as an agent for sealing tunnels and dams), paper production (as a retention aid), pharmaceuticals and cosmetics (face masks and anti-diarrhea medicines), as well as in wine/juice clarification.

Related: Roasted Bentonite Granules Manufacturing Industry. Bentonite Clay Granules

Market Demand and Growth

Global bentonite is expected to continue expanding. The market was valued at USD 1.5-2 billion in the mid-2020s and is expected to grow by a CAGR between 6-8 percent annually. The diverse industries that it serves are responsible for this growth. Asia-Pacific is the dominant region for bentonite demand and production, thanks to China and India as major users and producers. China and India, for example, are the leading consumers of bentonite due to their large pet population (for cat litter) and booming foundry industries.

The demand for bentonite clay in North America is also high, as it is mined there (e.g. In Wyoming, USA, bentonite clay is mined and used widely in the drilling and pet litter industries. The demand for oil exploration, infrastructure (foundry castings used in auto and machine parts) and environmental applications such as wastewater treatment and landfill liner all contribute to the increase. The push to use natural additives, such as bentonite in cosmetics or winemaking instead of synthetic chemicals, also contributes to market growth. The use of bentonite instead of synthetic chemicals in winemaking or cosmetics is a major contributor to the growth of this market.

Entrepreneurial Opportunity

Bentonite processing is a lucrative business opportunity for small and mid-sized manufacturers, particularly in areas where bentonite raw is plentiful. A bentonite company is typically started by mining raw bentonite in bulk, then processing it to the desired form. This may include drying and roasting the granules or grinding and milling them into powder. Processing technology isn’t complex but quality control is. For example, the clay must meet industry standards for its swelling index and absorbency.

Entrepreneurs can choose to specialize: For example, they could produce double-roasted bentonite for agriculture (there’s a high demand for carrier materials from pesticide and fertilizer companies), or concentrate on bentonite for drilling fluids. You can start a bentonite plant with moderate capital. A small-scale facility might include mixing and roasting machines, and the capacity of this plant can be increased over time. A new player could also highlight the environmentally friendly nature of bentonite, given its increasing use in sustainable solutions. Bentonite is a versatile clay that has a growing demand in many sectors.

2. Cow Dung Fertilizer – Organic Fertilizer

Overview

The opportunity to turn cow dung into organic fertiliser is one of the classic waste-to-wealth opportunities that has gained new momentum in this era. Small farmers have used cow dung as a natural organic fertilizer for many years. Entrepreneurs are now industrializing the process to produce standardized organic fertilizers of high quality, such as compost, pellets from manure, and vermicompost.

The concept is simple: gather abundant cow dung, which is often a by-product from dairy farming and cattle rearing. Compost it using biological processes to produce fertiliser rich in nutrients for crops.

Why Cow Dung Fertilizer Is in Demand

Globally, there is a shift towards organic farming and sustainable agricultural practices. The demand for organic products free of chemicals is increasing, and the government encourages farmers to use less chemical fertilizer. Demand for organic soil amending materials is a result. The use of cow dung as a fertilizer is beneficial in many ways: it improves the soil structure, increases moisture retention and introduces beneficial bacteria that promote plant growth. It releases nutrients gradually and improves the soil over time, unlike chemical fertilizers. Composting cow dung helps reduce greenhouse gas emissions and waste that can occur when manure is not managed.

Many countries with large agricultural industries (India for example) produce millions of tons per year of cow manure, which is a huge raw material. Some regions pay farmers to collect cattle manure (for instance, India’s Godhan Nyay Yajana) to provide a constant input for organic fertilizer.

Market Outlook

The organic fertilizer industry is growing rapidly. It is estimated to be worth USD 7-8 billion globally by 2025 and will reach $12-14 billion in the next decade. This is a CAGR of 8-10%. This growth is fueled by several factors: the growing demand for organic food, concerns over chemical runoffs and government policies that promote sustainable farming. Asia-Pacific is the region with the highest share of organic fertilizer (with countries like China, India and Southeast Asia that have begun to adopt organic farming practices).

The pie chart below, which shows the global organic fertiliser market by region, shows that Asia-Pacific is the biggest segment, a reflection of its large agricultural base and active shift to organic farming. North America and Europe are also significant segments in the market.

