A recent industrial profile reveals that India ranks sixth among the leading global suppliers in the Indian Speciality Chemical Industry, holding a 7% share of 2022 sales volumes and an annual growth rate of 4%. The Indian Speciality Chemical Industry plays a crucial role in the global market, providing vital chemical products that serve a wide range of industries. Despite its growing importance, India’s role as a key provider of specialty chemicals remains underrecognized.

India’s Historical Role in the Indian Specialty Chemical Industry

India has been a leading producer of spices, textiles, and other specialty chemical products for centuries. Today, many of these product lines are exported worldwide, marking India’s significant presence in the global market. However, India’s domestic market is not large enough to support full specialization in these areas, leading companies to transform into global suppliers.

Challenges in the Indian Specialty Chemical Industry

Despite its long history, India lacks a major manufacturing base for specialty chemicals. The industry’s reliance on imported raw materials has been an ongoing issue since India’s independence. This dependence makes the chemical industry a secondary industry rather than a primary driver of economic growth.

Role of Government in Chemical Industry Sustainability

While the national government plays a role, it is primarily the responsibility of the state governments to ensure the sustainability of the Indian Speciality Chemical Industry. This decentralized approach presents challenges in terms of uniform policy enforcement and support across the country.

Visit this Page for More Information: Start a Business in Spthe ecialty Chemicals Manufacturing Industry

Challenges in the Indian Chemical Industry

Limited Competition and High Prices

Foreign partners strategically tie the Indian Chemical Industry to financing, technology transfer, and R&D. This relationship includes both backward linkages with suppliers and forward linkages to customers.

However, this strategy limits competition, which often leads to higher prices. Additionally, it restricts the entry of new players into the market, reducing overall market dynamism.

Standardizing Quality Products

One of the major challenges in the Indian Chemical Industry is standardizing quality products, particularly for chemicals imported into India. This remains a significant hurdle as inconsistent product quality can affect both domestic production and international trade.

Insufficient Government Support

Indian manufacturers also face the challenge of insufficient government support for indigenous specialty chemical industries. Without adequate backing, these industries struggle to compete globally and expand their market share.

Standardizing quality products poses one of the major challenges for chemicals imported into India. Indian manufacturers also face the challenge of insufficient government support for indigenous specialty chemical industries.

Watch videos here: click here

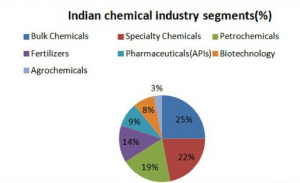

Segments of the Chemical Industry in India:

The chemical industry breaks down into five main categories:

-

Bulk Chemicals: These are large-scale chemical productions, further divided into organic, inorganic, and alkali chemicals.

-

Hydrocarbons: Derived from crude oil or natural gas, hydrocarbons are chemical compounds used to produce petrochemicals and polymers.

Fertilizers: These provide plants with the nutrients they need to grow. We can divide these into natural, synthetic, organic, and inorganic categories. Additionally, we can categorize them generically as phosphate, potassium, and nitrogenous.

Speciality Chemicals: These chemicals are derived from fundamental compounds and are specifically produced for targeted applications.

As a result, they possess high value, involve intensive R&D, and are typically manufactured in low volumes.

Agrochemicals: These substances are used to protect crops from the many types of insects and pests listed above. These include, among others, fungicides, herbicides, and insecticides. In agricultural practices, farmers apply these substances to irrigation water, seeds, soils, and crops.

These compounds stand out due to their high-value, low-volume composition and their focus on specific end-user applications that enhance performance.

These include colorants, water treatment chemicals, construction chemicals, paints and coatings, personal care ingredients, and polymer additives, all of which fall under the Indian speciality chemicals segment.” Chemical Industry.

Find the best-fit speciality chemical business for you using our Startup Selector Tool

Growth of the Indian Speciality Chemical Industry

FICCI’s research shows that speciality chemicals make up 22% of the global chemical sector, valued at US$35.9 billion. From FY19 to FY22, experts anticipate that demand for specialty chemicals will grow at a CAGR of 12% to 14%. Investments in end-user industries like personal care, food and beverage, textiles, and packaging are driving this increased demand.

When compared to basic chemicals, specialty chemicals offer knowledge-based solutions to customer applications, providing higher returns. India’s Indian Speciality Chemical Industry continues to have a competitive advantage in this space.

Read Similar Articles: Chemical Industry

India Benefits from China’s Chemical Sector Growth Is Stalled

Due to China’s tepid economic growth, which continued to be in a growth overhang, the domestic chemical sector is steadily slowing down. According to estimates, China’s GDP will increase by 6- 6.5% in comparison to the 8–10% growth seen between 2009 and 2018–18. The following is a discussion of the main causes of a decline in the chemical sector.

The adverse global environment, including the U.S.-China trade war and slowing global growth, significantly impacts China’s output growth.

Beginning in January 2015, the Chinese government tightened the requirements for environmental preservation.

According to the Crisil study report, around 40% of chemical manufacturing facilities, including those in the Indian Speciality Chemical Industry, experienced temporary closures due to safety inspections in 2017.

