At the intersection of manufacturing and sustainability, a new chance for smart founders is taking shape: pivoting systems of waste into dollars. Historically, excess sludge, fly ash, and other refinery scraps have been accepted as budget-draining chores. Now, market forces and an accelerating shift toward circular economies are changing that story. Vanadium Extraction recovery from these waste streams is the showcase example proving that the next gold mine might already be parked behind the smokestacks and cooling towers of your region’s oldest plant.

Furthermore, net positive environmental impacts are quickly joining profit as a shareholder pledge. For seed-stage firms eager for rapid scale and measurable impact, the vanadium extraction ecosystem marries technical viability and compelling return profiles. Instead of penetrating new geological frontiers which demand high geological, capital, and regulatory risks, a new venture routes off-geometry waste already handled, analyzed, and partially stored by the same refinery that generated it. The asphalt pool is already classified, the extraction line is half planned in the excuse report, and the permitting concurrency is half solved by previous projects.

Our next section will outline mineral markets and effective process pathways, and in the third for the other quadrant of the slide-in canvas, provide options for leveraging these data-driven advantages into a decisive, enduring value proposition for investors and the region’s net surcharges.

Related: From Waste to Watts: Your Complete Guide to Building a Biogas Plant Project

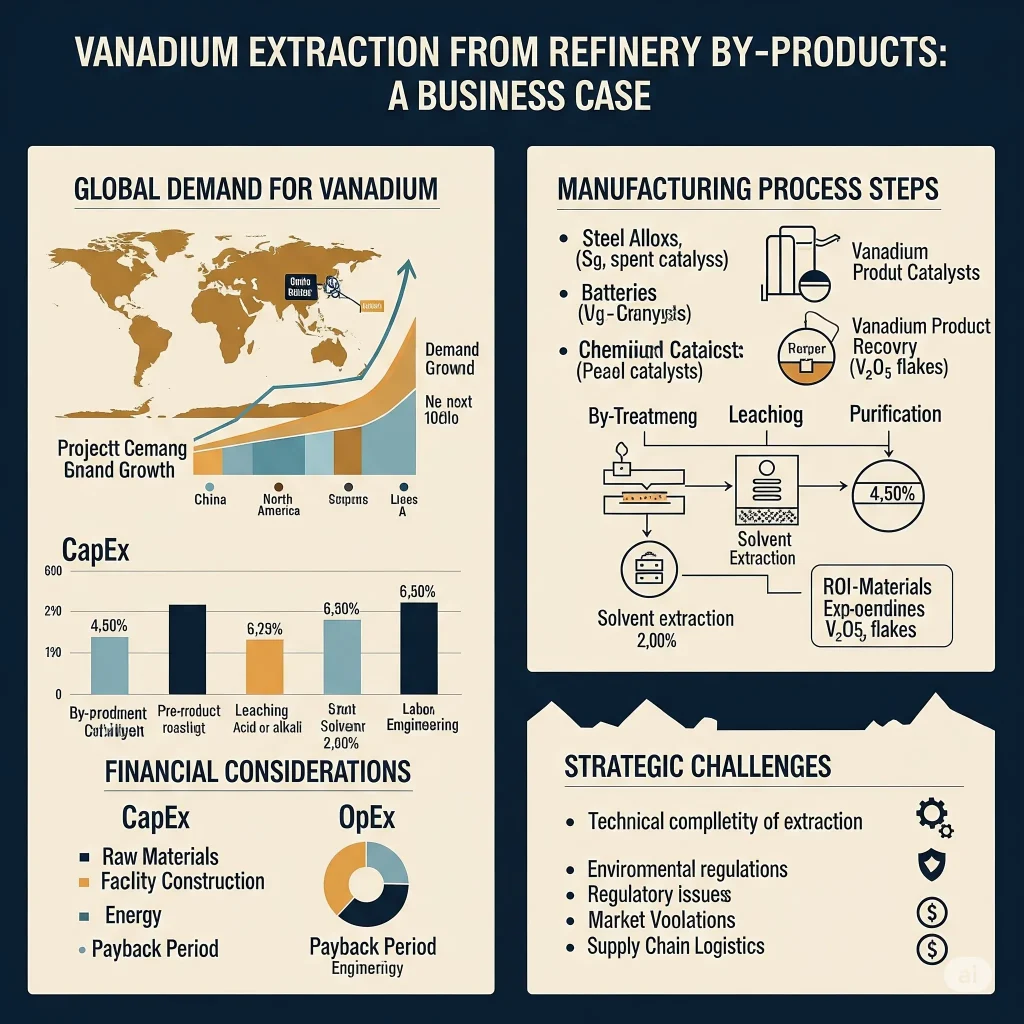

The Global Demand for a Strategic Mineral

Vanadium may not pop up in everyday conversation, yet it plays an unsung role in today’s technology. The bulk of vanadium goes toward HSLA steel, where just a droplet boosts tensile strength, toughness, and wear resistance. In other words, a tiny tweak makes giant, vital stuff stronger. Whether it’s a turbocharger, an oil-gas line, a high-rise girder, or a tank turret, voiceless vanadium makes them tick.

The mineral’s most exhilarating and fastest-growing stage is in power and grid stabilization. Compared to standard lithium-ion devices, vanadium flow batteries take the crown. These grid-scale giants run longer, can balloon to the size of a warehouse while keeping mineral energy safe, and aren’t redefined by a fire. As solar and wind leap from the lab to the mainstream, VRFBs provide the stability that weather-dependent renewables need to sit in the grid without patch-on pauses or overloads. Vanadium is, in effect, the beating mineral of the energy shift.

Market Forecast: A Snapshot of the Opportunity

The global vanadium sector looks like it’s gearing up for steady expansion, thanks mainly to the growing appetite for vanadium redox flow batteries (VRFBs) and high-strength low-alloy (HSLA) steel. Right now, production still comes mainly from China, Russia, and South Africa, but a circular economy mindset in other regions is changing the game.