View our books for more information

Production Process

The process of starting an organic fertilizer company from cow dung can be relatively low-tech, and it is scalable. This makes it appealing to entrepreneurs. The key steps are: collecting fresh cow dung, composting it (by piling the dung on a pile and letting the aerobic decomposition take place for several weeks or by using earthworms with vermicomposting to accelerate the breakdown), then processing and curing the compost (to ensure that the compost is mature and stable with no foul smells and high humus content), screening and packaging for sale.

As the demand increases, you can scale up your operation (with a few tons per day) and add mechanization, such as compost turners, pelletizers, or separators. This business has the advantage of using raw materials that are often free or extremely cheap. A businessperson can ensure a steady supply of manure by forming relationships with local dairy farmers or cattle owners. There is also the potential to brand organic fertilizer, perhaps with bio-cultures or specific nutrient boosts to differentiate in the market.

Growth and Profitability

Organic manure is gaining popularity among farmers to restore soil fertility degraded over time by chemical use. Some regions have programs to subsidize organic inputs, or certification programs that require soil health management. This indirectly boosts demand for composted animal manure. The low cost of raw materials can make margins attractive for entrepreneurs. You’re monetizing waste. The final product is sold in bulk by large farms, coffee/tea plantations, nurseries and even retail gardeners.

Marketers can highlight that organic fertilizer is a sustainable, eco-friendly product that provides nutrients and improves soil over time. The organic food industry is expected to grow (global sales of organic foods have surpassed $100 billion and are on the rise), so the demand for organic fertilizer will also continue to increase. Converting cow dung into fertilizer is an excellent startup idea. It requires a moderate investment, solves a problem for the environment, and taps a growing market trend.

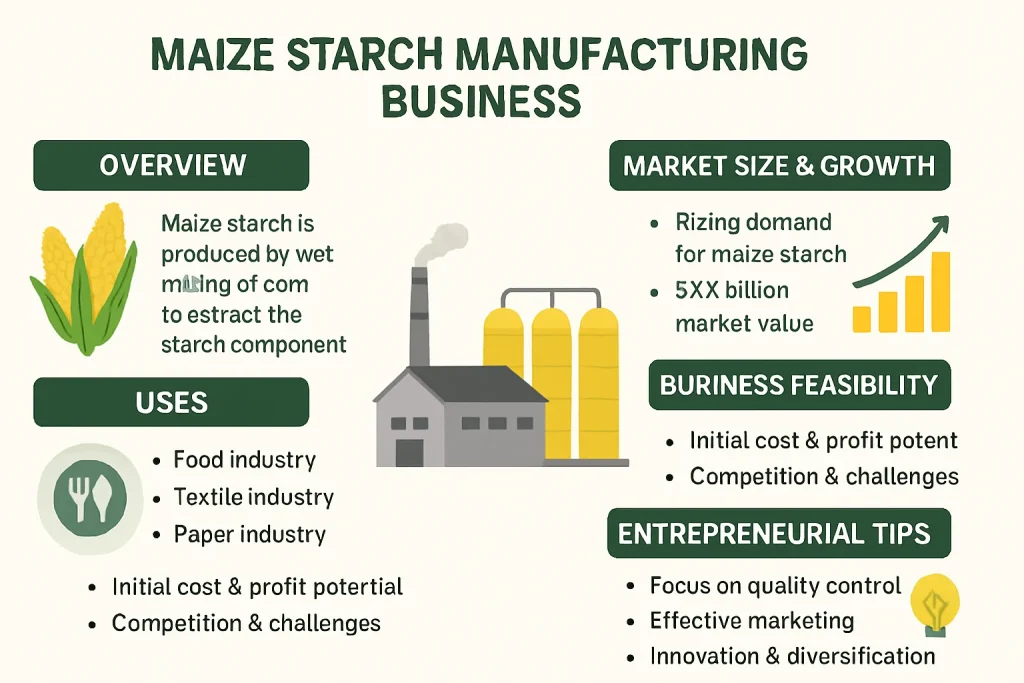

3. Maize Starch Production

Overview

The starch powder, maize starch (also known as cornstarch), is extracted from the corn kernels. It is used as a raw material for the food and beverage industries, but also has many uses outside of food. In order to produce maize starch, corn grain is wet-milled in order to separate the starch from other components such as proteins (gluten), fibers hulls and oil. Purified starch is dried into a fine powder.

