The chemical industry is one of the most important industries in India after manufacturing and services and the importance of this industry is clearly visible in the backdrop of world trade. This sector, which includes basic chemicals, petrochemicals, ferro alloys, paints, fertilizers, agri-chemicals and specialty chemicals, has become an integral part of the manufacturing and export system in India. Even as this world rushes to make India a five trillion dollar economy, as all understand all the way the chemical industry shall also get huge impetus.

Export Performance: A Competitive Edge

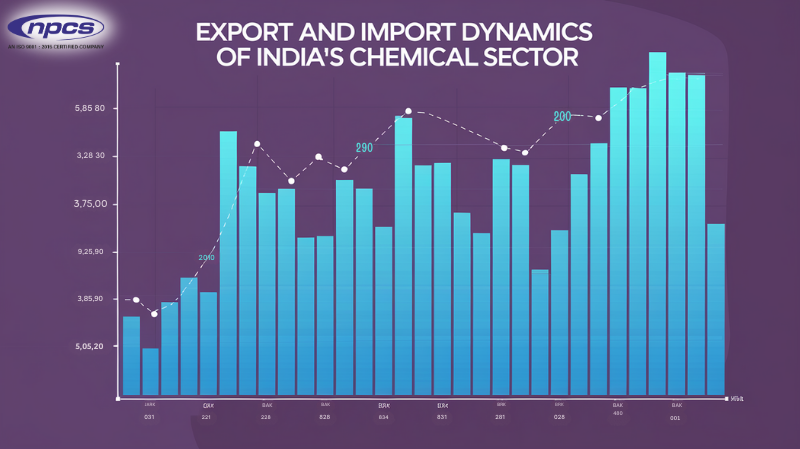

Indian chemical exports have been a major component in the trade expansion of the country, the increase in chemical exports has added on to the nation’s trade. As per the recent data release chemical and chemical product exports (estimated excluding that of pharmaceuticals and fertilizers) for the year 2021-22, accounted for 11.7% of total exports from India. To mitigate the alarming decline, the ratio demonstrated a dip in comparison to the previous years’ record of 12.9% of chemical substances; the dollar value of the exports has been very healthy. In the year 2021-22, the export value of the sector touched a monumental 368,597 crore rupees, showcasing the increasing importance of this sector within the international arena.

While a slight decline can be seen in percentage terms, the growth in overall figures has been quite strong. Looking back at the years 2017-18-2021-22, the exports of this chemical sector achieved the value of 13.86% CAGR export growth, which is higher than the economy’s overall export CAGR growth of 12.62% for the period. This not only speaks to the strength of the chemical sector in India, but also to its ability to compete in the international market.

Main contributors to exports comprise of the following:

- Organic chemicals

- Inorganic chemicals

- Plastics and articles

- Filaments and staple fiber made of synthetic materia

The chemical exports of India showcase that this sector has many more avenues to explore, other than raw materials, it could also produce high end advanced chemicals. Moreover, organic chemicals which are base ingredients for numerous exportables such as pharmaceuticals, dyes and agrochemicals, forms a major part of the exports.

Join With Us

Import Scenario: Addressing Domestic Gaps

The Indian economy presents import of certain key raw materials and intermediates despite the significant growth in exports. Out of the total imports by India in 2021-22, the imports of chemicals and chemical products stood at 11.9% which was lower than the 12.8% figure in the previous financial year. Nevertheless, the value of imports surged to Rs. 544,115 crore during the year 2021-22, indicating India’s unfinished relationship with some chemicals outside the country.

For the chemical sector, imports during the years 2017-18 to 2021-22 grew at a CAGR of 14.38%, higher than the national import CAGR of 11.10%. This implies that the rate at which imports grow is higher than the growth rate of the exports. That is an indication that some particular areas in the chemical industry, for instance in chemical manufacturing have advanced while India has not. Bridging these gaps will be important for enhancing the self-reliance of the country in respect to core sectors.

Moreover, some of the prominent import baskets are:

- Organic chemicals

- Articles of plastics and plasticware

- Inorganic chemicals

There is also a significant component regarding the imports of some organic and inorganic chemicals which are used as intermediates in the manufacturing of pharmaceutical, agrochemicals and other industry verticals which presents a case for increasing the manufacturing base in the country. This has created a problem which has led to measures of minimizing import expenditure and enhancing innovation and productive capacity within the country.

