Paints and coatings are not just surface products. They are essential to the modern world. Paints and coatings are used to protect, preserve and beautify surfaces on all kinds of objects, from bridges and skyscrapers to cars, appliances and smartphones. The coatings are designed to provide more than just color. They also offer durability, weather resistance and corrosion protection.

The paints and coatings sector will undergo a dramatic transformation by 2025. The demand is increasing not only in the traditional sectors such as construction and automotive, but also in special applications like industrial machinery, packaging and aerospace. Setting up a paints-and-coatings plant is an excellent opportunity for entrepreneurs. However, it’s important to have a solid feasibility study, a good understanding of the demand trends and a long term view of ROI.

Market Outlook: An Expanding Global Industry

Global paints and coats market is expected to grow at a CAGR between 4 and 5%. The estimated value of the global market in 2023 was USD 180 billion. By 2030, it will be USD 230 billion. The growth is concentrated in Asia-Pacific, which accounts over 45% for global consumption. India and China, both undergoing rapid urbanization and a rise in middle class consumer spending, are driving this growth.

Paints and Coatings Market in India will surpass USD 9.5 Billion by 2023. It is projected to grow 8-9% per year, exceeding global averages. The Indian market is dominated by decorative paints which make up about 75%. This is due to the high demand for housing renovation and construction. Industrial coatings are growing in popularity, despite their smaller share in the market. They can be found in automobiles, appliances and heavy machinery.

Paints and coatings are one of the industries that is most resilient, and this makes them attractive to both large companies and newcomers.

Read More: How to Start a Paint Manufacturing Business in India?

Global Paints & Coatings Market Outlook

| Year | Market Size (USD billion) | CAGR (%) | Key Demand Drivers |

| 2023 | 180 | – | Construction and automotive refinishing |

| 2025 | 200 | 4.4 | Demand for urban housing, electric vehicles, and industrial coatings |

| 2030 | 230 | 4.8 | Green coatings, nanotechnology, packaging |

Demand Drivers in Different Sectors

The paints and coatings industry is driven by a number of industries. Construction is the biggest consumer, representing more than half of all demand. Consumption is driven by the growth of urban housing projects, government-led infrastructure initiatives, such as India’s Smart City Initiative, and commercial projects.

Another important driver is the automotive industry. Modern vehicles need a variety of coatings, from primers that resist corrosion to high-gloss surfaces. Electric vehicles (EVs), which are on the rise, also create a demand for coatings with thermal management, insulation and lightweight finishes.

The packaging industry relies on coatings to increase shelf life, improve barrier properties and enhance aesthetic appeal. Electronics and consumer products rely on coatings to enhance their functionality and aesthetics.

The diversity of paints and finishes ensures they will be in demand, even if a particular sector experiences cyclical downturns. This provides long-term stability for manufacturers.