The business of maize starch production transforms corn from an agricultural product into a high-value ingredient in demand worldwide. The versatility of corn starch is due to its properties. It’s a great thickening agent, gelling agent, binding agent and also a base in sweeteners and fermented products.

Maize starch is used for a variety of purposes

- Food Industry: In the food industry, corn starch is used as a thickener or stabilizer. It is the ingredient of choice for thickening soups, sauces, puddings, custards, and gravies. It is used by bakeries to improve the texture of cakes and pastry.

- Starch or sugars: They are used to give beer body and clarity. Sugar syrup made from corn starch can be used to sweeten soft drinks and juices.

- Textile and Paper Industries: Maize starch is used in these industries. In the textiles industry, starch can be used to finish fabrics and size yarns (to make them stronger so they can withstand weaving). In the paper industry, starch is used to strengthen paper and as a coating for printing.

- Adhesives and bioplastics: Cornstarch is a key component of many adhesives, especially those used for paper products such as corrugated cardboard or paper bags. This is due to the sticky nature it takes on when gelatinized. Starch can also be used as a source of biodegradable plastics.

- Personal Care and Pharmaceuticals: Maize starch acts as a disintegrant and binder in tablets. This ensures that pills are not only held together but also dissolve properly in the human body. In cosmetics and baby powders, it is used as an absorbent that’s safe (usually replacing talc).

- Animal Nutrition: Byproducts from starch production, such as corn gluten meal or corn gluten feed, are highly valuable for animal and poultry feed. This is not the starch, but it adds value to a starch-processing business because of the secondary revenue streams.

Related: Start a Maize Starch Business

Market Size and Growth

The global corn starch market has grown in size and is growing along with the population and industrial requirements of the world. The global market for corn starch in 2024 was USD 22-24 billion. The market is expected to grow to approximately $50+ billion in the early 2030s with a CAGR of about 7-8%. This growth is driven by the increasing consumption of processed foods in developing countries.

North America, and in particular the United States, has historically dominated corn starch consumption and production due to the large corn crop and the food processing industry. The U.S. produces millions of tons annually of corn starch and uses most of it for high-fructose syrup, snack food, and exports. Asia-Pacific has the highest demand for corn starch, with countries such as China and India experiencing rapid growth in confectionery, textiles, and packaged foods.

Europe is a stable market that focuses on starches with higher value, such as organic and non GMO starch. This helps meet the consumer’s preferences. In addition, the market is expanding due to new applications of starch such as biodegradable packaging and ethanol production. Starch is becoming more important as consumers demand more convenient food and the world seeks sustainable alternatives to materials.

Business feasibility

The capital investment required to set up a plant for the production of maize starch is high, but it offers a good return. The success of a maize starch manufacturing plant depends on its location near hubs that produce corn to ensure low-cost raw materials. This process requires steeping, milling, separating and drying with high energy and water consumption. All parts of the kernel are available for sale, including starch, which can be used for food, industry and feed, as well as gluten meal, fiber and fuel.

Start with medium-sized plants that serve local industries such as textiles and foods, then expand to specialty starches or derivatives like modified starch or sugar syrup which have less competition. It is important to adhere to safety and quality standards, especially when selling food grade products. Maize starch production is expected to grow in the future due to rising demand for food, industrial and specialty applications.

4. Silica from Rice Husk Ash

Overview

Rice husk silica (RHA) production is a new business model that turns agricultural waste into an industrial material. The rice husks, which make up about 20% of its weight, are the protective shells that surround each grain of rice. These husks can be removed from rice and used in power plants or boilers. Rice husk ash contains high levels of silica, typically 85-95% if it is burned in controlled conditions. The traditional method of obtaining silica was to mine quartz sand, then process it. This is an energy-intensive and environmentally destructive procedure.

Extracting silica out of rice husk ash, on the other hand, is a recycling method that produces a highly pure product and solves a waste disposal issue. Silica can be extracted from RHA and processed into silica gel or compounds, which are used in many industries.

Applications of RHA Silica

- Construction and Cement: Raw rice husk ash, which is rich in amorphous silicon, is used as a pozzolan for cement and concrete. RHA, when finely ground, can be used to replace cement in concrete mixtures, increasing strength and durability, while reducing costs.