In addition, almost 80,000 manufacturing facilities received fines for exceeding emission standards, highlighting the challenges faced by chemical manufacturers globally, including in the Indian Speciality Chemical Industry.

Click here to send your queries/Contact Us

To combat pollution, the Chinese government mandated wastewater treatment facilities and imposed a green tax on the chemicals sector. As a result, the increased capital expenditures and higher compliance costs are expected to reduce profit margins.

Government regulations on emissions force businesses to limit their overall capacity. MC-Chemicals’ assessment shows that emission regulations caused a shortage of Maleic anhydride, limiting capacity utilization to 50–60%.

By the end of 2020, the Chinese government mandated that all small- to medium-sized chemical enterprises move to specialized chemical parks, away from residential areas.. Additionally, by 2025, all of the biggest plants must migrate.

Related Feasibility Study Reports: Pharmaceutical, Drugs, Fine Chemicals, Bulk Drug Intermediates, Pharmaceutical Drugs, Pharma Drug Ingredients Intermediates, Drug Intermediates.

Availability of Skilled Labour at a Reasonable Price

India has a cost-effective advantage over other countries in terms of skilled workforce. As a result, it has relatively cheaper operational costs and other cost components than its international competitors, particularly China.

The cost of labour in China has been steadily on the rise. Between 2005 and 2015, China’s average labour cost increased at a CAGR of about 19–20%, compared to India’s CAGR of 4-5%. Compared to India, this cost has more than doubled over the last five years, making Indian production somewhat more affordable.

Existence of Raw Materials

The organic value chain is supported by businesses like IOC, BPCL, and Reliance, which are top suppliers of fundamental raw materials. Basic inorganic chemicals, such as caustic soda, chlorine, and soda ash, are readily available in large quantities in India. Additionally, India benefits from its proximity to Southeast Asia and the Middle East, allowing it to import petrochemicals at a reasonable price.

Read our Books Here: Chemical Technology (Organic, Inorganic, Industrial), Fine Chemicals

Visit the page Select and Choose the Right Business Startup for You for sorting out the questions arising in your mind before starting any business, and know which start-up you can plan.

We, at NPCS, endeavor to make business selection a simple and convenient step for any entrepreneur/startup. Our expert team, by capitalizing on its dexterity and decade’decades-longng experience in the field, has created a list of profitable ventures for entrepreneurs who wish to diversify or venture. We regularly update the list to provide you with a steady stream of new emerging opportunities.

Read our books here

Push for Government Policies

To limit the import of cheap, subpar chemicals, the government has mandated BIS-type certification for imported chemicals.

The government has approved 100% FDI in the chemicals sector—excluding certain hazardous chemicals—through the automatic route. Additionally, to further support the sector’s growth, it introduced a draft National Chemical Policy. This policy aims to increase the sector’s GDP contribution to 6% within ten years. It also suggests combining the MSIHC Rules with the Chemical Accidents (Emergency Planning, Preparedness, and Response) Rules to simplify legislation.

NPCS Project Reports for Entrepreneurs

Niir Project Consultancy Services (NPCS) can provide project reports. The report covers – Manufacturing Plant, Detailed Project Report, Profile, Business Plan, Industry Trends, Market Research, Survey, Manufacturing Process, Machinery, Raw Materials, Feasibility Study, Investment Opportunities, Cost and Revenue, Plant Economics. The project report provided by NPCS gives a detailed market review.

The report analyses the market and confirms the availability of various necessities such as plant & machinery, raw materials, and provides information on the financial requirements. A lot of professionals have benefited from the project reports.

If you are interested in the manufacturing business, get in contact with us from the official website of NPCS.

Click here to send your queries/Contact Us

Reasons for Buying the NIIR Report:

- Our research report provides a detailed overview of the industry. It includes market structure and classification. The report also analyzes major growth drivers, current market trends, and the industry’s regulatory framework.

- Our Report provides an analysis and in-depth financial comparison of major Players / Competitors.

- Our report provides essential buyer data, including company financials and contact details. This information is a valuable tool for identifying target customers.

- Our report provides forecasts of key parameters that help to anticipate the industry performance.

- We use reliable sources of information and databases. And information from such sources is processed by us and included in the report.

Frequently Asked Questions (FAQ)

Q1. What are specialty chemicals?

A: Specialty chemicals are high-value, low-volume chemicals manufactured for specific end-use applications. They include additives, adhesives, agrochemicals, cleaning materials, construction chemicals, and more.

Q2. Why is the Indian specialty chemical industry important?

A: India is one of the top six global suppliers, contributing 7% of global sales volume in 2022. The sector supports industries like agriculture, pharmaceuticals, construction, and personal care.

Q3. What are the challenges faced by the Indian specialty chemical sector?

A: Key challenges include dependence on imported raw materials, inconsistent product quality standards, limited government support, and low R&D investment.

Q4. How is the Indian government supporting the chemical industry?

A: The government has approved 100% FDI (excluding hazardous chemicals), implemented BIS certification for imports, and introduced a draft National Chemical Policy to boost sectoral GDP contribution.