The pharmaceutical industry is one of the most dynamic and essential sectors of the global economy. At the core of this industry lies the manufacturing of Active Pharmaceutical Ingredients (APIs) and drug intermediates, which are critical to the creation of effective medicines. APIs are the biologically active components that deliver therapeutic effects, while intermediates act as chemical precursors in the complex synthesis of APIs. The production of these ingredients forms the backbone of healthcare systems worldwide, ensuring that life-saving drugs are available in sufficient quantity and quality.

In recent years, the manufacturing of API bulk drugs and intermediates has attracted significant attention from governments, pharmaceutical companies, and entrepreneurs. The surge in demand for medicines, rising chronic health conditions, and the global push toward self-reliance in healthcare supply chains have opened vast opportunities for new businesses. Startups looking to enter this space can find immense potential, provided they understand the market landscape, manufacturing complexities, and regulatory requirements.

This article explores the demand, growth prospects, manufacturing process, regulatory environment, and entrepreneurial opportunities within the API bulk drug and intermediates sector, providing aspiring entrepreneurs with an in-depth guide to this vital industry.

APIs and Intermediates

APIs are the active substances in medicines that directly produce therapeutic action. For example, paracetamol in a pain relief tablet is the API responsible for reducing pain and fever. Intermediates, on the other hand, are the molecular entities formed at different steps in chemical reactions during the synthesis of APIs. They are the building blocks that undergo further processing before transforming into the final API.

While APIs are often viewed as simple chemicals, they are in fact the critical foundation of modern medicine. Without APIs, no drug would be effective, and without intermediates, the production of APIs would not be possible. A steady supply of both ensures the uninterrupted manufacturing of essential medicines, making them indispensable components of global healthcare systems.

Market Outlook

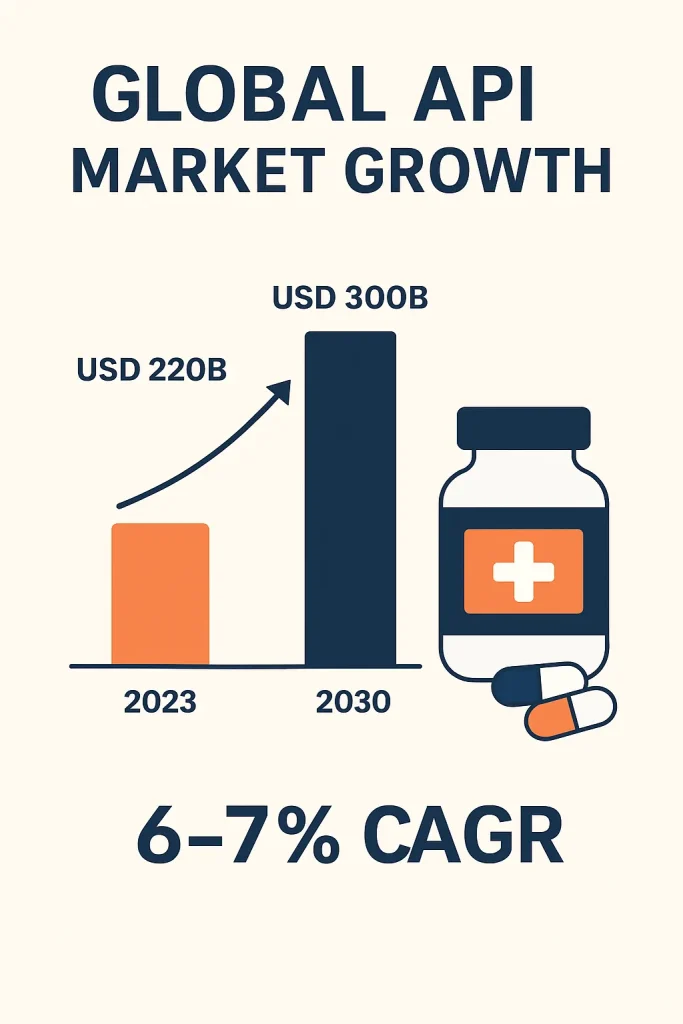

The global API market has witnessed consistent growth over the past decade. Industry reports valued the market at over USD 220 billion in 2023, with projections indicating a compound annual growth rate of around 6 to 7 percent between 2024 and 2030. This expansion is driven not only by the demand for branded drugs but also by the rising use of generic medicines.