- Rubber and Tire Industry: Precipitated Silica is a synthetic form of silica that’s used in rubber products. This includes tires. Green tires with silica compounds on the tread have a lower rolling resistance, which improves fuel efficiency. They also have a better grip. RHA silica is a good raw material for precipitated silica.

- Paints, coatings, and plastics: Silica can be used as a thickener and filler in paints or coatings to provide wear resistance and consistency. Fine silica in plastics can improve the heat resistance and mechanical characteristics of certain polymer composites.

- RHA-derived silicon: It can be purified to produce pure compounds of silicon. Some processes can convert RHA-derived silica into silicon carbide or polycrystalline silicon that is used in electronics and solar panels. Rice husk is a source of high-purity silicon, which is used to make photovoltaic wafers.

- Agriculture: Silica has been recognized as an important substance for a variety of plants, including rice and sugarcane. The RHA Silica can be used in the production of silicon fertilizers and soil conditioners.

Market and Growth Potential

Globally, the silica industry is gaining momentum. The rice husk market (including its application in cement etc.) is currently growing. The market for RHA silica products is estimated at low single-digit millions of dollars. Around 2030, the market is expected to reach USD 4-5 billion per year. This sector’s growth (maybe around 4-6% CAGR), while modest compared to some high-tech fields is still steady and driven primarily by key trends.

Sustainable materials are in high demand. Companies are actively searching for eco-friendly alternative raw materials. RHA can help companies achieve CSR goals, and it may also offer cost savings. Second, areas with abundant rice production, such as South and Southeast Asia (for example), are eager to use this waste. We see Asia-Pacific both as a major user and source of RHA silica.

Even if only a fraction is achieved via rice husk ash, this represents an opportunity worth billions of dollars. Environmental regulations also encourage people to avoid burning or dumping agricultural waste in the open. Where open-field burning is prohibited due to pollution concerns, the conversion of husk into ash and the extraction of silica in controlled facilities becomes an attractive option.

Why this is a great startup idea

Entrepreneurs who are interested in the circular economy and green technologies will find it attractive to produce silica using rice husk ash. This is because it uses a low-cost, abundant raw material. Many rice mills and biomass power plants give away or charge a very low price for rice husk ash, as it is a byproduct that they have to get rid of. A plant for the processing of RHA can be established with a modest investment in equipment. The steps are: collecting the rice husk or ash, burning it under controlled conditions (to make sure that the silica is amorphous), and then purifying the silica by chemical means. Some common methods are to treat the ash with caustic soda and then precipitate out silica or to use acid leaching in order to remove impurities.

The final product is a precipitated silica, which can then be dried and packaged. Small to medium-sized facilities can begin by focusing on local needs. (For example, selling pozzolan or supplying a tire factory nearby.) This business can be an advantage for startups because it is environmentally friendly. It could open doors for grants, subsidies or easier project approvals. Many governments, for example, support projects that turn waste into industrial inputs. Entrepreneurs may find technical assistance or incentives in these domains.

Profitability is a key consideration

Profit margins can be high in RHA silica due to the low cost of raw materials, but they must remain consistent (especially when targeting higher-end markets like tire-grade or export markets). To ensure a constant supply of rice husk and ash, entrepreneurs should partner with rice mills and agricultural cooperatives. By-products (sodium sulfate solution if this route is taken) of the process can also be sold or used by other industries. ).

One can emphasize that this silica product is sustainable, which could help clients reduce their environmental impact. A rice husk silica venture can help entrepreneurs at the intersection of industry and agriculture, as the world is increasingly focused on circular economies.

5. Chlorinated Paraffin Wax

View the full article

The chlorination process produces CPW, which is a chemical compound. The waxy liquid can be a soft, viscous solid depending on the chain length and chlorine content. The carbon chain length is used to categorize CPW: short-chain (C10-C13), middle-chain C14-C17, and long-chain C18-C30. The chlorine content also varies (between 40% and 70% by weight).

CPW is not a household word, but its properties make it a popular additive. It is a cost-effective plasticizer and a fire retardant. CPW is used in flexible products, yet needs to be fire-resistant or able to withstand pressure.

Industrial Uses of CPW

- PVC Plasticizer: Chlorinated paraffin can be used as a secondary polymerizer in PVC products (polyvinylchloride). PVC is rigid; you will need plasticizers to make it flexible (for example, cable insulation, floorings, synthetic leathers, garden hoses).

