The chemicals and petrochemicals sector in India has proved to be a pillar to the structure of the manufacturing and industrial sector within the country for the many years it has recorded growth. Between the years 2017 and 2023, the sector was able to remain dynamic, and even grow as a result of internal and external demand. This paper seeks to further analyze the production trends, growth rates, and projections for the chemical and petrochemical industry in India that are central to the economy of the country.

Overall Production Trends

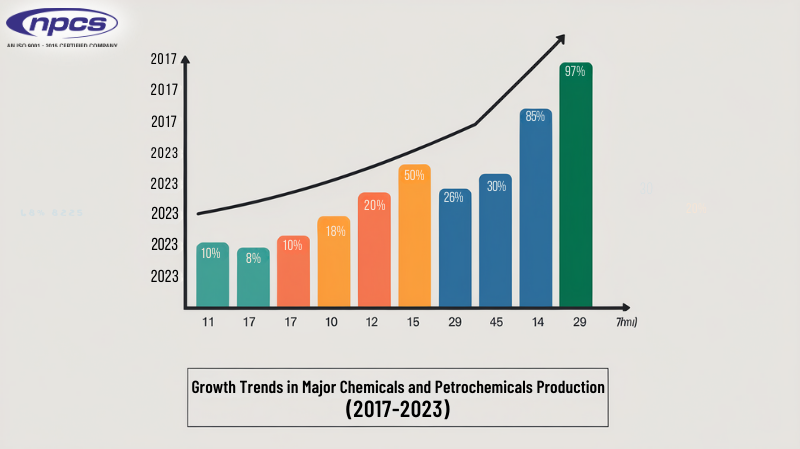

Past, Present, Future British Airways Changes The Scenario The Network Of Projects Contact Produced by the principal chemicals and petrochemicals in the country during the period from 2017- 18 to 2021- 22, went-up without fail. By the first half of 2022-23 (up to September 2022), the production had already touched 26,570 thousand metric tonnes (MT) – a strong indication that the industry was on track to maintain its upward trajectory.

The overall production of major chemicals and petrochemicals over the years considered was observed to grow at a Compound Annual Growth Rate (CAGR) of 4.61%. This denotes good and constant growth which means that the industry managed to cope with many issues including those that were exacerbated by the outbreak of global pandemic known as COVID-19. The Indian chemicals and petrochemicals sector did not only survive but thrived as a result of government intervention, creativity within the industry and growing consumer needs.

Chemical Sector Performance

There has been overall growth in the manufacturing sector of India and in this, the chemical industry plays an immense contribution Towards the expansion. Output of major chemicals grew from 11,069 thousand MT for the year 2017-18 to 12,743 thousand METs from 2021-22 thus standing at a CAGR of 3.58% for this duration.

He further expressed the confidence that the increased output should still continue towards the end of the first semester 2022-23 where the output stood at 6,487 thousand MT. and there continues to be a positive growth trend in this sector. This increased demand for specialized and basic chemical production is defined primarily by rising needs from such sectors as pharmaceutical, agricultural, as well as textile industries. Perhaps the following chemical segments demonstrated the strongest and rapid growth rates:

- Inorganic alkali: This section covers products such as caustic soda or soda ash, which has demonstrated a CAGR of 4.33%. Alkali chemicals are used in the production of soap and glass, detergent manufacturing, textiles, hence one of the industrial sectors, which is considered vital for the economy of India.

- Pesticides: Given the dependence of the country’s economy on agriculture, the need for the production of pesticides increased considerably and recorded a CAGR of 8.92%. Pesticide production entered the Indian market on a large scale, as India is one of the largest agricultural producing countries in the world.

- Dyes And Pigments: This segment has registered moderate growth with a CAGR of 2.03%. Dyes and pigments in the textile industry have always been in demand due to the fact that India is one of the largest textile producers in the world and hence the need for these chemicals has always been there.

Petrochemical Sector Highlights

The dynamic fortunes of the petrochemicals division, which boasts attachments that are indispensable in production, have baffled even the chemicals economy growth. In the time span between 2017-18 and 2021-22, the production of major petrochemicals soared from 36,813 thousand MT to 44,589 thousand MT, with a corresponding CAGR of 4.91%.