Experts predict that VRFB demand will leap, with a compound annual growth rate (CAGR) exceeding 10% over the next ten years. That growth creates a ripe chance for a start-up to position itself as the go-to supplier of vanadium electrolyte.

From Industrial Waste to Valuable Resource: The Source

Now, a faster and greener route is turning industrial waste into what engineers like to call a “feedstock.” Vanadium is a tiny trace element that’s naturally present in crude oil.

Think of it this way: what used to be trash is now treasure. It checks every box in the circular-economy playbook. Recent pilot plants in North America and Asia have achieved proof-of-concept, transforming crude residues into clean, marketable vanadium oxide. Far more than a distant dream, the circular vanadium ecosystem is becoming a near-term business reality.

Related: How to Start a Plastic Waste Recycling Business: A Comprehensive Guide

The Manufacturing Process: A High-Level Overview

Anyone eyeing a vanadium venture needs to wrap their head around the rinse-and-repeat basics. Next, a hot acid leach dissolves the desired metal, sending the rest of the sludge packing. The resulting pregnant solution is purified and crystallized into vanadium oxide, followed by market-grade conversion. Each stage is modular enough to be sized to the refinery’s throughput, making a project easier to retrofit and fund.

1. Feedstock Preparation

The first step is gathering leftover materials from the refinery. Usually, this means using petcoke or sludge. Before anything else, labs check the vanadium level in the sample.

2. Roasting and Leaching

Next, the crushed material is heated in a special furnace. Researchers usually add a small chemical booster to make vanadium turn into a form that can dissolve in water. After heating, the material is mixed with a mild acid or a base. This step, called leaching, pulls the vanadium and leaves behind the bulk of the non-valuable rock.

3. Purification and Precipitation

The leaching step gives us a liquid that contains vanadium, but also other bits of metal and impurities. To clean this liquid, the team uses methods like solvent extraction or ion exchange, which eliminate almost all the junk. The last step cranks out the vanadium in a solid form. In most setups, chemists use ammonium metavanadate (AMV), a bright yellow compound that they can easily dry and store for later use.

4. Final Processing

To finish, the process places the vanadium compound formed in the earlier stages into a calciner and heats it at very high temperatures. This step turns it into pure vanadium pentoxide (V₂O₅), the version of vanadium that most companies use in manufacturing. Once cooled and packaged, the V₂O₅ is ready to ship to makers of steel, specialty alloys, and vanadium-redox flow batteries (VRFBs).

This depends on the material you start with and the exact quality your customers need. Because of the detailed chemistry, high-tech equipment, and the money involved in the whole operation, it’s key to perform a pre-project evaluation in depth. Experienced consultants support companies at this crucial phase.