- Flame retardant: The high chloride content of CPW contributes to its flame-retardant properties. When exposed to flames, HCl is released. CPW can be found in materials that need to resist flames.

- Metalworking fluids: They are also widely used in the metal cutting and forming process. CPW, especially the short-chain grades (though these are being phased in by some regions because of environmental concerns), provides extreme pressure lubrication.

- Paints, Adhesives, and Sealants: CPW can be added to industrial paints and varnishes as a flame retardant and plasticizer. CPW can be found in paints that are fire-protective (intumescent). CPW is used in adhesives to modify the viscosity of certain adhesives for construction or automotive use and to add flame resistance.

- Rubber and Polymers: In the rubber industry, CPW is a low-cost alternative to conventional plasticizers. It can be found in rubber hoses and conveyor belts as well as shoe soles. Rubber is made more flexible, but it also becomes resistant to chemicals and water.

- Leather and Textiles: Though CPW is less common, it can be used to treat fabrics or leather when flame retardancy or PVC coatings are needed.

Market Overview

The global market for chlorinated paraffin is well established, with a moderate outlook. The market is expected to reach USD 2,0-25 billion annually by 2024-2025. The market is expected to reach $3-3.5 billion in the early 2030s. This represents a modest 3-5% CAGR. The slower growth of CPW (compared to sectors such as battery recycling) can be attributed to its maturity and the fact that it is used in traditional industries like PVC production, metalworking etc. It remains popular, however, as the industries continue to grow, particularly in Asia. Asia-Pacific, China and India are the two largest producers of CPW.

The region has a large PVC industry and metalworking industry that rely on CPW. Growth in infrastructure and manufacturing also translates to steady CPW usage. North America and Europe are more strict with their regulations (especially against short-chain CPWs which are classified as persistent organic pollutants).

Considerations for Entrepreneurs

A chemical processing setup is required to enter the CPW business. The reaction of heavy paraffin, which is often obtained from refineries, with chlorine gas must be done under controlled conditions. Heat and UV light may be used to start the reaction. Equipment includes tower reactors or batch reactors, chillers (temperature control is important because the reaction is exothermic), and tail gas treatment to capture unused HCl or chlorine.

The key success factors are: securing a reliable supply of raw paraffin (which could be heavy n-alkanes or normal paraffin wax from refineries), as well as adhering to quality standards. (Customers specify the ranges for chlorine content, viscosity and other specifications they require in CPW). You could also target a specific niche in the CPW industry, such as a particular grade.

Market drivers and outlook

The continued growth of the PVC sector is a positive factor for CPW. PVC will continue to grow (especially in pipes and wires in emerging economies), so CPW is a good, cost-effective alternative. CPW is also cheaper than alternatives like dioctyl phthalate (DOP) and certain phosphate-based flame retardants. This cost advantage can be crucial for markets that are price sensitive. Entrepreneurs should be alert to the challenges that they face, namely regulatory pressures. Some regions have banned short-chain CPWs due to persistent environmental issues and bioaccumulation. The medium-chain CPWs are not classified as POPs (persistent organic pollutants) and therefore still widely accepted. However, future regulations may tighten.

A forward-looking CPW company might, therefore, invest in environmentally friendly grades or ensure that waste management and emissions are well controlled to meet international standards. CPW manufacturing offers a good business opportunity, especially when the industrial demand is stable and the product can be produced at a large scale.

