Steel has been an important part of industrial and economic growth. Steel is still one of the most important materials in our society, from automobiles and infrastructure to renewable energy and machinery. The Steel Industry is going through a transformation as global economies change and concerns about sustainability reshape the manufacturing priorities.

This presents both challenges and opportunities for entrepreneurs and startups. In the next decade, a combination of technological innovation and policy-driven change, along with rising demand, is expected to redefine steel businesses worldwide.

Global Steel Industry Outlook

In 2024, the global steel production will reach nearly 1.9 billion tons. Asia is expected to contribute more than 70%. China is still the world’s largest producer, with over 50% of crude steel. India, Japan, the United States and Russia are also major producers. Chemical Weekly (Vol. While the chemical industry is concerned about overcapacity, carbon emissions and other issues, demand for its products continues to grow in areas such as construction, automotive and renewable energy.

India has become a steel superpower, with a production of over 145 million metric tons by 2024. This will make it the world’s second-largest producer, after China. The government’s infrastructure projects, the rise in urbanization and the “Make in India initiative are all expected to drive domestic steel consumption up by 7-8% per year in the next five.

Related: From Steel Container to Smart Asset: The Future of Cargo Containers in Global Logistics

Forecasting Market Demand and Growth

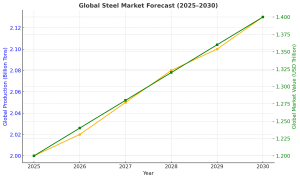

Global steel production is projected to grow by a CAGR of 3-4% from 2025 to 2030. This growth will be driven primarily by the demand for infrastructure, housing and automotive as well as renewable energy. The developed markets are expected to grow moderately, but the emerging economies of Asia and Africa, due to industrialization and urbanization, will expand rapidly.

The Indian steel market is especially promising. There is room for significant growth with an estimated per capita steel consumption of 86kg in 2024, compared to a global average of about 230kg. The government wants to boost per capita consumption of steel to 160 kilograms by 2030. This will be backed up by housing schemes and smart city projects.

Global Steel Industry Forecast

| Year | Global Production (Million tons) | Global Market Size in USD Billion | CAGR % |

|---|---|---|---|

| 2024 | 1,900 | 870 | 3.2% |

| 2025 | 1,940 | 900 | 3.3% |

| 2026 | 1,975 | 940 | 3.4% |

| 2027 | 2,010 | 980 | 3.5% |

| 2030 | 2,120 | 1,120 | 3.6% |

This forecast highlights the steadiness of the steel sector and the opportunities to expand capacity and increase value-added production in emerging markets such as India.

The Future of Industry: Key Trends

The industry’s shift to low-carbon steelmaking is one of the biggest trends. Steel is responsible for a staggering 7-8% global carbon emissions. As a result, pressure is increasing to adopt more environmentally friendly technologies like hydrogen-based direct reduction iron (HDRI), electric-arc furnaces (EAFs), and carbon-capture systems. This change will create new opportunities for startups to explore clean technology integration and waste heat recovery.

It is also important to note the diversification of applications for steel. Electric vehicles (EVs), solar and wind projects, as well as wind turbines, have increased demand for advanced steel grades, such as high-strength, low-alloy steel (HSLA). Specializing in high-demand niche grades can be lucrative for new entrants.

Related: 7 High-Growth Steel Business ideas for Entrepreneurs and Startups

Steel Manufacturing Process Overview

The two main methods of steel manufacturing are Basic Oxygen Furnace-Blast Furnace and Electric Arc Furnace.

The BF-BOF method involves melting iron ore in a blast oven using coke, producing hot metal that is refined in a basic oxide furnace to make crude steel. It is an energy-intensive method, but it remains the dominant one in China and other major producers.

Electric arc melting (EAF) is a process that uses recycled scrap steel and direct reduced iron as inputs. The EAF process, which emits significantly less carbon, is more environmentally friendly and increasingly popular in regions and economies that are focused on green steel.

Following primary steelmaking, processes like secondary refining and continuous casting are used to create flat and long products for various industries. Understanding these production stages is important for entrepreneurs as each stage provides opportunities for specialized industries ranging from refractories, ferroalloys, and rolling mill technology.