Read More: How to Set Up a Profitable Vedic Paint Industry in India

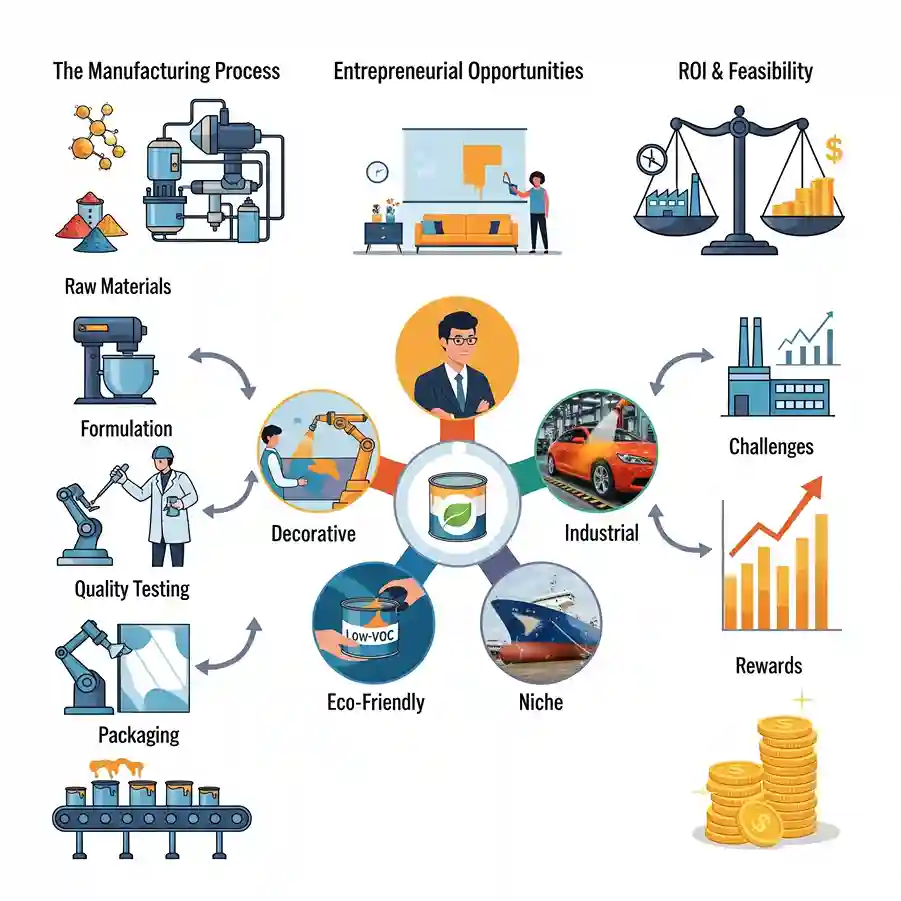

The Manufacturing Process: Overview

Paint and coatings production is a process driven by science that demands precision and quality assurance. The process is divided into several stages.

- Raw Material Selection: The main ingredients are resins (such a acrylics, alkyds polyurethanes or epoxies), color pigments, solvents and water to control viscosity, and additives like UV resistance.

- Mixing and dispersion – Pigments and fillers can be dispersed in resins by using high-speed mixers or dispersers.

- Formulation and Adjustment: Additives can be added to change gloss, durability and flow.

- Quality Testing: Each batch is subjected to rigorous testing in terms of viscosity and opacity. They are also tested for adhesion, moisture resistance, and drying times.

- Filling and packaging – Depending on the application, the paint or coating will be filled into drums, cans or bulk containers.

Plants can specialize in industrial coatings or decorative paints. The water-based formulations that are rapidly growing due to environmental regulations require slightly different equipment compared to solvent based paints.

Read Our Book: Click Here

Opportunities for Entrepreneurs

Paints and coatings offers many lucrative opportunities for startups. In emerging economies such as India, the decorative paints sector is very attractive. Rising disposable incomes and urbanization are driving demand. Entrepreneurs can enter the decorative paints segment by offering tailored products such as low-VOC or eco-friendly paints.

Industrial coatings are used in many industries, including automotive, aerospace, oil & Gas, and marine. Entrepreneurs who focus on high-performance niche coatings, such as heat resistant, anti-fouling or nano-coatings, can tap into specialized market with higher margins.

Eco-friendly products are also in demand. Both governments and consumers are pushing for paints that have reduced volatile organic compound (VOC) levels and recyclable packaging. Startups who invest in R&D to develop green formulations will be able to differentiate themselves from the competition in this crowded market.

Customization and regional focus are two other opportunities for entrepreneurs. Smaller players will thrive by providing paints and finishes tailored to the local climate, for example in arid or tropical zones with high humidity.

ROI and Feasibility: Insights

The return on investment for a business in paints and coatings depends on a number of factors including the product mix, size of operations and distribution strategies. The industry is able to benefit from a high volume, recurring market, especially in the decorative segment, where repainting cycles are responsible for consistent consumption.