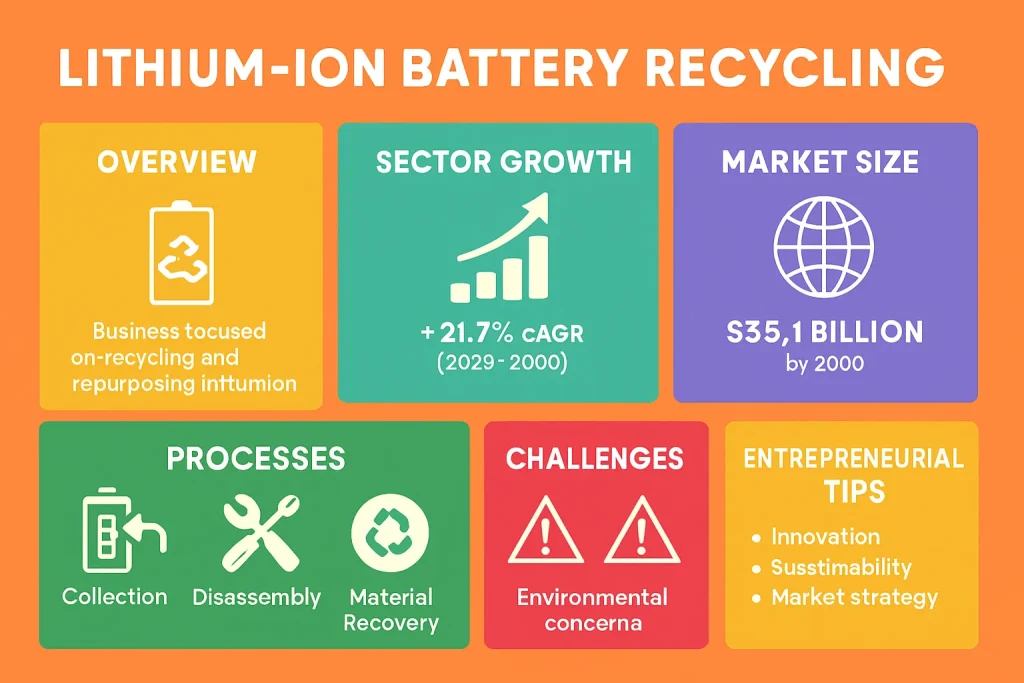

6. Lithium-Ion Battery Recycling

View the full article

The lithium-ion battery industry is one of today’s most important and exciting emerging industries. The Li-ion batteries that power our smartphones and laptops are also the ones that power electric vehicles. The capacity of these batteries drops after a limited time (typically 5-10years or a set number of charging cycles). The volume of Li-ion battery waste is expected to increase in the next few years due to the boom in EVs and portable electronics.

Why the sector is growing

Electric vehicles are on the rise, and this is backed up by ambitious targets set by automakers and governments. This has led to a huge increase in batteries at end of life that need recycling. The growing demand for consumer electronics is also a factor. Recycling is seen as an important strategic need, because critical materials such as cobalt and Nickel are concentrated in a few regions, and their recovery ensures the security of resources.

The environmental concerns are further strengthened by the fact that improper disposal of lithium-ion batteries may cause fires or contamination. In response, recycling is mandated by regulations, with Europe enforcing strict quotas, and countries such as China and the U.S. financing large-scale capacities. These forces combine to fuel the rapid growth of the lithium-ion battery recycling sector.

Market Size and Forecast

Although still small, the global lithium-ion recycling market is growing at a rapid pace. By 2030, the market is expected to grow from $5 billion up to $20 billion. Some forecasts suggest $18-24 billion. This would indicate annual growth rates of 20-30%. The revenue comes primarily from recycling fees, but also, and more importantly, sales of recovered materials like cobalt and nickel compounds, which are then reintegrated back into the battery supply chains.

Asia, led by China, South Korea and Japan, dominates the world due to its strong battery industries, government support and rapid capacity building in Europe. North America has seen major investments by startups to prepare for EV batteries. Countries like India have begun to focus on recycling to coincide with their EV adoption goals.

Recycling Processes and Opportunities

The technology behind Lithium-ion battery recycling is complex. However, many companies are working to develop efficient methods. The process involves the collection of batteries and their sorting, discharging them safely (to prevent fires/explosions), then shredding or dismantling. The shredded material can be processed using pyrometallurgical methods (high-temperature melting to produce alloys and slag, from which metals can be extracted), or hydrometallurgical methods (using chemicals to dissolve metals in solution and precipitate them).

The newer “direct recycling’ approaches are designed to recover and refurbish the entire cathode material of a battery without reducing it into its elemental form. This could save energy and cost. Entrepreneurs can enter this field in several ways: by setting up a collection network for batteries (since having enough feedstock is important), by establishing a recycling plant that uses a proven technology or by partnering with manufacturers to recycle their production scrap.

For more information, check out our related video

What are the Challenges?

Entrepreneurs need to be aware of the challenges. Li-ion battery are classified as hazardous materials, and therefore must adhere to regulations when handling or transporting. The fire hazard (thermal runaway) in damaged batteries is a major concern. The technology is constantly evolving. Staying up to date and licensing or partnering with advanced recycling tech could give you an advantage. Support is abundant: Many governments provide incentives or loans to set up recycling plants. Even automotive companies invest in recycling startups.

