Executive Summary

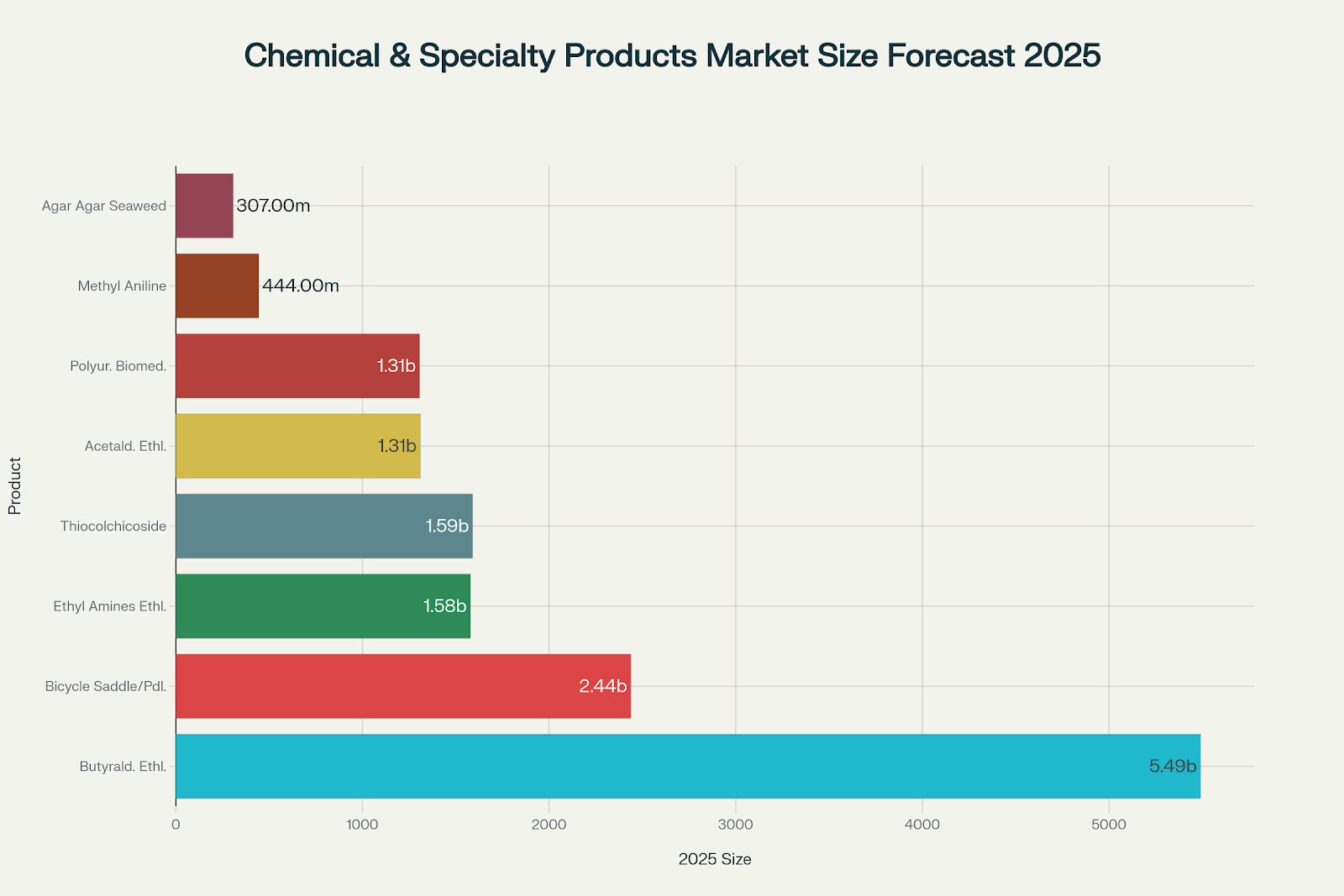

Eight key product segments with strong market fundamentals and impressive growth projections present exceptional opportunities to entrepreneurs in the chemical and specialty Manufacturing Business ideas. The market potential for these segments is $14.46 billion, with CAGRs ranging from 2.9% – 9.2%. The market for butyraldehyde produced using ethanol is $5.49 billion, while the acetaldehyde industry has the highest growth rate at 9.2%. Manufacturing bicycle pedals and saddles is the best entry point for new entrepreneurs. It offers 28% profit margins with relatively low technical complexity.

