The chemical market of Indonesia is undergoing a significant transformation driven by industrial growth, increased urbanization, and a rising middle-class population. For Indian chemical startups, Indonesia has become a vibrant market with the issuance of the ASEAN-India Trade in Goods Agreement (AITIGA). Indian SMEs in the chemical sector stand to gain from enhanced competitiveness and market penetration, as well as a stronger foothold in the greater Southeast Asia region with AITIGA’s benefits on tariff reduction and trade facilitation. This article highlights the entrepreneurial opportunities available in Indonesia, utilizing the AITIGA advantages in the chemical industry.

Overview of the AITIGA Agreement

AITIGA, which is already signed with India and the member states of the ASEAN, aims to eliminate the tariffs on a wide spectrum of goods as well as foster bilateral trade and strengthen the relations of the economies. Indian chemical exporters, in particular, receive benefits from the agreement in the form of lower or zero tariffs on a whole list of organic, inorganic and specialty chemical goods. This works in favor with the goods, make them more competitive in price against non-ASEAN suppliers, therefore easing the competitiveness gateway to the Indonesian market.

Related: How to Build a Profitable Business in Fine Chemicals with Minimal Infrastructure

Overview of Indonesia’s Chemical Market

Indonesia’s chemical industry includes basic chemicals and petrochemicals, agrochemicals and specialized chemicals. Induced demand originates from manufacturing, construction, agriculture, and consumer goods. Finished goods and chemical raw materials are essential due to the manufacturing sector and the country’s large population.

Why Indian Chemical Startups Should be Looking at Indonesia

It is helpful to note the following appealing advantages of Indonesia for Indian exporters:

- Expansion of the economy’s primary chemical and petrochemical industries

- Trade facilitation under AITIGA with lower tariffs and simplified trade formalities.

- A Re-export regional center for ASEAN makes Indonesia’s geographical position an advantage.

Potential Chemical Sub-Market Indonesians Are Looking For

Indian startups should consider Indonesia’s requirements and focus on niche and value-added products.

- Plant Protection Chemicals – Crop A agrochemicals.

- Dyes and Pigments – For textiles, plastics, and coatings.

- Construction additives, water treatment chemicals, and surfactants are classified under performance chemicals.

- Emulsifiers, plant derived actives, and specialty additives for personal care are categorized under cosmetic ingredients.

Related: Startup Alert: Chemical Products in High Global Demand with Local Production Potential

Market Forecast and Demand Trends

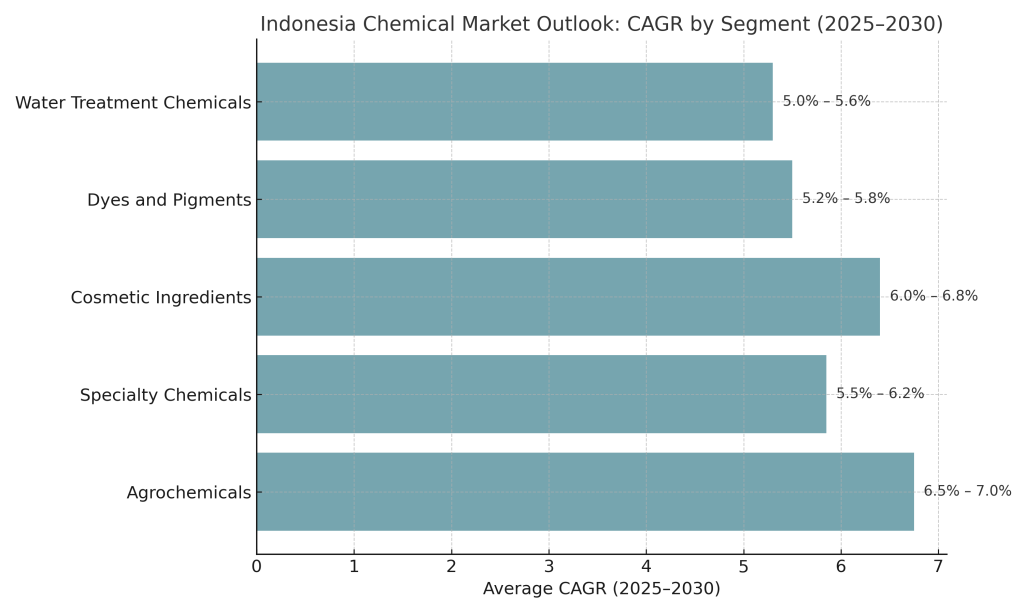

The chemical industry in Indonesia is poised to accelerate and is expected to develop consistently over the next 5 years. The agrochemical, specialty, and cosmetic ingredient chemicals are projected to lead the growth due to strong domestic consumption and their contribution to export-driven industries.

Forecast Table

| Chemical Segment | Demand Drivers | CAGR 2025-2030 |

| Agrochemicals | Improving agricultural productivity needs government spending and reliance on imports | 6.5% – 7.0% |

| Specialty Chemicals | Advancement in manufacturing, electronics, and application of performance materials | 5.5% – 6.2% |

| Cosmetic Ingredients | Centered middle class and per capita spending on the care of one’s self | 6.0% – 6.8% |

| Dyes and Pigments | Centering fiber, plastics and packaging industries | 5.2% – 5.8% |

| Water Treatment Chemicals | Urban infrastructure growth and enforcement of water regulations | 5.0% – 5.6% |

The following factors will continue to shape demand in Indonesia:

- Increased infrastructure, along with industrial investment.

- Increased consumer spending on personal care and household goods.

- Growth of the domestic manufacturing and agriculture industries.

Example Process – Raw Material Acquisition

Find reputable suppliers for the active and inert chemicals.

Blend active and inert materials in the specified temperature and humidity conditions.

Formulation – Apply granulation, blending, or emulsification techniques based on the specific product.

Quality Testing – Evaluate the product’s stability, performance, and adherence to Indonesian regulations.

Packaging – Apply moisture-resistant and tropical climate-appropriate, tamper-proof packaging.

Logistics – Optimize the supply chain to preserve freshness and efficacy.

View our handbooks on the related topics here

Strategies for Targeting the Indonesian Market

- Conduct thorough market research to understand the specific requirements of the Indonesian industries.

- Use the tariff advantages of AITIGA to enhance pricing competitiveness.

- Work with local distributors to understand the rigid regulatory policies and cultural practices.

- Attend trade fairs and business matchmaking events in Indonesia.

- Emphasize sustainability to appeal to the growing environmental awareness among the buyers.

For more information, check out the related video

How NPCS Can Help Entrepreneurs

Niir Project Consultancy Services (NPCS) prepare Market Survey cum Detailed Techno Economic Feasibility Reports for setting up new industries or businesses. Such reports outline in-depth manufacturing processes, raw material sourcing, plant layout designs, and financial projections. NPCS enables entrepreneurs to evaluate the feasibility and profitability of industrial ventures by guiding them with well-informed strategies, thus fostering sustainable business growth.

Find the Best Idea for Yourself With our Startup Selector Tool

Conclusion

The provisions put forth in AITIGA uniquely position Indian chemical startups to take advantage of Indonesia’s expanding need for high-grade chemical products. Through prioritization of niche, value-added products and tailored approaches to local market dynamics, SMEs can enhance their presence in one of the most promising ASEAN markets and take advantage of the preferential tariff systems. Supported by NPCS specialists, Indian entrepreneurs can overcome market entry obstacles and develop lucrative, sustainable export partnerships in Indonesia.

Data Source: Basic Chemicals, Cosmetics & Dyes Export Promotion Council (CHEMEXCIL) established by The Ministry of Commerce and Industry, Government of India.