Global Leaders of the Steel Industry

The steel industry is characterized by both strong regional players and large multinational corporations.

| Name of the Company | Country of Origin | Production Capacity in Million Tonnes | Priority Areas |

|---|---|---|---|

| China Baowu Steel | China | 132 | Flat steel, green steel initiatives |

| ArcelorMittal | Luxembourg | 69 | Specialty steels for automotive applications |

| Nippon Steel | Japan | 44 | High-grade steel, R&D innovation |

| POSCO | South Korea | 42 | Green steel, automotive, shipbuilding |

| HBIS Group | China | 41 | Construction, energy and infrastructure |

| Tata Steel | India | 35 | Steel with added value and sustainability as a focus |

| JSW Steel | India | 29 | Flat steel, infrastructure projects |

| U.S. Steel | United States | 23 | EAF Automotive expansion |

| Severstal | Russia | 17 | Long-lasting products for energy applications |

| Thyssenkrupp | Germany | 16 | Special grades of automotive steel |

India’s future potential as a steel hub is highlighted by the presence of Indian giants such as Tata Steel and JSW Steel. Startups will benefit from ecosystems created by these companies, especially in the ancillary industry, logistics, and services.

View our Books on Steel, Iron, Ferrous, Non-Ferrous Metals with Casting and Forging, Aluminium, Ferroalloys Technology

Startups and Entrepreneurs have many opportunities.

Entrepreneurs have new opportunities to explore due to the transformation of the steel industry. Specialty steels are in high demand, especially for the automotive, renewable energy, and defense sectors. Green technologies are driving innovation in hydrogen-based systems for steelmaking, carbon capturing, and recycling.

Digital technologies offer startups a variety of opportunities, including AI-driven quality controls, blockchain-based supply chain tracking, and IoT energy management. In India and elsewhere, there are also scalable opportunities for industries such as ferroalloy manufacturing, refractory material production, and steel fabrication.

The business climate is favorable in India, thanks to the strong support of the government, which includes the National Steel Policy 2030, and energy reforms linked to ethanol blends, which encourage the integration of renewable power into steel plants.

NPCS: Helping Entrepreneurs Build Future-Ready Industries

Niir Project Consultancy Services (NPCS) is a trusted name in the field of industrial consultancy, helping entrepreneurs navigate complex manufacturing sectors like steel. NPCS prepares Market Survey cum Detailed Techno Economic Feasibility Reports that guide entrepreneurs through every stage of planning. Their reports include details on manufacturing processes, raw materials, plant layouts, and financials to ensure well-informed decision-making. By combining data-driven insights with practical expertise, NPCS helps entrepreneurs assess the feasibility of setting up new industries and businesses effectively.

For more information, check out this related video

Conclusion

The steel industry is at a crossroads. It must balance the challenges of sustainability and overcapacity with the opportunities presented by digitalization, urbanization and green transition. This sector is a fertile ground for entrepreneurs and startups to innovate and grow.

Chemical Weekly (issue 2025) notes that steel will continue to be a major component of global industrialization, while also evolving into a more intelligent and greener sector. Future business success will be determined by the ability to adapt to such shifts.

Niir Project Consultancy Services prepares market survey cum Detailed Techno-economic Feasibility reports for entrepreneurs. These reports contain information on manufacturing processes, raw materials requirements, plant layouts and financial details. NPCS assists startups and industrialists in assessing the feasibility of new ventures. This helps them make informed decisions and reduces business risks.

Find Your Perfect Business Match Using Our Smart Startup Selector

Frequently Asked Questions (FAQs)

Q1. What is the current global demand for steel, and how is it expected to grow?

The global steel demand is around 2 billion metric tons annually and is projected to grow steadily, reaching 2.13 billion tons by 2030, supported by urbanization, infrastructure growth, and renewable energy projects.

Q2. What are the main challenges faced by the steel industry today?

The biggest challenges include environmental concerns due to high carbon emissions, fluctuating raw material prices, trade restrictions, and the need for massive technological upgrades to remain competitive.

Q3. How is the steel industry moving toward sustainability?

Steelmakers are adopting hydrogen-based DRI, carbon capture technologies, and increased use of electric arc furnaces to reduce emissions. Recycling of scrap steel is also becoming a key contributor to sustainable steel production.

Q4. Which countries are the largest steel producers in the world?

China is the largest producer, followed by India, Japan, the United States, and Russia. European countries like Germany and Italy are also significant players, focusing on high-quality steel production.

Q5. What opportunities exist for startups in the steel industry?

Startups can explore niches such as specialty steel manufacturing, digital industrial solutions for process optimization, recycling technologies, and downstream steel fabrication. They can also collaborate with established producers on sustainability-focused projects.