Eight chemical and specialty products market size forecasts for 2025

Market Landscape and Growth Dynamics

Globally, the chemical industry is transforming towards sustainable production methods using bio-based feedstocks. This creates substantial opportunities for entrepreneurs with a forward-thinking mindset. This transition is most evident in the production of aldehydes, pharmaceutical intermediates and specialty chemicals.

CAGR projections for eight segments of the chemical and specialty manufacturing industry

The growth of 9.2% in acetaldehyde production is a reflection of the growing demand for bio-based intermediates. Meanwhile, the growth rate in bicycle components has increased by 8.0%. This shows the expansion in the recreational and urban mobility market. More traditional segments, such as agar-agar extraction, show a steady growth of 4.52%. This is due to the increasing demand for pharmaceutical excipients and natural food additives.

View our Books for more important and additional information

Market Analysis and Product Details

1. Agar Agar from Red Seaweed Manufacturing

Market fundamentals: the global agar industry is expected to reach $409.9 millions by 2032, growing at a CAGR of 4.52%. This natural polysaccharide is extracted from red seaweed and serves as an important ingredient in multiple industries. Its demand has been growing particularly fast for plant-based foods and pharmaceutical applications.

Primary applications and market segments:

- Food and Beverages: This segment is driven by the growing demand for clean-label ingredients and plant-based foods.

- Pharmaceuticals (25%): Excipients used in capsules and tablets as well as controlled-release formulations

- Microbiology (15%): essential for culture media and diagnostic applications

- Cosmetics (10% Share): Natural thickening agents in personal care products

Production Process: Seaweed harvesting, extraction, purification, and drying processes are all part of the agar manufacturing process. This process requires knowledge of marine biotechnology and standards for food-grade manufacturing. Modern extraction techniques use enzymatic treatment and membrane filtration to increase yield and purity.

Investment Analysis: The initial investment required for a 150-metric-ton annual production facility ranges from $800,000.0-$1,000,000. Profit margins are 22% with a payback of 3.2 years. Securing reliable supply chains of seaweed, maintaining consistency in quality standards, as well as developing relationships with customers from the food and pharmaceutical industries are all success factors.

Market growth drivers: The red seaweed industry is expanding rapidly in Southeast Asia, and the $12.03 billion commercial market for seaweed provides raw materials.

Related: How to Start an Agar-Agar Manufacturing Business?

2. Bicycle Saddle & Pedals Manufacturing

Market Size and Forecasts: The global market for bicycle saddles was valued at 2,27 billion dollars in 2024, and is expected to reach $3.525 billion by 2030. This growth rate of 8.0% CAGR is impressive. The growth of the bicycle saddle market is attributed to an increase in the use of bicycles for recreational, fitness, urban commuting, and environmental sustainability.

Market Segmentation by Application

- Sports and Recreation (40%): High-performance saddles designed for competitive cyclists and cycling enthusiasts

- Comfort-focused designs: Daily transportation for city cycling and urban commuters (30% demand).

- Professional Racing (15%): Lightweight, aerodynamic designs for competitive cyclists

- E-bikes (10% demand): Growing segment requiring specialized comfort features for longer rides

- Other Applications (5% Demand): Includes touring, mountain biking and specialty applications

Manufacturing requirements: Injection molding, foam padding assembly, cover assembly and quality testing are all part of the production process. Materials such as polyurethane, synthetic leather and carbon fiber are key. The manufacturing process requires knowledge of ergonomic design, materials science, and sports goods production standards.

Technical Innovation: The industry focuses on ergonomic design, pressure distribution and lightweight materials. Advanced cushioning systems are also a priority. Recent innovations include 3D-printed designs and 3D-printed carbon fibers, as well as smart saddles that integrate sensors.

Investment Profile: Initial investment of $1.5 million with a capacity for 50,000 units per year. This business model has a 28% profit margin with a payback period of 2.8 years, which makes it very attractive to entrepreneurs. The low technical complexity and the excellent availability of raw materials are additional advantages.

Market drivers: Global push for sustainable transportation, urban cycling development, health and wellness trends, and growing e-bike markets create sustained demand. The global cycling market, worth $2.1 billion, offers significant growth potential.

3. Methyl Aniline Manufacturing

Market Overview: The methylaniline market is projected to reach $648.48 million by 2033, with a CAGR of 4.3%. This aromatic amine is a key intermediate in many chemical manufacturing processes.