Specialty coatings are often more profitable, as customers will pay a higher price for superior performance. Startups that focus on niche markets such as paints for EV Batteries or water-based construction can build a strong brand while achieving attractive margins.

Integration of the supply chain is also crucial to feasibility. Access to resins and pigments as well as additives are essential, since raw materials account for a large portion of the overall cost. Set up a factory near industrial clusters and ports to reduce logistics costs.

Read More: How Paint is Made. Paint Manufacturing. How to Start Your Paint Factory

New Entry Challenges

The paints and coatings industry has great potential but also challenges. Capital is a major issue in the industry, which requires investments in R&D laboratories, quality assurance systems, and machinery. Compliance with environmental regulations, such as those regulating hazardous chemicals and solvent emissions, is a challenge.

In the decorative paints industry, competition from multinational brands is fierce. Direct competition with these giants is not always feasible for startups. Success often comes from identifying niches, creating local distribution networks and offering differentiated product.

The volatility of raw material prices, particularly in crude oil derivatives that are used to make resins and solvents can affect margins. Entrepreneurs should plan their procurement strategies, and where possible, consider backward integration.

Paints & Coatings: Global Leaders in Paints & Coatings

| Company Name | Country | Strengths and Specializations |

| AkzoNobel N.V. | Netherlands | Paints for decorative purposes, marine and protective coatings |

| PPG Industries Inc. | USA | Automotive OEM coatings, industrial finishes |

| Sherwin-Williams | USA | Paints and protective coatings for decorative purposes |

| Nippon Paint Holdings | Japan | Asia-Pacific decorative paints, automotive finishes |

| Asian Paints Ltd. | India | Market leader for decorative paints in India |

| Berger Paints India | India | Decorative & industrial coatings |

| Axalta Coating Systems | USA | Powder coatings for automotive refinishing |

| RPM International | USA | Sealants and coatings for specialty applications |

| Jotun Paints | Norway | Marine & industrial coatings |

| Kansai Nerolac paints | India | Automotive & industrial coatings |

Global leaders are able to dominate the coatings market due to their brand, size, and R&D. However, regional players, startups, and niche markets can also thrive.

Read Our Project Report: Click Here

India’s Strategic Avantage

India has a distinct advantage when it comes to manufacturing paints and coatings. Domestic demand is growing due to a rapidly urbanizing populace, government infrastructure efforts, and an automotive and industrial base that’s thriving.

India is also becoming a hub for the export of paints and coatings. Its favorable manufacturing environment is characterized by low production costs, a large labor pool, and easy access to raw materials. India’s startups can serve both the domestic and international market, maximizing ROI potential.

