In India, the Packaged Water Business industry has grown from a luxury for tourists and high-end customers to a necessity for millions. The increasing urbanization, the health-conscious, and the declining trust in municipal water supplies have pushed consumers to purchase bottled water as a safe, portable way to hydrate. This once-occasional purchase is now a regular household expense. It’s one of the fastest-growing FMCG sectors in the country.

Entrepreneurs and startups will find that the sector offers not only an industry with a rapidly growing market, but also a chance to create a brand of trust in a category where quality and safety are key factors for long-term loyalty. This guide offers a comprehensive look at the market potential of this sector, its manufacturing process, regulatory structure, branding strategies, and sustainability concerns.

Understanding the Packaged Drinking Water Industry

Water that has been purified and packaged for human consumption is considered packaged drinking water. Natural mineral water is obtained from springs that are protected and then bottled. Packaged drinking water, however, undergoes extensive purification and filtration to meet the safety standards of the Bureau of Indian Standards.

The industry serves a variety of customers. Bottled water is a common ingredient in urban homes for cooking and drinking. Hoteliers, restaurateurs, and caterers rely heavily on branded water to provide to guests. Airlines, railroads, bus operators, and other travel and transportation companies distribute packaged water for passengers. For their employees and students, corporate offices and educational institutions buy it in bulk – usually in 20-litre jars. Small sachets or pouches are an affordable way to provide safe drinking water at events and festivals in rural areas.

Related: Packaged Drinking Water, Soda Water, and Pet Bottles Business Scope and Growth

Market size, demand, and growth potential

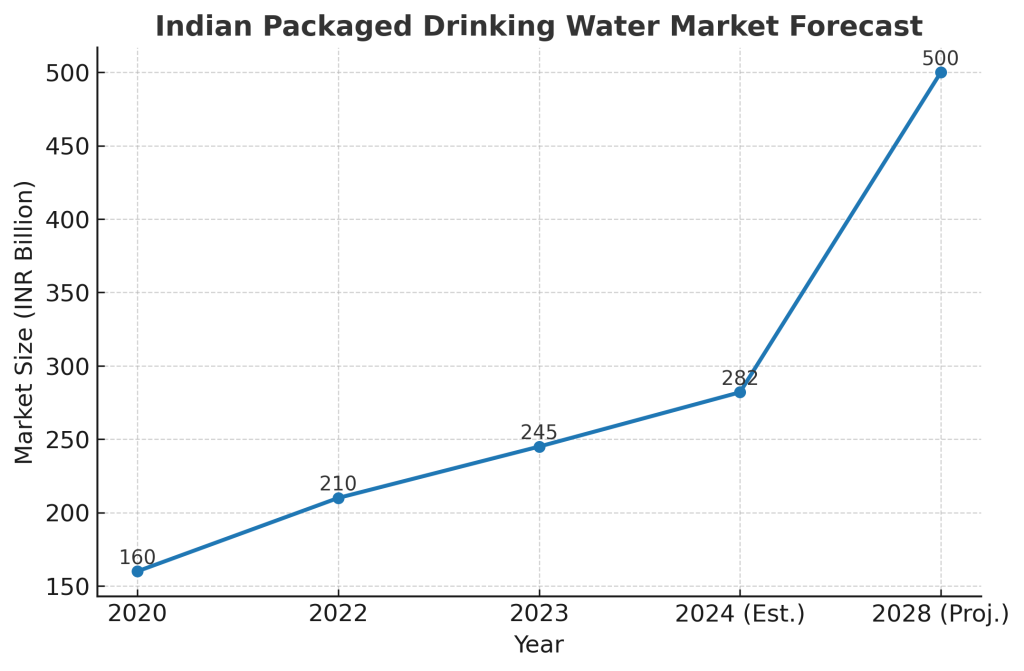

In the last decade, India’s packaged-water sector has grown at double-digit rates, thanks to rising disposable incomes and urban migration. The market was valued at around Rs 160 billion in 2020. By 2023, it will be worth approximately Rs 245 billion. According to industry projections, the market could reach Rs500 billion in 2028 with a CAGR of 14-15%.

Demand is not restricted to metropolises. As distribution networks grow and waterborne disease awareness increases, smaller towns and semi-urban areas are becoming high-potential market segments. Rural demand has also been steadily growing, helped by affordable sachet packages and local distribution hubs.

The shift to premiumization is a key driver for future growth. The consumer is interested in mineral-enriched water, alkaline waters, and flavoured waters. The travel and tourism sector continues to be one of the major demand generators, as tourists, both domestic and foreign, rely heavily on packaged waters for convenience and safety. The category will mature as more regional and multinational brands enter the market.

Standards and Compliance Requirements

In India, the packaged drinking water industry is subject to strict safety and quality regulations. BIS certification is required under IS 14543, which specifies parameters for purity and microbiological safety. Mineral content must also be specified. This certification ensures every batch of bottled water meets the national standards required before it reaches consumers.

Businesses that operate in the food and beverages sector must also obtain an FSSAI licence. To operate water extraction and processing facilities, you will need approval from the State Pollution Control Board. If you are obtaining water from borewells, then clearance may be needed from the local municipal authorities and groundwater boards.