End-Use Applications:

- Dyes and Pigments (35%): essential intermediate for azo dyes and textile colorants.

- Agrochemicals (25%): used in pesticide, herbicide and fungicide production

- Pharmaceuticals (20% of consumption): Intermediates used in the synthesis of APIs and drug manufacture

- Rubber Chemicals (15% consumption): Antioxidants, processing aids and rubber products

- Other Applications (5% Consumption): Includes specialty chemicals and Research Applications

Production Technology: Manufacturing uses catalytic methylation, distillation, purification and quality control systems. This process requires knowledge of organic chemistry, hazardous materials, and catalytic processes. Modern plants include continuous processing, automation control systems, environmental protection measures, and other features.

Regulatory Environment: Compliance with regulations on chemical manufacturing, environmental permits and safety protocols is required for production.

Investment Requirements: Facility setup requires a $2 million investment, with a production capacity of 800 tons per year. Profit margins of 18% are available with a payback period of 3.5 years. The high level of technical complexity and the regulatory requirements require specialized knowledge and experienced management.

Market Outlook: The growth is primarily driven by the expanding chemical industry, especially in developing economies that have growing textile, agriculture, and pharmaceutical industries. The global ethylene-amines market, worth $4.4 billion, offers related opportunities and synergies in the supply chain.

4. Ethanol production of Ethyl Amines

Market Dynamics: The market for ethylamine is expected to grow at a CAGR of 5.2%, from $1.5 billion in 2020 to $2.3 billion in 2033. This growth is due to the increasing demand for chemical intermediates that are derived from renewable feedstocks such as ethanol, rather than petroleum.

Primary Applications

- Agrochemicals (40%): essential for herbicide production, including atrazine and simazine.

- Pharmaceuticals (25%): Used for API synthesis and intermediate production

- Water Treatment Chemicals (Ion Exchange Resins) and Water Treatment Chemicals (15% demand).

- Personal Care (12%): Emulsifiers and cosmetic ingredients

- Other Applications (8%): This includes rubber chemicals, textile additives, and specialty applications

Bio-based Production: Ethanol production of ethylamine offers advantages in terms of environmental protection, cost and regulatory compliance over petroleum-based processes. This shift is in line with government policies and global sustainability initiatives that promote bio-based chemicals.

Production Process: The production involves ethanol catalytic separation, distillation, and a purification system. This process requires knowledge of catalytic chemistry and process engineering as well as product separation technologies. Modern facilities use continuous processing, energy-recovery systems, and automated control of quality.

Investment Analysis: A manufacturing facility with a capacity of 1,200 tons per year requires an initial investment of $1.8 million. The business model offers 20% profit margins and a payback period of 3.0 years. The high level of technical complexity demands specialized chemical engineering knowledge and an experienced operations manager.

Related: Setting Up an Ethanol Manufacturing Plant

5. Manufacturing of Ginger Oleoresin & Curcumin & Coleus Extract

Market Size: The thiocolchicoside market is expected to grow at a 2.9% CAGR from $1.5 billion in 2013 to $2.1 billion by the year 2033. The herbal extracts market, which includes ginger oleoresin (CAGR 10.7%) and curcumin-oleoresin (4.7% CAGR), is growing faster due to the demand for natural health products.

Product Portfolio Applications:

- Pharmaceuticals (50%): Thiocolchicoside, for muscle relaxation; herbal extracts as APIs and nutraceuticals

- Nutraceuticals (25%): Functional foods, health products, and dietary supplements

- Cosmetics (15%): anti-aging, natural, anti-inflammatory and cosmetic ingredients

- Food Additives (8 % demand): Natural flavorings, colors, and preservatives

- Other Applications (2%): Includes veterinary and research applications

Manufacturing complexity: This industry requires a high level of technical expertise, especially in the areas of phytochemistry, extraction technology, and pharmaceutical manufacture. The processes include preparation of plant material, solvent extractions, chromatographic purifications, standardization and quality control.

Production of Thiocolchicoside: Derived by Colchicum autumnale. To ensure pharmaceutical-grade purity, manufacturing requires advanced extraction equipment and specialized botanical expertise.

Herbal extract processing: Ginger oleoresin (curcumin), ethanol extraction and standardization techniques are required for the extraction of curcumin and coleus. Modern facilities use green extraction methods and bioavailability enhancement.