For more information, check out our Project Reports on Waste Management and Recycling, Industrial Waste Management

Conducting a Feasibility Study: The Blueprint for Success

Launching any large manufacturing operation is a huge step. Entrepreneurs must think through their ideas dozens of times and craft a step-by-step blueprint that can measure the project’s chances of success. This blueprint is the Market Survey with a Detailed Techno-Economic Feasibility Report. The entrepreneur gets a thorough, data-backed guide in balancing risks against potential rewards and making informed choices before investing serious money and resources.

NPCS, or NIIR Project Consultancy Services, is a leading source when you need in-depth project reports. Their documents cover every angle, featuring a step-by-step guide of the manufacturing process, market and demand research, process flow diagrams, and a complete financial analysis to judge whether the venture is feasible. By drilling down into machinery specs, raw material requirements, and profit forecasting, NPCS gives entrepreneurs the data they need to confirm the viability and growth potential of their plans. Their expertise turns a good idea into a fully functioning, revenue-generating business.

The Financial Picture: Capital and Operational Costs

Understanding the financial landscape of a vanadium extraction plant is mandatory for any startup. The project divides the overall cost into two key categories: Capital Expenditure (CapEx) and Operational Expenditure (OpEx).

Capital Expenditure (CapEx)

CapEx reflects the up-front, one-time costs of establishing the plant. The key line items include:

- Land and Building: This covers the cost to buy the land and erect the required manufacturing facilities.

- Plant and Machinery: A significant share of the budget is dedicated here, covering equipment for roasting, leaching, purification, and end-stage processing.

- Utilities and Infrastructure: Expenditures required to set up electricity, water, and waste treatment systems fall into this category.

View our books on Products From Waste, Automobile, Leisure, Entertainment, Ware Housing & Real Estate Projects, Greases, Hospitality, Medical, Infrastructure, Lubricants, Petro Chemicals, Petroleum, Waste Management, Recycling

Contingency

Set aside a portion of the budget as a safety net for unexpected costs that may arise once the project is underway.

Operational Expenditure (OpEx)

OpEx covers the day-to-day expenses required to keep the business running. Here’s a closer look:

- Raw Materials: This includes the costs of the refinery by-products that serve as feedstock and the chemical reagents necessary for extraction.

- Power and Fuel: Energy charges for heating, operating machinery, and lighting the facility.

- Manpower: This line accounts for the salaries and wages of both the technical staff and the supporting labor force.

- Maintenance: Regular inspections, routine upkeep, and necessary repairs of the plant and its machinery.

- Marketing and Sales: Expenses related to promoting, distributing, and selling the finished product.

The profitability of the project is a function of the efficiency of the extraction process, the price of the final product, and the ability to minimize operational costs. A detailed feasibility report will provide a clear financial projection, including a break-even analysis and return on investment (ROI) calculations, giving the entrepreneur a clear picture of the project’s financial viability.

For more information, check out our related video

Strategic Considerations and Challenges

While the business case for vanadium extraction from refinery by-products is compelling, it is not without its challenges. Entrepreneurs must be prepared to address these strategically to ensure long-term success.

1. Technology and R&D: The extraction process is chemically complex. A startup must either develop its proprietary technology or partner with a technology provider to ensure high yield and product purity. Continuous investment in research and development is key to staying competitive and improving efficiency.

2. Regulatory Compliance: The handling of industrial by-products and chemical reagents requires strict adherence to environmental regulations and safety standards. Securing the necessary permits and licenses is a non-negotiable step in the process.

3. Supply Chain Management: A consistent supply of the right feedstock is critical. Establishing strong, long-term relationships with refineries is essential. A startup should also consider diversifying its feedstock sources to mitigate supply chain risks.

4. Market Volatility: The price of vanadium, like any commodity, can be subject to market fluctuations. A startup should have a robust sales strategy, including long-term contracts with buyers, to hedge against price volatility.

Find Best Idea for Yourself With our Startup Selector Tool

Conclusion: A New Era of Industrial Opportunity

The extraction of vanadium from refinery by-products is a clear example of how industrial challenges can be transformed into profitable business opportunities. For entrepreneurs and startups, this is more than just a business venture; it’s an opportunity to build a sustainable, impactful enterprise at the intersection of manufacturing, energy, and the circular economy.

By carefully assessing market demand, meticulously planning the manufacturing process, and seeking professional guidance through a detailed feasibility report, a new business can successfully navigate the complexities of this sector. The journey from waste to wealth is not just about making a profit; it’s about building a future where our industrial processes are smarter, more efficient, and inherently more sustainable. The time to act on this opportunity is now.