Compliance is not an event; it’s a continuous process. Regular testing, audits, and documentation are necessary to maintain certifications and licenses. Non-compliance may result in penalties, suspensions of operations, or a loss of trust on the market. Quality control is therefore a priority.

View our Handbooks for more information

Product formats and market segmentation

It is important to choose the right product mix in order to capture different market segments. Retail shelves are dominated by standard PET bottles ranging in size from 200ml to 2 liters, which cater to impulse purchases as well as family consumption. Glass bottles are often preferred by fine dining establishments and premium hotels because of their eco-friendly image and aesthetic appeal. Offices, schools, and households use the 20-litre jar for bulk supplies. It offers value for money, while also ensuring repeat purchases.

Low-cost pouches or sachets for rural markets and large gatherings are popular, as they offer affordability to price-sensitive customers. Brands diversify formats to balance premium sales at high margins with high-volume economy sales. This ensures a consistent cash flow throughout the seasons.

Detail of the Manufacturing Process

The process of setting up a packaged water plant is a complex one, involving multiple steps. Each step is designed to ensure that the end product will be pure, safe and taste consistent.

It can also come from natural sources. Pre-treatment is the first step, which involves removing large particles, visible impurities, and suspended solids large particles through sedimentation and sand filtering.

Because RO filtration removes essential minerals from water, manufacturers use a remineralization process to add beneficial elements such as calcium and magnesium. Automated lines then bottle the water, filling it into sterile containers, sealing, and labelling it.

Related: How to Start a Profitable Drinking Water Business

Location and Infrastructure Considerations

Location is a key factor in determining the efficiency of production and managing costs. It should be located near a source of clean, abundant raw water to minimize the cost of water procurement. The proximity to major markets can help minimize transportation costs, which are significant due to the weight of bottled water. For both bulk jars and small retail packs, easy road access is crucial.

For a medium-sized facility, it is necessary to designate areas for water treatment and bottling. The separation of these areas ensures hygienic conditions, a smooth flow of work, and compliance with safety standards. Businesses must maintain adequate warehouse facilities to safely store products before distributing them.

Branding, positioning, and marketing strategies

Differentiation is crucial in a market that has established national brands such as Bisleri and Kinley, as well as a number of regional competitors. Brand communication should include a strong focus on quality assurance, backed up by BIS and FSSAI labels that display certifications. Packaging plays a key role in brand recognition. Clear labelling, attractive bottle shapes, and convenient formats can all influence the consumer’s preference.

This sector often benefits from localised marketing. Build strong relationships with retailers and distributors to secure prime shelf space. Unique value propositions such as eco-friendly bottles, mineral blends of premium quality, or flavoured products can help you carve a niche. Sponsorships of local events, partnerships with hotel chains, and social media campaigns that target specific audiences can help to increase brand awareness.

Distribution and Supply Chain Management

A well-organized supply chain will ensure the timely delivery of goods, particularly during peak seasons such as summer. The majority of manufacturers use a combination of direct distribution for large clients and partnerships through regional distributors to supply smaller retail outlets. Bulk supply agreements with corporations, institutions, and government agencies provide stable revenue streams.

In recent years, the e-commerce platform and apps for delivery have opened up new channels of direct-to-consumer sales. Many bottled-water brands have also integrated last-mile delivery to compete with local providers, especially in the 20-litre segment.

Sustainability and Environmental Responsibility

As environmental awareness grows, more brands are adopting recyclable PET containers, setting up take-back programs for used containers, and exploring biodegradable alternatives.

Water recovery systems reduce waste and increase operational sustainability. Companies that demonstrate their commitment to the environment not only adhere to evolving regulations but also appeal to eco-conscious customers.

For more information, check out this related video

Risk factors and challenges

The business has a lot of growth potential, but it is not without its challenges. Price pressure is often a result of intense competition, especially in the mass market segment. The regulatory compliance requires ongoing testing and certification. Cash flow can be uneven due to seasonal fluctuations, such as summer peaks or monsoon lows. Fuel and transportation costs can make logistics, particularly for bulk formats, expensive.

Entrepreneurs who plan for these challenges and maintain uncompromising standards, as well as diversify their client base, are in a better position to build a resilient company.

Why Choose NIIR Project Consultancy Services?

Expert guidance is essential for those who are entering the packaged water business. NIIR Project Consultancy Services delivers comprehensive market surveys and tailors detailed techno-economic feasibility reports to this sector. These reports include the whole manufacturing process, raw materials required, plant layout, and financial projections. NPCS has decades of experience in assisting entrepreneurs to evaluate the feasibility of setting up new industries or businesses. This ensures that decisions are based upon reliable data and proven strategy.

Find Best Idea for Yourself With our Startup Selector Tool

Conclusion

In India, the packaged drinking water industry is about more than just quenching your thirst. It’s also about trust, safety, and quality. Urban and rural consumers are driving demand, creating opportunities to position products for both mass markets and premium segments.

In this highly competitive market, entrepreneurs who invest in quality control, branding, distribution efficiency, and sustainable practices will be able to build brands that last. Using professional consultancy services, such as those provided by NPCS, can help startups navigate the regulatory, technical, and market complexities in the industry. This will set them up for success over the long term.