Investment Profile: A comprehensive facility with a combined 500-metric-ton annual capacity requires an initial investment of $3 million. Profit margins are attractive at 25%, but the business requires a 4.2-year payback due to complex approval processes. The high level of technical complexity and regulatory requirements restrict market entry.

Market drivers: Growing consumer demand for herbal medicines, growing nutraceutical markets and regulatory approval of herbal drugs are driving growth. There are significant opportunities in the $131 million market for turmeric oleoresin alone.

6. Butyraldehyde Using Ethanol Production

Butyraldehyde is the market leader, with a projected $5.49 billion market in 2025 and a projected $6.96 billion market by 2030 (CAGR of 4.8%).

Core Applications

- Plasticizers (45%): Production of 2-ethylhexanol for PVC plasticizers, flexible plastic applications and other plasticizers

- Coatings and resins (30% consumption). Solvents and intermediates for synthetic resins and protective coatings.

- Solvents (15%): Industrial solvents used in paints, adhesives and chemical processing

- Agrochemicals (7%): Pesticides and agricultural intermediates.

- Other Applications (3%): This includes pharmaceuticals, flavorings agents, and specialty chemical applications

Bio-based production route: Ethanol-based butyraldehyde offers greater sustainability than traditional propylene-based processes. This route uses renewable feedstocks, reduces the carbon footprint and is aligned with environmental regulations that promote green chemistry.

Manufacturing Technology: The production uses ethanol dehydrogenation and aldol condensation processes. Modern facilities integrate continuous processing, heat integration and advanced catalytic systems to maximize efficiency and product quality. This process requires expertise in organic chemical engineering, catalyst management, and process engineering.

Investment Requirements: A large-scale plant requires an initial investment of $2.5 million to support 1,000 metric tonnes of production capacity per year. Profit margins of 19% are achieved with a payback period of 3.8 years.

Market outlook: The growth is primarily driven by the expansion of construction activities, demand from automotive industries, packaging applications and the shift to bio-based chemicals production.

7. Acetaldehyde produced from ethanol

Acetaldehyde is the fastest-growing segment, with a 9.2% CAGR. The bio-based segment was valued at $1.2 Billion in 2024 but will reach $2.5 Billion by 2033. This growth is a result of the industry’s transition to sustainable production methods, and its expansion into new application areas.

Key Applications

- Acetic Acid Production (40%): Primary feedstock used for downstream derivatives and acetic acid manufacturing.

- Natural flavoring compounds are required by the food and beverage industry for applications that require a minimum of 25% consumption.

- Perfumes & Fragrances (15%): Intermediate for fragrance industry aldehyde-based scents

- Pharmaceuticals (12%): Intermediates for APIs and pharmaceutical chemical syntheses

- Other Applications (8%): Includes plastics, resins and specialty chemicals applications

Bio-based Production: Ethanol-based acetaldehyde produced by fermentation of ethanol provides significant environmental advantages compared to the ethylene-oxidation process. This route is environmentally friendly, utilizing renewable feedstocks and reducing carbon emissions.

Process of production: The process uses ethanol dehydrogenation and distillation purification systems, as well as quality control systems. The process uses selective catalysts and temperature control technologies. Modern plants have continuous processing, integrated energy, and automated controls.

Investment Analysis: $2.2 million investment is required to build a production facility with 900 tons of annual capacity. The business model provides excellent profit margins of 24% with a payback period of 3.3 years. The high level of technical complexity calls for specialized knowledge in aldehyde and catalytic processes.

Growth drivers: The bio-based chemicals industry will generate $97.2 billion in revenue by 2027, creating substantial opportunities.

8. Polyurethanes in Biomedical Applications

Specialized Market: Medical polyurethane is expected to reach $1.81 billion in 2031, at a 5.6% CAGR. This high-value segment is used in critical medical devices and pharmaceutical applications that require biocompatibility.

Medical Applications

- Medical Devices (40%): catheters, tubing, surgical tools, and diagnostic equipment

- Implants (25%): orthopedic implants and cardiovascular devices.

- Wound Care (15% demand): Advanced wound dressings and bandages

- Drug Delivery (12%): controlled-release systems (transdermal patches), pharmaceutical formulations, and transdermal patchs

- Other Applications (8%): Dental materials, surgical instruments, and specialty medical devices.

Technical Requirements Medical polyurethane production requires a high level of technical expertise, including polymer chemistry and biocompatibility testing.

Biocompatibility is one of the most important properties. Other key characteristics include mechanical strength, flexibility and chemical resistance. Clean room facilities, an advanced mixing system, and comprehensive test protocols are used in the manufacturing process.