As healthcare needs continue to rise, the production of APIs and intermediates remains central to meeting global demand. The COVID-19 pandemic further highlighted the importance of strong pharmaceutical supply chains, emphasizing the need for local manufacturing and reducing dependence on imports. This shift has created new opportunities for both established players and emerging entrepreneurs in the pharmaceutical manufacturing space.

Growth Drivers

Several factors contribute to the growing demand for APIs and intermediates. One of the most significant is the rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, respiratory illnesses, and cancer. These conditions require long-term treatment, which keeps demand for medicines consistently high.

Another driver is the aging global population. With more elderly individuals requiring healthcare support, the consumption of medicines has surged worldwide. Additionally, the expiration of patents for several blockbuster drugs has fueled demand for generics, which depend heavily on affordable API production.

Governments across the world are also pushing for greater self-reliance in pharmaceutical supply chains. For example, India and the United States are encouraging domestic API production to reduce dependency on imports, particularly from China. Finally, the rapid growth of biotechnology-based therapies has created demand for more complex APIs and high-value intermediates, further boosting the sector’s potential.

Detailed project report on API Bulk Drugs & Intermediates Manufacturing

Regional Insights

The API manufacturing landscape varies across regions. India, as one of the world’s largest producers of generic drugs, has built a strong reputation for API production. Supported by government initiatives such as the Production Linked Incentive (PLI) scheme, the Indian API market is projected to reach USD 35 billion by 2030. This growth is fueled by both domestic demand and export opportunities.

China, traditionally the largest supplier of APIs and intermediates, continues to dominate the market but faces increasing competition from India. Stricter environmental regulations in China have also shifted some of the production advantages to other regions.

In Europe and the United States, there is a renewed focus on bringing API production closer to home. The vulnerabilities exposed during the COVID-19 pandemic have encouraged these regions to prioritize local manufacturing and reduce reliance on overseas suppliers, creating new business opportunities for startups and established companies alike.

Opportunities for Entrepreneurs

The API and intermediates manufacturing sector presents abundant opportunities for entrepreneurs. One promising area is import substitution. Many countries still depend heavily on imports for key starting materials, intermediates, and APIs. Local production of these ingredients can not only enhance national healthcare security but also provide profitable ventures for businesses.

Contract manufacturing is another growing area, as pharmaceutical companies increasingly outsource API production to specialized manufacturers. Entrepreneurs who can deliver high-quality, compliant products at competitive costs will find significant opportunities in this model.

Niche therapeutic areas also offer potential. By focusing on APIs for rare diseases, specialized oncology drugs, or high-value biologics, new businesses can differentiate themselves from large-scale commodity producers. In addition, adopting eco-friendly practices aligned with sustainability and green chemistry principles can create a competitive edge while contributing to environmental goals.

For further information, please consult our books.

Manufacturing Process

The manufacturing of APIs and intermediates involves a complex series of steps, combining chemistry, biotechnology, and rigorous quality control. It begins with the procurement of raw materials, including key starting materials, solvents, and catalysts, sourced from suppliers who comply with Good Manufacturing Practices.

Once raw materials are secured, a multi-step synthesis is undertaken to produce intermediates. This can involve organic synthesis, fermentation, or biotechnology-based methods, depending on the type of API. The intermediates are then processed through additional reactions to form the final API.

Purification and drying are critical to ensure the removal of impurities, by-products, and residual solvents. Advanced techniques such as chromatography, recrystallization, and lyophilization are often employed. Following purification, rigorous testing is carried out to verify purity, potency, stability, and safety, with reference to pharmacopeia standards like USP, EP, and IP.

Finally, APIs are packaged in controlled environments and stored under specific conditions to preserve their stability and prevent contamination. Every stage requires precision, strict monitoring, and adherence to international regulatory standards.

Related articles:- Specialty Chemical Manufacturing: Transitioning from Bulk to High-Value Export Products

Regulatory Environment

The pharmaceutical industry is among the most heavily regulated worldwide, and API manufacturing is no exception. To ensure patient safety, manufacturers must comply with Good Manufacturing Practices set by organizations such as the WHO, USFDA, and EMA.