Conclusion

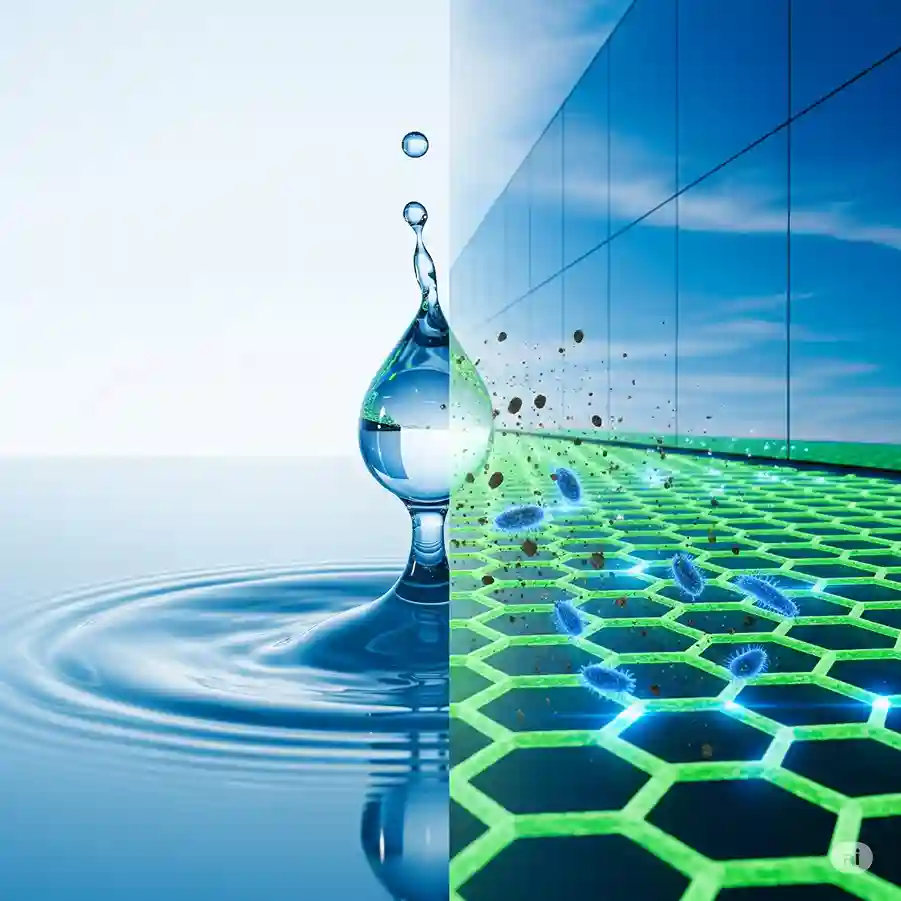

Sustainability, innovation and specialization are the keys to the future of paints, coatings, and other products. Paints that are water-based or low-VOC are replacing solvents. Nanotechnology allows coatings to have antimicrobial and self-cleaning properties. Modern manufacturing techniques, such as automation and AI-driven control of quality, make plants more efficient.

Setting up a paints-and-coatings plant by 2025 is an excellent opportunity for entrepreneurs. However, the venture must be backed with a robust feasibility plan, quality-driven process, and a product strategy that looks to the future. Startups can achieve a strong market presence and high returns by focusing on specialty coatings and green formulations.

Discover the Right Business for You With Our Startup Selector Tool

About Niir Project Consultancy Services

Niir Project Consultancy Services provides detailed insight to entrepreneurs for successful paints and coatings plant setup. NPCS provides detailed reports on the feasibility of a paints and coatings plant, including a market survey and Detailed Techno Economic Feasibility Reports. These include everything from raw materials and manufacturing processes to plant layouts as well as financial projections. NPCS has decades of experience in helping startups to assess the feasibility, plan efficiently and maximize ROI within the paints and coats sector.

Coatings Industry: Frequently Asked Questions (FAQs)

Q1: How big is the paints and coatings market, and is it actually growing?

The market is huge—worth about $180 billion in 2023. It should reach $230 billion by 2030. India’s market is growing even faster because of new construction and factories.

Q2: What are the main industries driving this demand?

Construction uses the most paint, over half the market. Automotive is next, including new demand from EVs. Factories and machinery need industrial coatings. Packaging and electronics use paint for looks and protection.

Q3: What’s the difference between decorative paints and industrial coatings?

Decorative paints go on homes and buildings. They cover about 75% of India’s market. Industrial coatings protect things like ships, machines, and cars from damage.

Q4: What are the best opportunities for a new entrepreneur in this industry?

Don’t fight big brands on basic paint. Go for eco-friendly paints or high-performance coatings for things like EVs or boats. You can also make paints for local weather.

Q5: What are the biggest challenges in setting up a paint manufacturing plant?

You need a lot of money for equipment and labs. The government has strict safety and environmental rules. Big companies dominate the market. Raw material prices, especially oil, change often.

Q6: What does the future of the paints and coatings industry look like?

The industry is moving to safer, greener products. Smart coatings are coming, like paint that cleans itself or kills germs. Expect more innovation and focus on health and the environment.