Regulatory Environment: Medical devices require extensive regulatory compliance. This includes FDA 510(k), ISO standards compliance and biocompatibility tests. Regulatory pathways for new medical applications typically last between 2-5 years.

Investment Profile: A specialized facility with a 300-metric-ton annual production capacity requires an initial investment of $4 million. This business has a premium profit margin of 26% but requires a 4.5 year payback due to the regulatory development timelines. The high level of technical complexity and the regulatory requirements present significant barriers to entry.

Market Growth: A growing global population, medical advances, rising healthcare costs, and the expansion of medical device markets are all driving factors for growth. The market for medical polyurethane is expected to reach $20.5 billion by 2031.

Investment Analysis and Comparison

Eight chemical and specialty manufacturing companies: Investment requirements versus margins

The investment analysis shows distinct strategic positioning for each of the eight manufacturing options. The manufacturing of bicycle saddles and pedals offers the best combination of low investment ($1.5M), high margins (28%), manageable complexity and low initial cost. This is ideal for new entrepreneurs. The lowest barrier to entry is agar agar production, which requires an investment of $800,000. It offers dependable returns of 22%.

Entrepreneurs with higher capital capacities can benefit from polyurethanes used in biomedical applications and the production of thiocolchicoside. These products offer high margins (26 and 25%) but also require considerable technical expertise and regulatory knowledge. While butyraldehyde requires $2.5M in investment, it offers the biggest market with steady returns.

Market Share Distribution and Competitor Landscape

Distribution of market share across eight categories of specialty and chemical products in 2025

Butyraldehyde commands 38% of the total market addressable, a reflection of its importance as a chemical intermediate. While smaller, the remaining segments offer opportunities for specialized products with high margins and potential growth.

This distribution suggests an “elbow” strategy, where entrepreneurs have the option of choosing between high-volume, low-margin markets (butyraldehyde and ethylamines), or niche, high-margin markets (biomedical urethanes and herbal extracts).

Local Manufacturing and Regional Advantages

Asia Pacific is the global leader in chemical manufacturing, with its established supply chains and growing markets. India offers low labor costs, PLI incentives, abundant access to raw materials, and growing domestic demand.

The following are the key manufacturing states in India:

- Gujarat: Clusters of chemical industry, infrastructure, and port access

- Maharashtra: a pharmaceutical hub with a skilled workforce and close proximity to the market

- Tamil Nadu: Infrastructure, connectivity and government support

- Karnataka’s biotechnology, research institutions and startup ecosystem

The proximity of ethanol production plants, chemical industrial parks and transportation networks as well as a skilled technical workforce are all critical success factors. Prioritize locations that offer integrated chemical complexes and utility infrastructure.

Trends in Technology and Innovation Opportunities

Green Chemistry and Sustainability

New entrants gain a competitive advantage from the chemical industry’s transformation towards bio-based feedstocks and renewable energy integration. Ethanol production routes are aligned with sustainability mandates, and they offer cost advantages compared to traditional petrochemical methods.

Intensification of the Process

Integrated processing systems, continuous manufacturing, and microreactor technologies enable smaller, more efficient production. These technologies are especially beneficial to specialty chemical manufacturers who have lower volume requirements.

Digital Manufacturing

IoT sensors and AI-powered processes optimize operational efficiency, while predictive maintenance systems enhance product quality. Digital integration allows for real-time monitoring and automated quality control.

Advanced Materials

Specialty products with high value can be created using nanotechnology, bioactive compounds, and smart polymers. Premium market segments include medical applications, functional food, and advanced materials.

Regulatory Framework and Compliance Strategies

Chemical Manufacturing Regulations

Environmental regulations, safety standards and product quality are required in all segments. The key regulatory bodies are the Central Pollution Control Board, Bureau of Indian Standards and Drug Controller General of India.

Pharmaceutical and Food Applications

Food and pharmaceutical products that are sold in the food or pharmaceutical markets must meet GMP requirements, have drug licenses, and be certified for food safety. These segments require higher regulatory investments but offer premium prices and market stability.

International Standards

Export opportunities are only possible if you comply with US FDA, European EMA and international standards. These requirements allow access to international markets with high value.