API producers supplying global markets are often required to submit Drug Master Files to regulators. Compliance with environmental regulations, including effluent treatment and waste disposal, is equally critical. Intellectual property laws also govern the production of APIs to avoid patent infringements in generic manufacturing. For startups, navigating these regulations may be challenging, but it is essential for long-term success.

Emerging Trends

The API manufacturing industry is evolving rapidly with several emerging trends. One major shift is the rise of biologically derived APIs, such as peptides, proteins, and monoclonal antibodies. These biotech APIs are increasingly important for advanced therapies.

Another trend is the adoption of continuous manufacturing techniques, which offer cost efficiency, scalability, and faster production timelines compared to traditional batch methods. Green chemistry practices are also gaining traction, with companies focusing on eco-friendly solvents and waste minimization.

Digitalization is transforming the sector as well. Artificial intelligence, machine learning, and advanced analytics are being used to optimize processes, predict yields, and enhance quality control. Additionally, personalized medicine has created demand for customized APIs tailored to individual patients, opening new frontiers for innovation.

Challenges

Despite its potential, the API sector is not without challenges. Regulatory hurdles remain a significant barrier, as approval processes can be slow and complex. Supply chain risks, particularly reliance on imported raw materials, pose another concern.

Price competition is intense, especially for commoditized APIs where large-scale producers dominate. Technological complexity also creates barriers, as some APIs require specialized reactors or fermentation technologies. Entrepreneurs entering this field must be prepared to invest in advanced equipment, skilled personnel, and continuous innovation to remain competitive.

Entrepreneurial Potential

Even with these challenges, the API bulk drug and intermediates industry offers remarkable opportunities for entrepreneurs. The essential nature of medicines ensures stable demand, while both domestic and export markets provide growth potential. Startups can begin with niche production and eventually scale up to large contract manufacturing operations.

With global healthcare needs expanding, the long-term growth of this sector is virtually assured. For entrepreneurs willing to commit to quality, compliance, and sustainability, API manufacturing represents not just a profitable business but also a meaningful contribution to healthcare security.

Role of NPCS

Organizations such as Niir Project Consultancy Services (NPCS) play a vital role in supporting entrepreneurs in this sector. NPCS prepares Market Survey cum Detailed Techno-Economic Feasibility Reports that guide businesses through critical decisions. Their reports cover manufacturing processes, raw materials, plant layouts, financial projections, and regulatory requirements.

With decades of experience, NPCS helps entrepreneurs assess feasibility, mitigate risks, and identify profitable opportunities in API and intermediates manufacturing. This expert guidance can significantly reduce the learning curve for startups entering such a complex industry.

Conclusion

The manufacturing of API bulk drugs and intermediates is not just a commercial opportunity but a cornerstone of global healthcare. As demand for reliable, affordable, and high-quality medicines continues to grow, the need for APIs and intermediates will only intensify.

For entrepreneurs, this sector offers a unique mix of steady demand, export potential, and opportunities for innovation. By focusing on quality standards, sustainability practices, and compliance with international regulations, new entrants can establish themselves as trusted players in the pharmaceutical value chain. With expert support from organizations like NPCS, startups can successfully navigate the complexities of this industry and build ventures that are both profitable and impactful.

Discover best business ideas for yourself using our startup selector tools

Frequently Asked Questions

Q1. What are bulk drugs and intermediates?

Bulk drugs are active pharmaceutical ingredients (APIs), while intermediates are the compounds used during API production.

Q2. Which industries rely on bulk drug manufacturing?

Pharmaceutical companies, healthcare institutions, and export markets depend heavily on bulk drug manufacturing.

Q3. Is India a leader in API production?

Yes, India is among the largest producers of APIs globally, supplying both domestic and international markets.

Q4. What challenges does the industry face?

The main challenges include raw material dependency, environmental regulations, and global competition.

Q5. What role does NPCS play in this sector?

NPCS provides feasibility reports, covering raw materials, manufacturing process, plant layout, and financials for entrepreneurs.