Battery recycling is profitable because it can extract a large percentage of metals. Cobalt prices and nickel have been historically high. So recovering these metals yields a good return. The demand for lithium is high, but the supply is plentiful. Recycled lithium has become valuable.

Expert Guidance for Entrepreneurs: Niir Project Consultancy Services (NPCS)

The process of starting a new manufacturing business involves many stages, from market research to technology selection and plant planning. Niir Project Consultancy Services is an organization that supports entrepreneurs on their journey. NPCS produces Market Surveys and Detailed Techno-Economic feasibility Reports in a variety of industries, including those mentioned above. These reports are comprehensive and cover all aspects of a project, including the manufacturing process, technology, raw materials and their sourcing, layouts, and machinery as well as financial projections. Using NPCS expertise, entrepreneurs are able to thoroughly evaluate the feasibility of establishing a new business or industry before committing resources. NPCS provides the blueprints and confidence that entrepreneurs need to make these high-potential ideas a reality.

Discover the Right Business for You With Our Startup Selector Tool

Frequently Asked Questions (FAQs)

Q1: Which of these manufacturing opportunities requires the highest investment to start?

A1: Among the listed opportunities, Maize Starch production and Lithium-ion Battery Recycling typically require the highest initial investment. Maize starch factories need large-scale processing equipment, significant raw material (corn) handling capacity, and infrastructure for effluent treatment, which means high capital expenditure.

Q2: Which business idea offers the fastest growth and future demand among these?

A2: Lithium-ion battery recycling is expected to offer the fastest percentage growth. This is because the sector is in its early stages and the volume of batteries to be recycled will explode in the coming years as electric vehicles and electronics usage soars. High double-digit annual growth rates are projected for battery recycling throughout the 2020s. In terms of robust demand coupled with high growth, organic fertilizer is also notable – driven by the global shift to organic farming, it enjoys strong growth (~8-10% CAGR) and consistent demand since food production is essential.

Q3: Can these businesses be started on a small scale, or do they require big factories?

A3: Several of these businesses can be started on a small or medium scale and scaled up over time. Organic fertilizer from cow dung is highly scalable – one can start with a small composting yard serving local farms and gradually grow into a larger plant with bagged products for retail. Bentonite granule/powder processing can also start relatively small if there’s access to raw bentonite; a basic crushing and roasting setup could serve initial orders, then reinvest profits to add capacity. Silica from rice husk ash can be done in a medium-scale plant (even a mini-plant processing a few tons of husk ash a day) targeting local industrial buyers, and later expanded with more furnaces or extraction lines.

Q4: What are the main challenges faced in these industries for a new entrepreneur?

A4: Each industry has its specific challenges:

- For bentonite products, a key challenge is raw material consistency – securing bentonite clay of the right grade (sodium vs calcium content, swelling index, etc.) is crucial.

- In organic fertilizer (cow dung), the challenges include collecting sufficient raw manure and maintaining quality and compliance (pathogen-free, properly composted product).

- Maize starch manufacturing’s main challenges are high competition and price sensitivity – the starch market has big players, so a newcomer must be efficient and perhaps find a niche or local market to serve.

- For silica from rice husk ash, the process must be finely controlled to achieve consistent silica quality (e.g., consistent burning conditions for the husk). Impurity removal can be technically challenging.

- Chlorinated paraffin wax businesses face regulatory and safety challenges. Handling chlorine and ensuring there are no harmful emissions (chlorine and HCl must be contained) requires investment in safety systems. Environmental regulations can change, so one must stay compliant.

- In lithium-ion battery recycling, technology and know-how are major challenges. It’s a cutting-edge field; entrepreneurs need a solid process that maximizes metal recovery efficiently. Safety is also a huge concern – handling damaged batteries can be dangerous.

Q5: How can I learn more about the technical and financial feasibility of these projects before investing?

A5: A prudent approach is to conduct a feasibility study or consult detailed project reports for the specific industry. This is where organizations like Niir Project Consultancy Services (NPCS) are very valuable. They offer in-depth reports and consulting for each of these project ideas, covering technical requirements, market outlook, cost analysis, and profitability projections.