Petr sneb transportaion of prfoductions was 20,083 thousand MT achieved yet akain defying the odds and kept going up. The petrochemical sector, which provides intermediate products for various industries such as flexible and rigid packaging, automotive and non-automotive textiles and healthcare, forms an integral part of the manufacturing sector in the country. While most of them have their own importance the following has been the significant growth drivers within Petrochemicals:

- Polymers: The polymers segment has been one of the fastest growing with a CAGR of 7.68%. Various industries such as packaging, construction and electronics employ Polymers, which also include plastics. The increasing production of polymer has been due to the rising consumer trends towards more packaged and long lasting goods.

- Synthetic Rubber: This segment is important for the automotive sector, with a CAGR of 5.60%. In tire production, synthetic rubber is an essential ingredient, thus the automotive industry in India is on the rise and there is wide demand for it.

- Olefins: The growth of olefins, which are key petrochemical building blocks, has also been impressive with a CAGR of 8.58%. They are used to make plastics, resin and solvents which makes them an integral part of the industrial manufacturing process.

Government Initiatives and Policy Support

The Indian government plays a crucial role in expanding the chemicals and petrochemicals sectors. It has taken several steps to improve production capacity, encourage investment, and facilitate the adoption of environmentally friendly measures in industries. One of the highly commended developments contributed by the Government is the Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs), which are extensive and self-sufficient areas of industrial development created to promote investment and provide facilities for the undertaking of petrochemical projects.

Besides, the government has also established Plastic Parks to stimulate local plastic production and discourage its importation. These parks aim to offer modern buildings, advanced technology, and machines to small-scale and medium-sized firms, enabling them to expand their business activities and improve efficiency.

The government’s drive toward Make in India and Atmanirbhar Bharat (Self-Reliant India) has also provided an impetus for the growth of the chemicals and petrochemicals industry. With policies aimed at liberalizing business, cutting regulatory hindrances, and improving export competitiveness, the chemicals and petrochemicals sectors in India are likely to turn out to be the best in the world in the years to come.

Industry Challenges

Not with standing the favorable growth trajectories, the industry does face numerous factors that pose as threats to the growth of the same. The issue of feedstock availability poses a major challenge, since the industry relies heavily on imported crude oil and natural gas to manufacture petrochemicals. As a result, the sector is also subject to external of global oil market price mood outlook and any actions that may hinder the supply chain of the given sector.

Alongside this, environmental sustainability poses challenges, particularly in the chemicals and petrochemicals sector, which is energy-intensive and pollutive. To counter such trends, businesses are resorting more and more to green chemistry approaches and cleaner technologies as well as circular economy principles. It is clear to transition towards means of production that are sustainable will not be less costly, especially by putting into consideration the research and development (R&D) aspects, but state policies will be vital to encourage the green practices.

Future Outlook

The chemicals and petrochemicals sector of India has experienced transformative growth from 2017 to 2023 thus in high regard due to its industrial and economic significance in the country. The industry grew at a strong pace driven primarily by growth in regional demand, outward government’s exports and towards the sector. Initiatives such as PCPIRs and plastic parks indicate that the industry will attract more investments and achieve higher levels of production in the future.

In the foreseeable future, the demand shall remain on the increase amongst other driving factors the continued expansion of sri lanka’s economy, specifically the pharmaceutical, agriculture, automotive and the packaging industries. Nevertheless, addressing the challenges of feedstock, environmental sustainability, and supply chain risk factors will be equally important to achieve the forecasted growth.

Conclusion

Overall, the chemicals and petrochemicals sector will increasingly be important in the realization of India’s dream of being a great manufacturing nation. In spite of the recent volatility and fluctuations in the growth rates of various sectors, the industry’s structural strengths will accelerate India’s economic growth, create jobs, and enhance the country’s export competitiveness over the next ten years. As the sector embraces innovation and sustainability, it will further solidify its role as a key pillar of the Indian economy.

Note: If you have any questions related to opening any manufacturing business , contact us Niir.org

Read related blogs: Npcs blog