Government Initiatives: Boosting Competitiveness

Recognizing the immense potential of the chemical industry as an engine of growth, the Indian government has implemented a range of policy measures aimed at increasing production, promoting innovation as well as increasing exports. These measures are intended to put in place a strong framework for both the stimulation of the internal market and outward-oriented growth.

- Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs): The country has four PCPIRs to encourage integrated development in chemical manufacturing hubs. These regions have the requisite infrastructure and enable companies to increase output thereby improving the domestic supply and competitiveness of exports.’

- Plastic Parks Scheme: The Plastic Parks Scheme has played a vital role in the development of the plastic processing sector. To date, approval has been granted for ten plastic parks in various states, aimed at reinforcing the country’s plastic manufacturing and export capabilities.

- Centers of Excellence: In view of the need for sophisticated research and development, the government has set up 13 Centers of Excellence (CoEs). These centers have an objective of providing advanced polymer technology, which will result in enhanced innovation and production of advanced materials to satisfy the current global needs for high tech materials.

- Production Linked Incentive (PLI) Scheme: Even though the program is not made to target particularly chemicals, the PLI Scheme has been covered for some parts of the area. This is an incentive-based scheme to enhance the industry of manufacturing of chemical products with high value and intermediates for which imports are presently required in considerable amounts and hence, these products will be exported instead of being imported.

These policies are essential in making sure that India is still able to compete favorably in the international market, cut down on the level of imports and raise much needed exports of value added goods.

Feasibility reports on: Soda Ash

Challenges and Opportunities

THe industry’s expansion rate might be very appealing, however members of this sector authority have to work on some issues to keep this momentum going. There is ever-growing import dependence for some advanced chemicals which limits the growth of the industry into higher value products. Furthermore, quite a number of developed countries like Europe and North America are increasingly emphasizing environmental concerns and compliance to safety and other regulatory requirements for imports.

The New-Gen chemical manufacturers strive to adapt to this changing environment and face challenges in correlating more of their product ranges to eco-friendly ones. This challenge will confront the Indian chemical industry, as it must direct adequate funding into R & D to compete at all in the technology race. For example, this applies to so-called ‘bioplastics’, green chemicals and renewable feedstock.

Nevertheless, the chances are greater than the risks. Experts predict a steady growth in the demand for chemical products and global chemical markets, as the medical, pharmaceutical, electronics, agricultural, and construction sectors increasingly need chemical products. India’s extensive manufacturing capacity and talented workforce place it advantageously on the demand curve.

Also, these developments have favorable implications for India’s prospects as a chemical manufacturing and export base within a multipolar world, particularly in view of diversification away from China for many countries as a response to aggressive geopolitics and trade wars.

Future Outlook: Building on Strong Foundations

The impressive export achievements of India, favorable government policies, and a surge in global market demand continue to drive the evolution of the chemical industry in India. However, for the sector to fully realize its current promise, it must promote creative, environmentally friendly practices and develop higher value products and services.

This is particularly important as the chemical industry continues to expand its role in global trade by eliminating import dependence, promoting domestic production, and shifting to selling more sophisticated goods and services. With the nation set to achieve its ambition of a 5 trillion dollars economy, the chemical industry will be significant in propelling industrialization, creating jobs, and improving the country’s foreign exports earning strategy.

To summarise, the prospects of the chemical industry in India seem to hold promise but does not mean that there are no obstacles. If the industry resolves issues related to sustainability, innovation and bearing competition on a global scale, it can build upon current successes and in a few years time turn out to be a proper big global player. Under optimum funding and strategic direction, the Indian chemical industry has the capacity to spearhead the nation’s increased economic advancement and supremacy in global commerce.

Conclusion

The chemical sector in India has become a good example of a global trade and is displaying high growth and increasing competitiveness. The focus of the sector has largely been on reaching international markets, but at the same time, barriers such as overreliance on imports and lack of sufficient domestic production capacity remain. The program’s measures, together with the ones directed at stimulating creativity, enhancing eco-friendliness, and developing more sophisticated goods, create a possible scenario for the sector’s future development

As India continues its journey toward becoming a $5 trillion economy, the chemical industry will play a crucial role in driving export-led growth. With the right investments and policy support, the sector is poised to further strengthen its position in global markets, contributing to India’s long-term economic success.