Risk Assessment and Mitigation Strategies

Market Risks

- Raw material price volatility – Implement supply agreements and inventory strategies

- Changes in regulations: Monitor policy changes and maintain compliance systems

- Concentrate on niche markets and customer relations to compete with established players

- Economic cyclicality – Diversify your product portfolio and keep flexible operations

Technical Risks

- Invest in proven technologies and technical expertise to reduce the complexity of your processes

- Quality Control Challenges: Implement robust testing systems and quality assurance systems

- If you’re having difficulty scaling up, start with tried-and-tested processes and expert engineering support

- Equipment reliability: Partner up with established suppliers and maintenance providers

Financial Risks

- Capital intensity: plan adequate financing and maintain Working capital Reserves

- Long payback periods – Ensure you have enough capital to support extended development timelines

- Hedging international transactions against currency exposure

- Cash flow management: Implement receivables and credit policies

For more information, check out our related videos

NPCS Consultancy Services

Niir Project Consultancy Services (NPCS) serves as an invaluable partner for entrepreneurs entering the chemical and specialty manufacturing sector. NPCS prepares comprehensive Market Survey cum Detailed Techno Economic Feasibility Reports that include thorough market analysis, detailed Manufacturing Business ideas specifications, raw material sourcing strategies, optimal plant layout designs, and complete project financial modeling, including capital requirements, operating costs, and profitability projections. Their expertise helps entrepreneurs assess the technical and economic feasibility of establishing chemical manufacturing businesses, providing essential guidance for successful project implementation and risk mitigation.

Future Market Outlook and Growth Projections

2025-2030 Market Evolution

The chemical manufacturing landscape will continue evolving toward sustainability, specialization, and digitalization. Bio-based production routes will gain market share, specialty chemicals will command premium pricing, and digital technologies will enable operational excellence.

Emerging Opportunities

- Circular economy chemicals: Recycling and waste-to-chemical processes

- Precision agriculture inputs: Specialized fertilizers and crop protection chemicals

- Advanced healthcare materials: Personalized medicine and regenerative medicine applications

- Sustainable packaging materials: Biodegradable and compostable chemical products

Discover the Right Business for You With Our Startup Selector Tool

Investment Priorities

Successful entrepreneurs will focus on sustainable production methods, specialized market niches, technical excellence, and customer partnership development. The combination of environmental compliance, technical innovation, and market focus will determine long-term success.

Frequently Asked Questions

Q: Which product segment offers the best opportunity for first-time entrepreneurs in chemical manufacturing?

A: Bicycle saddle and pedals manufacturing presents the most attractive entry opportunity with low initial investment ($1.5M), high profit margins (28%), manageable technical complexity, and strong market growth (8.0% CAGR). The sector benefits from growing cycling popularity and established supply chains.

Q: What are the key factors driving the shift toward ethanol-based chemical production?

A: The transition is driven by environmental regulations promoting renewable feedstocks, cost advantages of bio-based processes, government incentives for green chemistry, and consumer demand for sustainable products. Ethanol-based routes offer carbon footprint reduction and regulatory compliance benefits.

Q: How important is technical expertise in these manufacturing businesses?

A: Technical expertise requirements vary significantly by segment. Bicycle components and agar agar require moderate expertise, while pharmaceutical intermediates and biomedical polyurethanes demand very high technical knowledge. Success depends on matching technical capabilities with market requirements.

Q: What regulatory approvals are typically required for chemical manufacturing in India?

A: Essential approvals include environmental clearance from CPCB, factory license from state authorities, GST registration, and product-specific certifications. Pharmaceutical applications require drug licenses, while food applications need FSSAI approval. International exports require additional compliance certifications.

Q: How do raw material costs impact profitability in chemical manufacturing?

A: Raw material costs typically represent 40-60% of production costs in chemical manufacturing. Ethanol availability and pricing significantly impact bio-based processes, while specialty raw materials for pharmaceutical applications command premium pricing but offer higher margins.

Q: What are the typical timelines and investment requirements for establishing a chemical manufacturing facility?

A: Project timelines range from 12-24 months for simpler processes to 36-48 months for complex pharmaceutical applications. Investment requirements vary from $800K for agar agar production to $4M for biomedical polyurethanes, with payback periods spanning 2.8-4.5 years.

Q: Which geographic regions offer the best manufacturing advantages in India?

A: Gujarat, Maharashtra, and Tamil Nadu provide optimal manufacturing conditions with established chemical industry clusters, skilled workforce availability, infrastructure support, and government incentives. Proximity to ethanol production and chemical parks offers additional advantages.